Are you considering canceling your health insurance plan? It's a big decision that can impact your finances and well-being, and understanding the process is crucial. In this article, we'll guide you through the essential steps of crafting a formal cancellation letter, ensuring you cover all necessary details to avoid any complications. Ready to take the next step? Read on to discover the best practices for your cancellation letter!

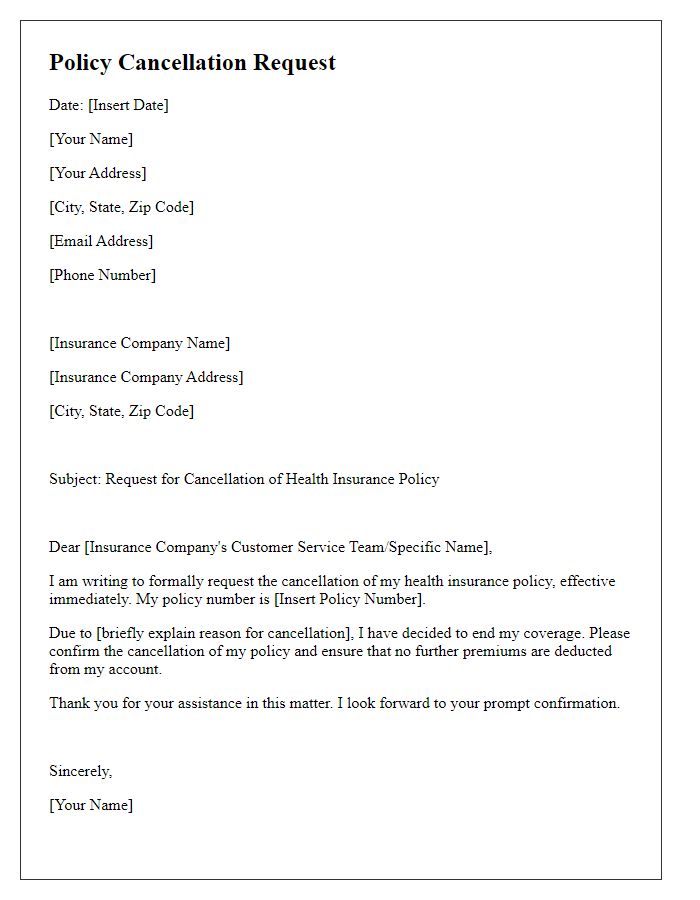

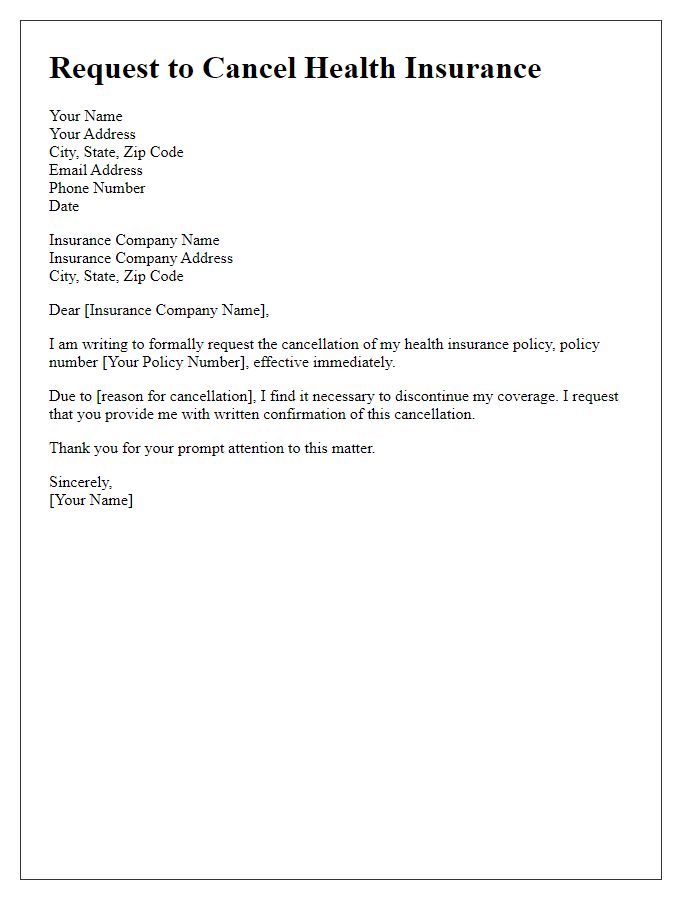

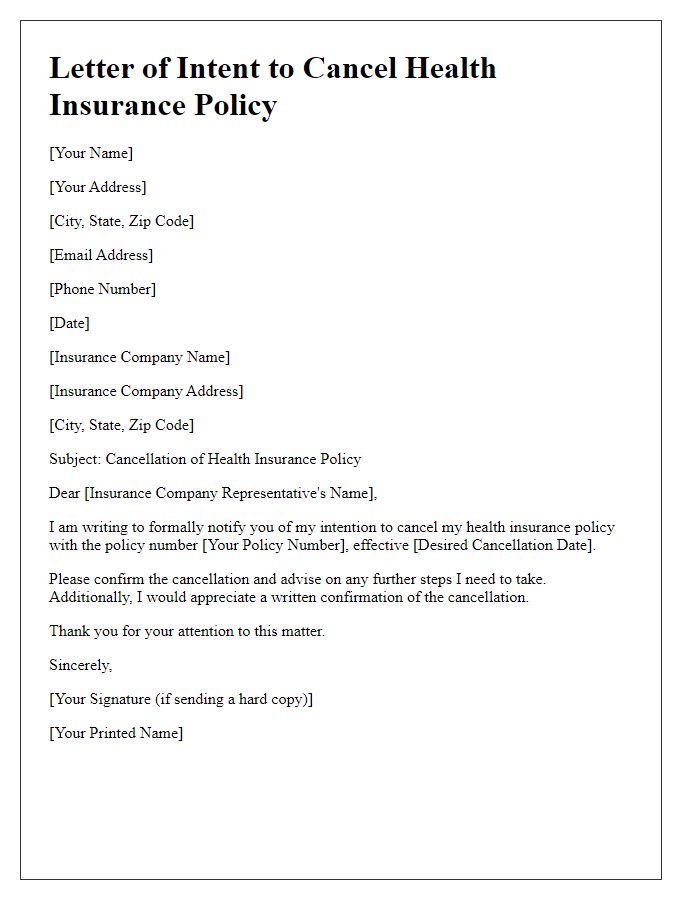

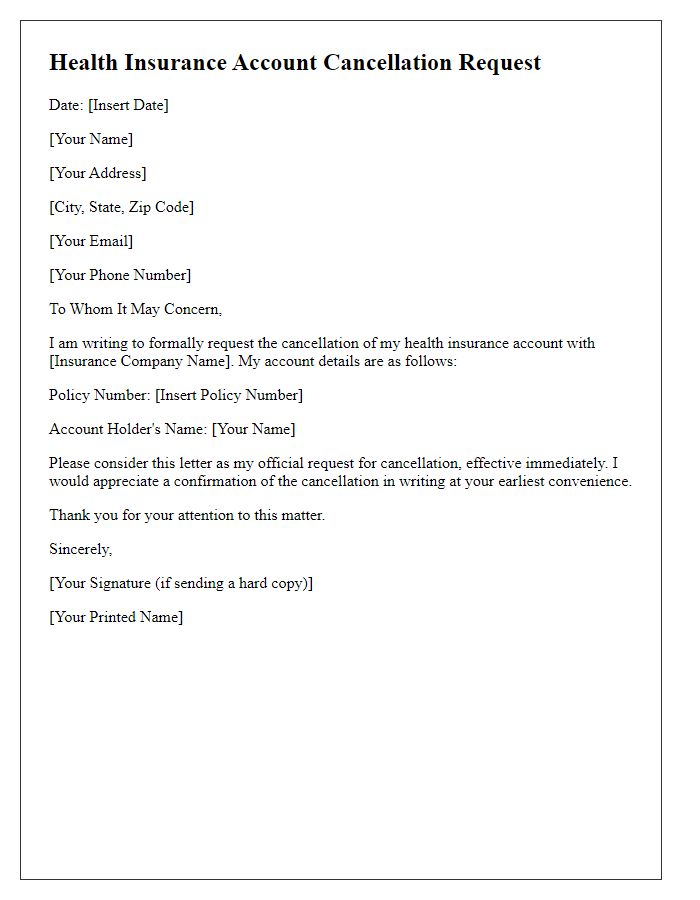

Policyholder Information

Health insurance cancellation requires careful attention to policyholder information details. Essential components include policyholder name, such as John Doe, and policy number, for instance, #123456789. Communication address must be precise, including street, city, state, and zip code, for example, 123 Main Street, Springfield, IL, 62701. Phone number (e.g., (555) 123-4567) is crucial for potential follow-up inquiries. Additionally, provide any relevant email address, like jdoe@email.com, to facilitate electronic communication regarding cancellation confirmation. Include the specific dates for effective cancellation, such as December 31, 2023, to ensure clarity in the request.

