Have you ever checked your paycheck and found unexpected deductions? It can be confusing and frustrating, especially when it feels like your hard work isn't being fully recognized. Disputing payroll deduction errors doesn't have to be daunting; with the right approach, you can navigate the process smoothly. So, let's explore how to effectively draft a letter to address these discrepancies and ensure you receive what you rightfully deserveâread on for our helpful tips!

Employee Identification and Contact Information

Disputing payroll deduction errors requires clear communication. Employee identification includes unique identifiers such as social security numbers (SSN) or employee ID numbers, essential for accurate record-keeping in human resources (HR) systems. Contact information typically consists of a residential address, email, and phone number for effective correspondence. Detailed records showing erroneous deductions should be included, possibly referencing pay stubs or bank statements that demonstrate discrepancies. Accurate context regarding the specific payroll period (week ending date or month) enhances understanding of the issue. Employees must ensure all provided information is up-to-date, ensuring HR departments can respond efficiently to disputes.

Detailed Description of the Error

An accurate understanding of payroll deduction errors is crucial for employees concerned about their earnings. Payroll deductions, which include taxes, insurance premiums, and retirement contributions, can sometimes be miscalculated, resulting in discrepancies in net pay. For example, an employee may notice a deduction labeled as "Health Insurance Premium" that exceeds the agreed monthly rate of $300, incorrectly listing $450 instead. Such errors may stem from data entry mistakes or changes in employee status not being promptly updated in the payroll system. Additionally, discrepancies can also arise from incorrect tax withholdings, where an employee might be categorized in a higher tax bracket than applicable, impacting their take-home pay significantly. Timely identification and reporting of these errors are essential for accurate payroll management and financial planning.

Relevant Payroll Dates and Amounts

Payroll deduction errors can significantly impact employees' financial stability and overall satisfaction with their employer. Inaccuracies often arise from miscalculations or system glitches affecting specific pay periods, such as the bi-weekly payroll cycle running between June 1, 2023, and June 15, 2023. For example, an employee's expected deduction for health insurance, typically $150 per pay period, might be incorrectly adjusted to $200, leading to an undue financial burden. Such discrepancies should be documented with relevant dates, amounts, and payroll statements from the company's Human Resources System, allowing for a clear and compelling case when disputing the errors. Timely communication regarding these issues is essential to ensure prompt resolution and restore employee confidence in the payroll process.

Supporting Documentation (Pay Stubs, Time Sheets)

Inaccurate payroll deductions can significantly impact employee finances, particularly when deductions for taxes, health benefits, or retirement contributions do not align with the agreed-upon amounts. Supporting documentation, such as pay stubs (official records detailing earnings and withholding amounts per pay period) and time sheets (hourly records tracking worked hours), is essential for addressing and rectifying these errors. Employees should gather recent pay stubs showing discrepancies in net pay (the amount received after deductions) and relevant time sheets that provide evidence of hours worked, overtime rates, or unpaid leave. For instance, a pay stub may reveal a $200 discrepancy in health insurance deductions, while a time sheet could confirm that an additional ten hours of overtime were not compensated. Presenting clear, organized documentation facilitates effective communication with payroll departments, making it easier to resolve these financial inaccuracies promptly.

Clear Request for Resolution and Follow-Up Actions

Payroll deduction errors can lead to significant financial discrepancies for employees. Identifying incorrect withholdings, such as retirement contributions or health insurance premiums, often requires thorough review of pay stubs and deduction statements. Accurate records, including dates and amounts from the past three months, should be compiled to support the claim. Clear communication with the payroll department at the employing organization, specifying the nature of the error and the desired resolution, can expedite the correction process. Following the initial request, it's crucial to establish a timeline for resolution, enabling necessary follow-up actions to ensure compliance and rectify any unpaid balances. Such diligence promotes transparency and accountability in handling employee compensation and benefits.

