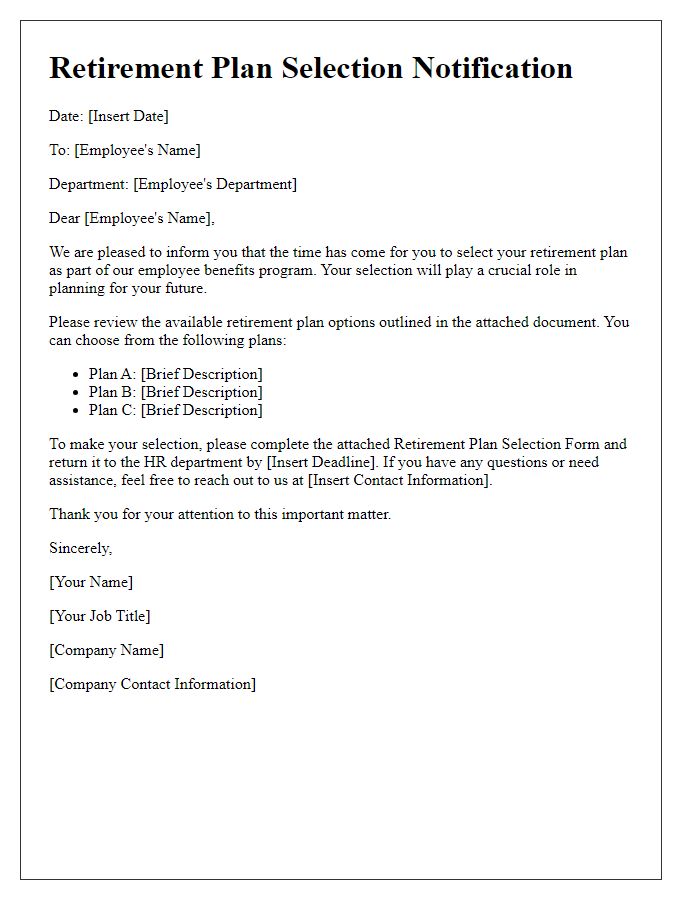

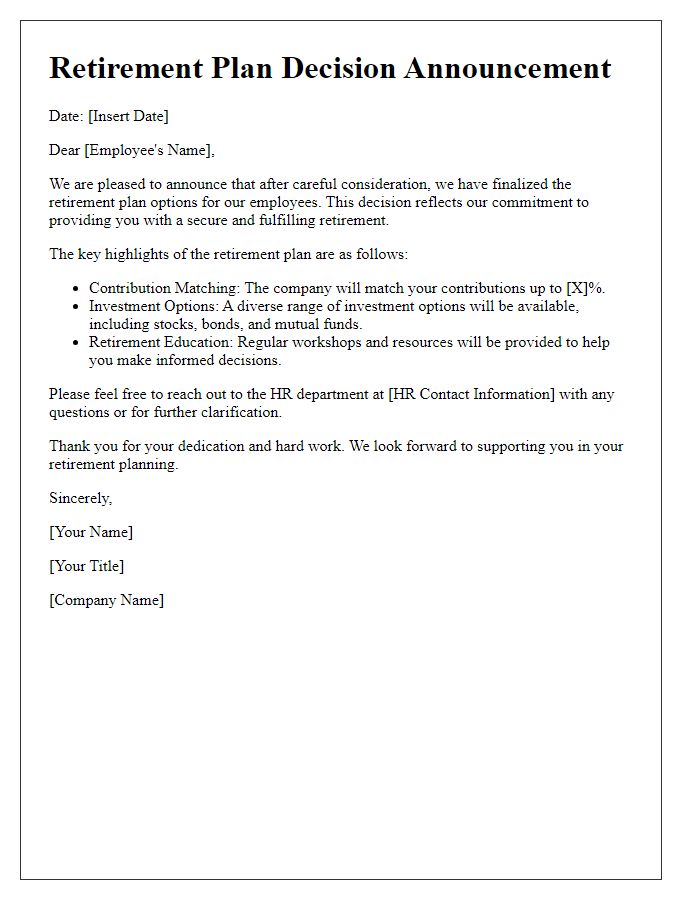

Are you considering updating your retirement plan or notifying your employees about important changes? Navigating the complexities of retirement planning can be challenging, but effective communication is key to ensuring everyone is on the same page. In this article, we'll explore essential components of a retirement plan notification letter that not only clarifies the decision but also fosters transparency and trust within your organization. Ready to dive deeper? Let's get started!