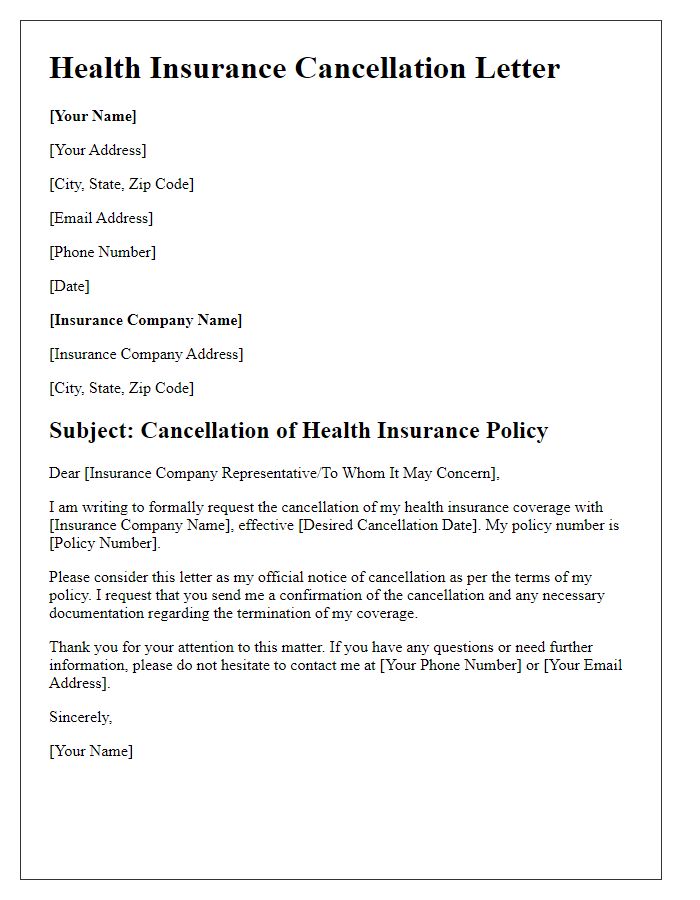

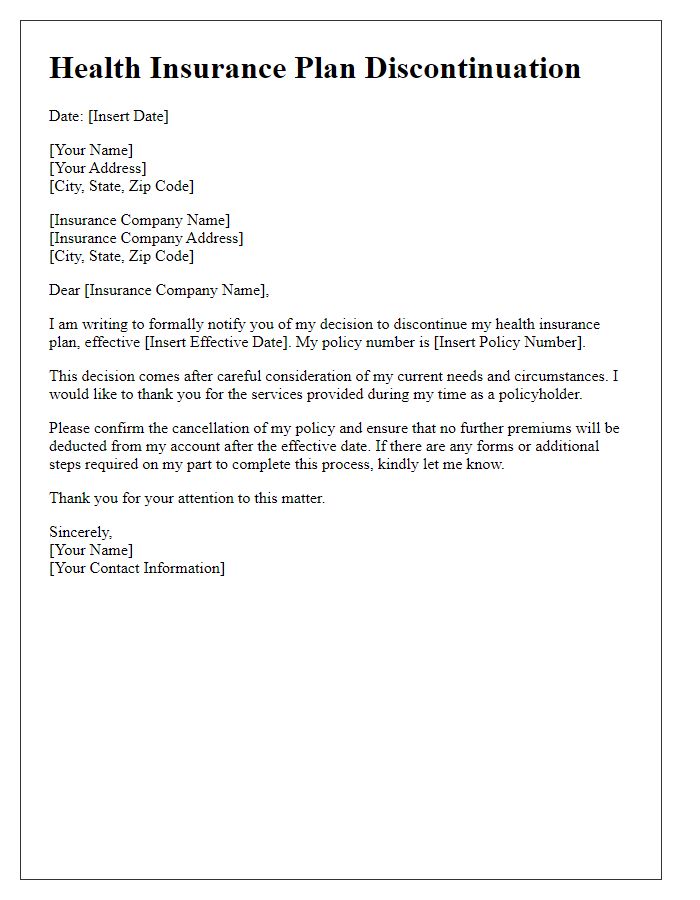

Policy Details

The cancellation of health insurance policies requires careful attention to specific details, such as policy number, effective date, and the name of the insured individual. A policy number, typically consisting of a mix of letters and numbers, is essential for accurate identification of the contract with a provider like Blue Cross Blue Shield or Aetna. The effective date signifies the moment coverage begins or ends, which is crucial to avoid gaps in protection. Furthermore, including personal details such as the insured's name, address, and contact information ensures that the provider can efficiently process the cancellation request. Each provider has its procedure and required documents, which may involve submitting a formal written request via email or postal mail to the customer service department, ensuring compliance with state regulations regarding cancellation terms and notice periods.