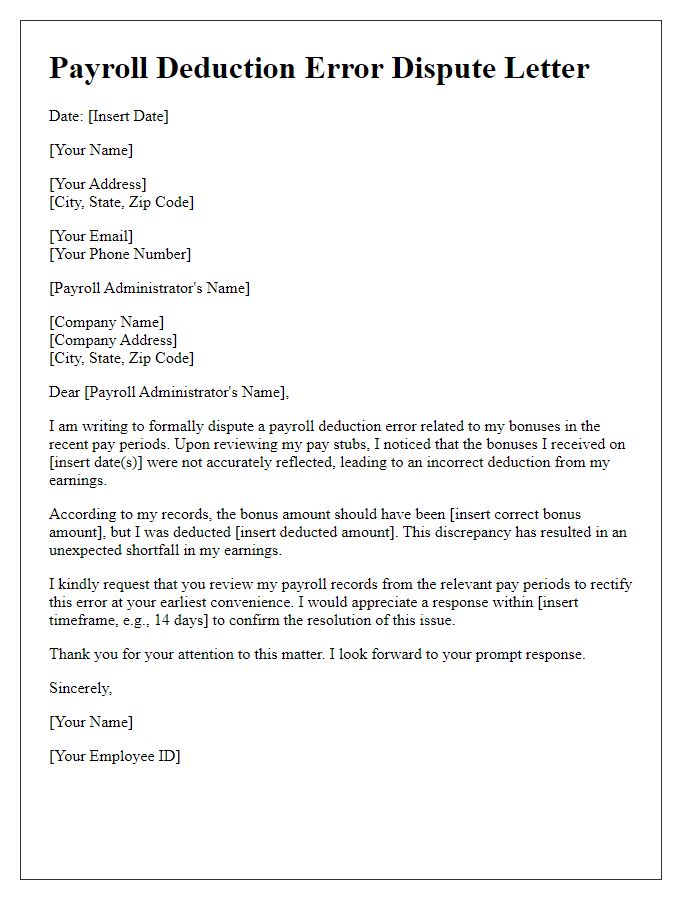

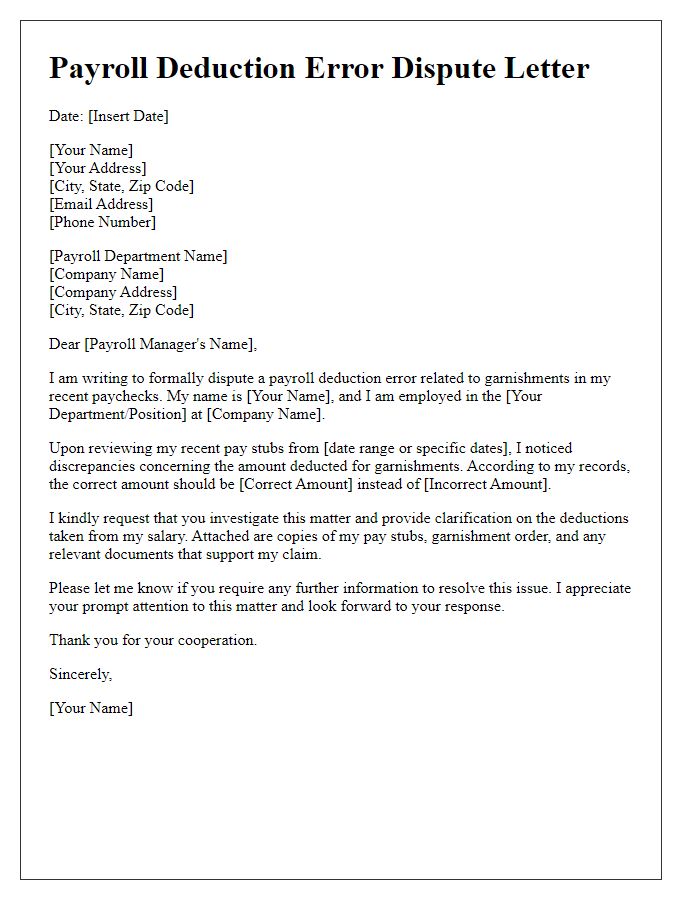

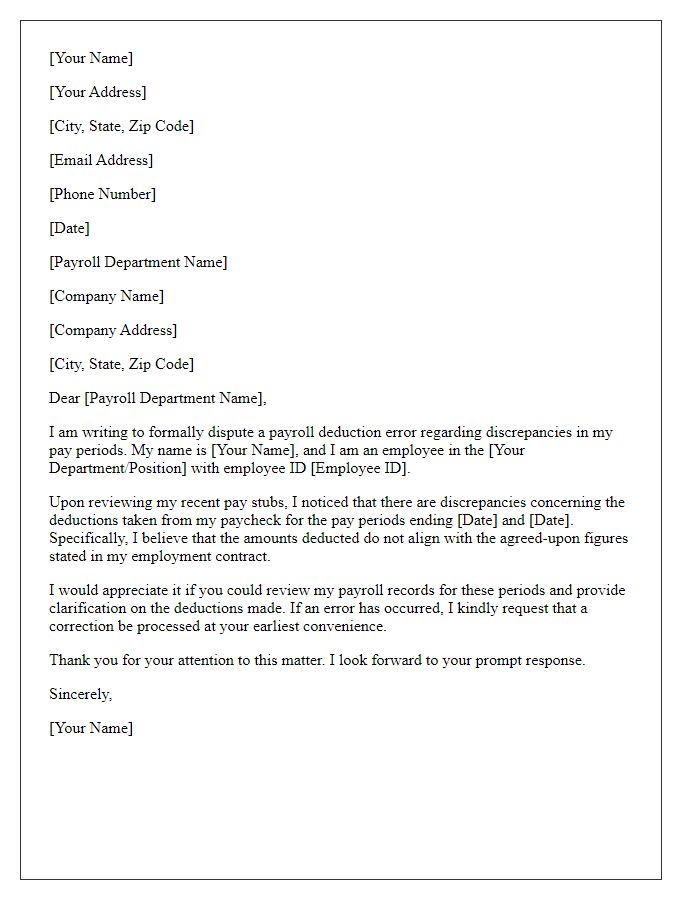

Letter Template For Disputing