Clear Notification of Retirement Decision

Employees nearing retirement must understand their options under the employer's retirement plan, often governed by the Employee Retirement Income Security Act (ERISA). Individuals should review the specifics, such as benefits eligibility requirements, calculation formulas based on years of service (often ranging from 5 to 30 years), and any potential penalties for early withdrawal. Comprehensive retirement plans, including 401(k) and defined benefit plans, require timely notice to ensure appropriate distribution choices are made before retirement, typically at least 30 to 90 days before their intended retirement date. Consulting with a financial advisor can provide clarity on maximizing benefits while considering factors like Social Security eligibility at age 62 or full retirement age between 66 and 67.

Detailed Retirement Timeline and Date

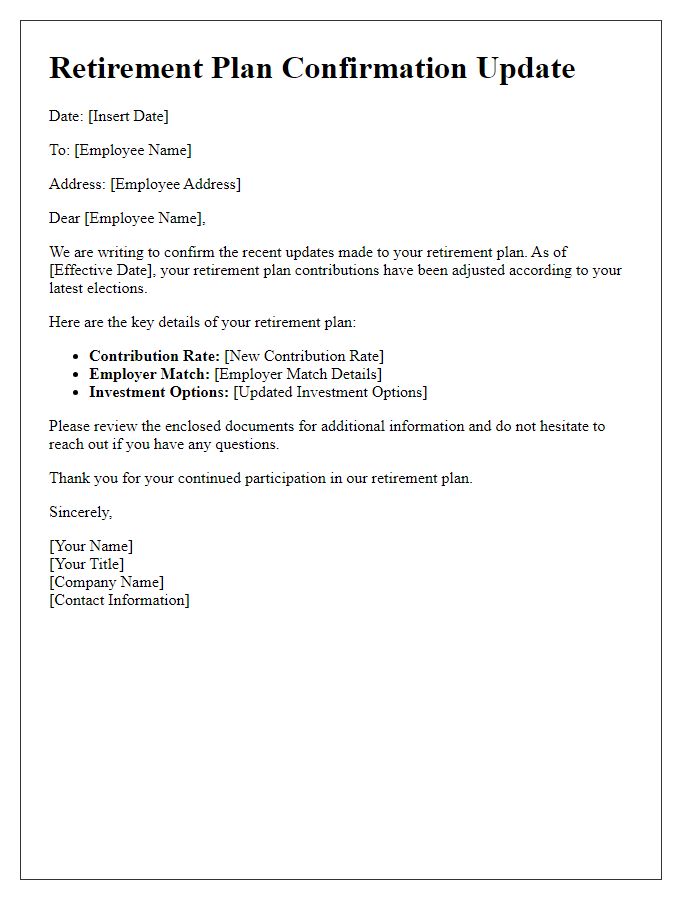

Retirement plans require careful consideration and planning for a smooth transition from active employment to retirement. A detailed retirement timeline serves as a structured guide, helping individuals navigate important milestones. The retirement date, a pivotal point, often correlates with age (such as 65 years for full Social Security benefits in the United States) and employment tenure. Potential retirement benefits include pensions, 401(k) plans, and Health Savings Accounts (HSAs), which require thorough understanding of withdrawal rules and tax implications. Key documents include retirement benefit statements and Social Security Administration notifications. Consulting with financial advisors and evaluating healthcare plans can clarify remaining questions. Lastly, consideration of lifestyle changes post-retirement is essential for financial stability and personal fulfillment.

Transition Assistance and Next Steps

Transitioning into retirement requires careful consideration and planning to ensure a secure financial future. Personal retirement plans often involve various investment options, such as 401(k) plans or IRAs, which can be customized based on individual preferences. The decision to retire can include factors like age, typically around 65 in many countries, and overall savings goals, often assessed using retirement calculators. Important next steps include seeking guidance from financial advisors, examining Social Security benefits, and understanding healthcare options like Medicare to avoid unexpected costs. Additionally, reviewing asset allocations can aid in maximizing retirement income, ensuring a smooth transition into this new life phase.

Gratitude and Acknowledgment of Contributions

Gratitude emanates from companies recognizing the substantial contributions of long-term employees as they approach retirement. An acknowledgment of these contributions often highlights specific achievements, such as meeting quarterly sales targets, spearheading successful projects, or enhancing team collaboration, which have all positively impacted company growth. Special attention is given to the years of dedicated service, often spanning decades, fostering company culture and mentorship among newer employees. Celebratory events, such as retirement parties, often occur, allowing for a formal farewell and expressing appreciation publicly for the retiree's unwavering commitment to the organization.

Contact Information for Further Assistance

Retirement plan decisions can impact financial security and lifestyle choices significantly. Documents like the Summary Plan Description (SPD) detail eligibility requirements and benefits coverage related to retirement plans. Employees should consider reaching out to specific contact numbers provided by their employers for personalized assistance regarding retirement options. Human Resources departments typically offer resources, including counseling sessions or workshops, dedicated to retirement planning intricacies. Additionally, professional advisors or financial planners can provide expert guidance tailored to individual retirement goals and investment strategies.

Comments