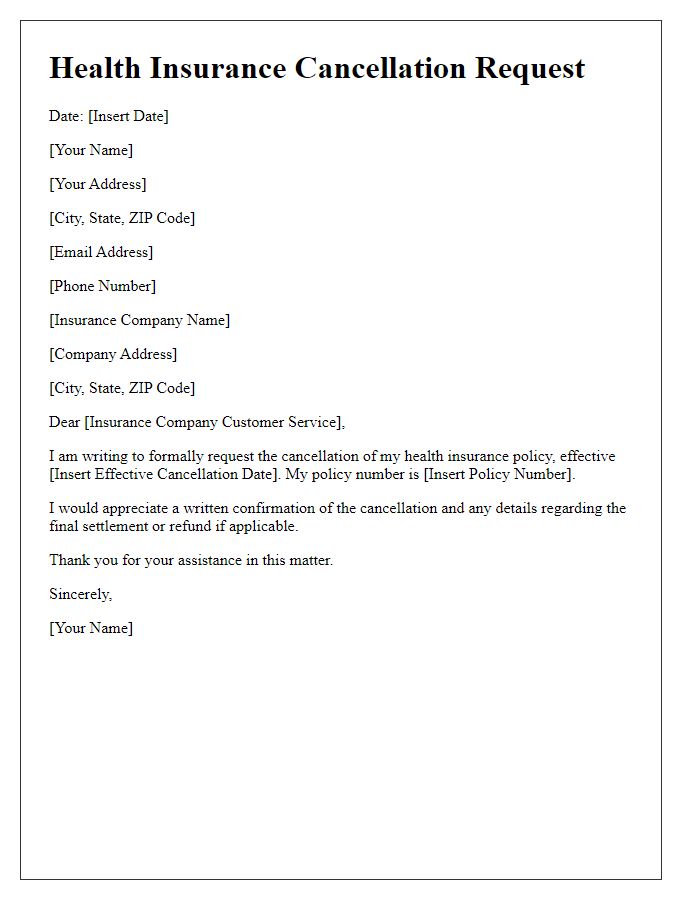

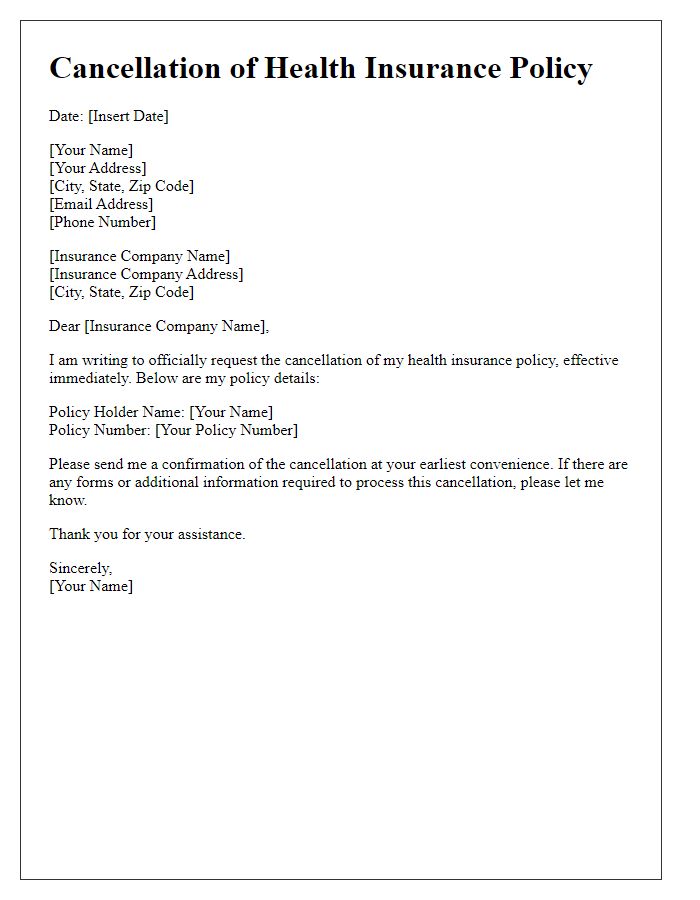

Request for Cancellation

Health insurance cancellation can lead to significant financial implications and stress. Policyholders must consider factors like open enrollment periods and alternative coverage options before proceeding with cancellation. The process typically involves submitting a written request to the insurance provider, ensuring to include essential details such as policy number, effective dates, and personal identification information. It is crucial to verify any potential fees associated with the termination of a plan, which can vary by provider and state regulations. Understanding the coverage gaps created by cancellation is vital, as individuals may find themselves without necessary health services during a transition phase, particularly in cases involving ongoing medical treatments or prescription medications.