Payroll Deduction Errors Samples

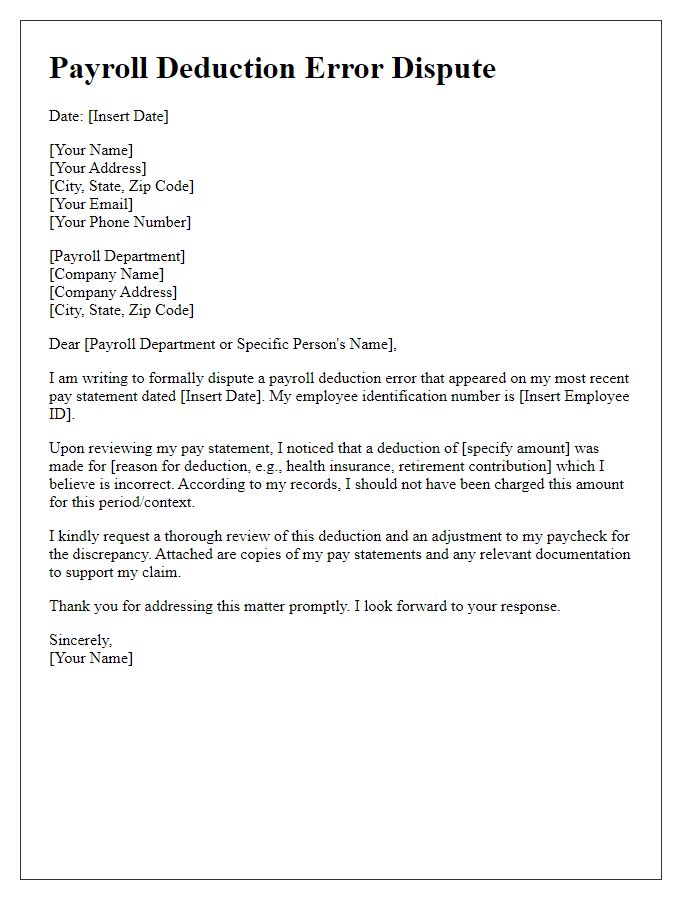

Letter template of payroll deduction error dispute for hourly employees.