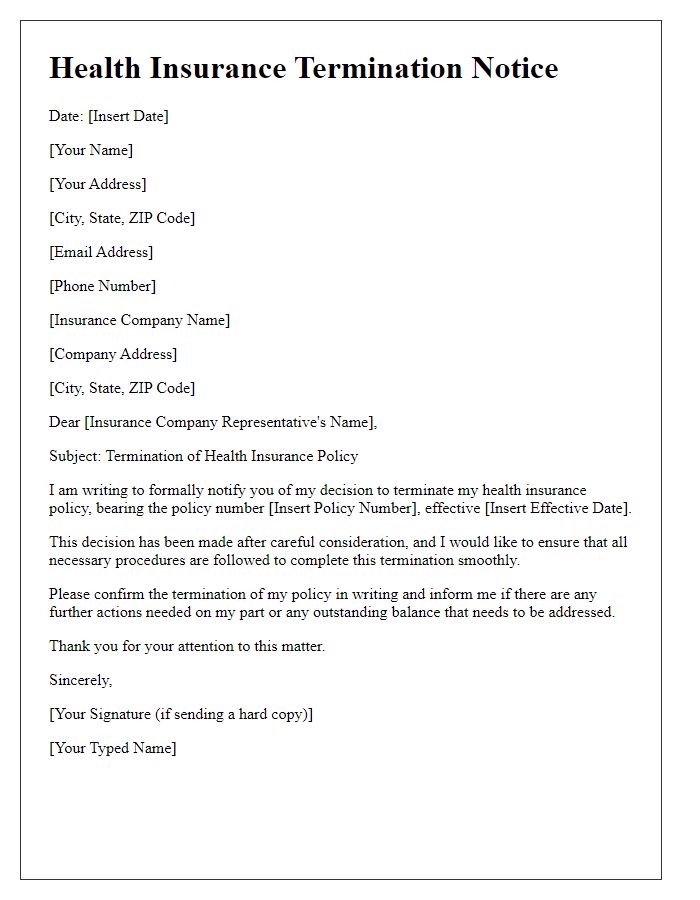

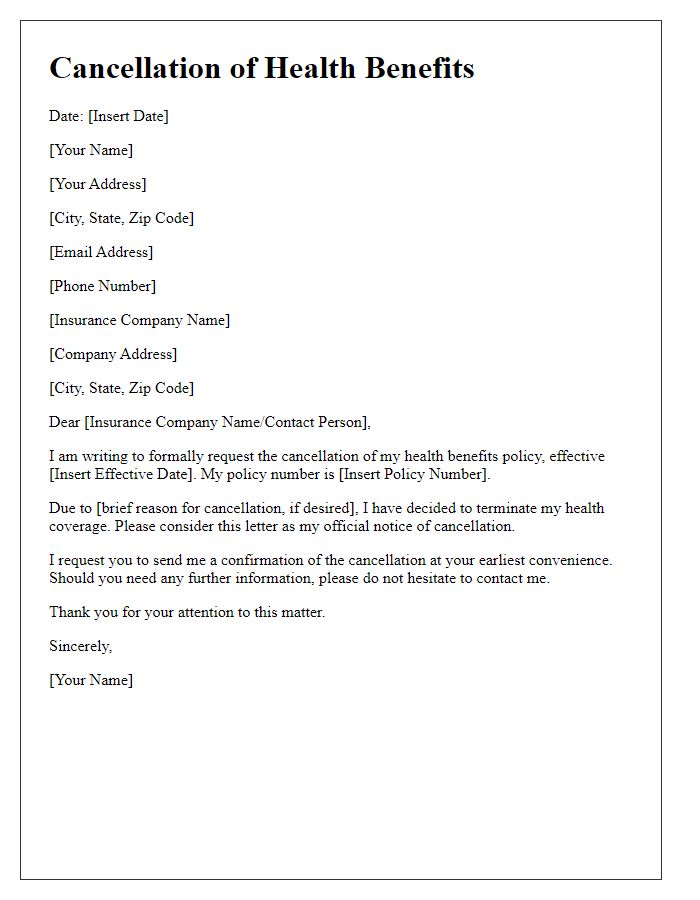

Effective Date of Cancellation

The effective date of health insurance cancellation refers to the specific day when the insurance coverage officially ends. This date is crucial for maintaining proper health coverage and avoiding unexpected medical expenses. For instance, many insurance providers such as Blue Cross Blue Shield or Aetna require a written notice submitted at least 30 days prior to the cancellation date to process the request smoothly. Depending on the policy type, such as individual or family plans, the terms of cancellation may vary. It is important to document this cancellation request and retain copies for personal records. Failure to adhere to the established timeline may result in extended liability for premiums, which can accumulate substantially over time. Therefore, policyholders should consider the implications carefully before proceeding.

Contact Information for Queries

Health insurance cancellation can be a complex process that requires clear communication with your insurance provider. Your contact information, including a valid phone number and email address, should be easily accessible for any queries. Provide multiple options, such as a direct customer service line (e.g., 1-800-123-4567) for immediate assistance or an official email address (e.g., support@insurancecompany.com) for detailed inquiries. Including information about office hours (9 AM to 5 PM EST) will help facilitate timely responses. Additionally, mention any specific departments or representatives that can be contacted regarding cancellation issues, ensuring a smoother communication flow.

Comments