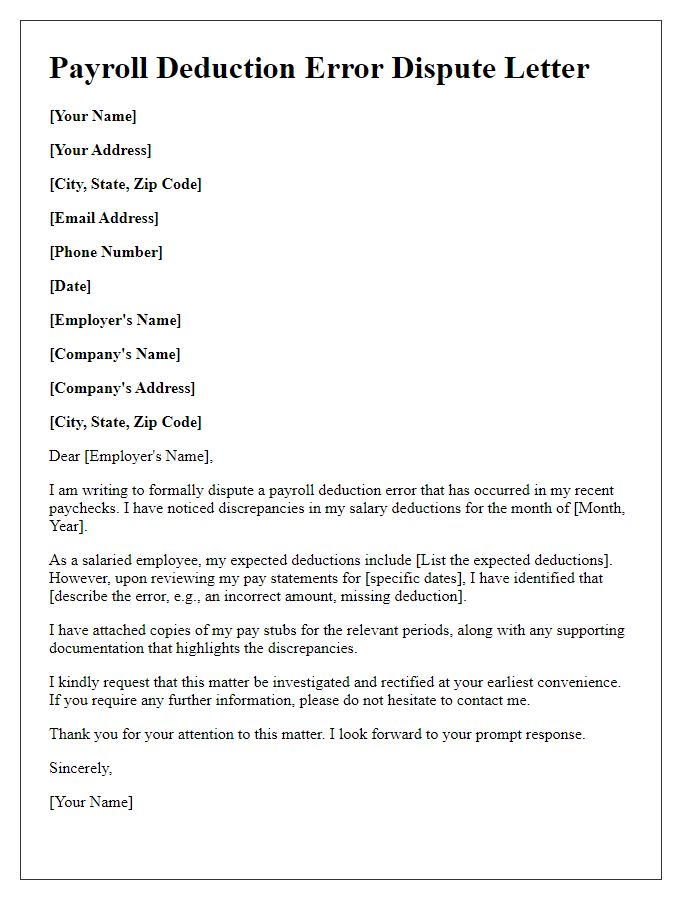

Letter template of payroll deduction error dispute for salaried employees.

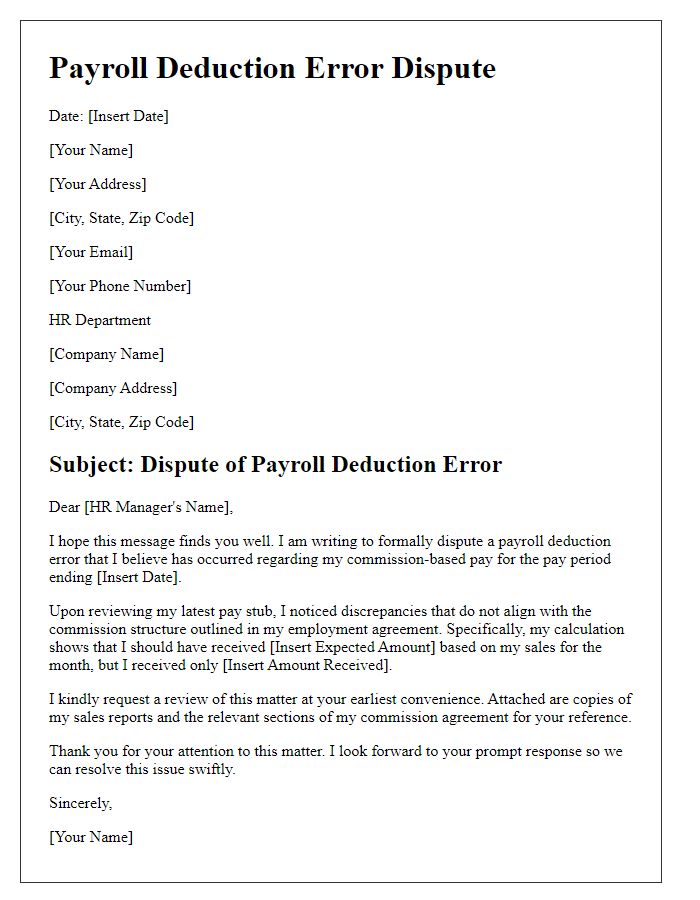

Letter template of payroll deduction error dispute for commission-based pay.

Letter template of payroll deduction error dispute for tax withholding issues.

Letter template of payroll deduction error dispute for health insurance deductions.

Letter template of payroll deduction error dispute for retirement contributions.

Letter template of payroll deduction error dispute for payroll processing timing issues.

Comments