Are you considering closing your bank account but unsure how to navigate the process? Writing a formal letter can make all the difference, ensuring that your request is clear and effective. In this article, we'll provide you with a simple yet professional template that you can follow, along with tips to make your cancellation experience as smooth as possible. So grab a cup of coffee and let's dive in to help you take that next step!

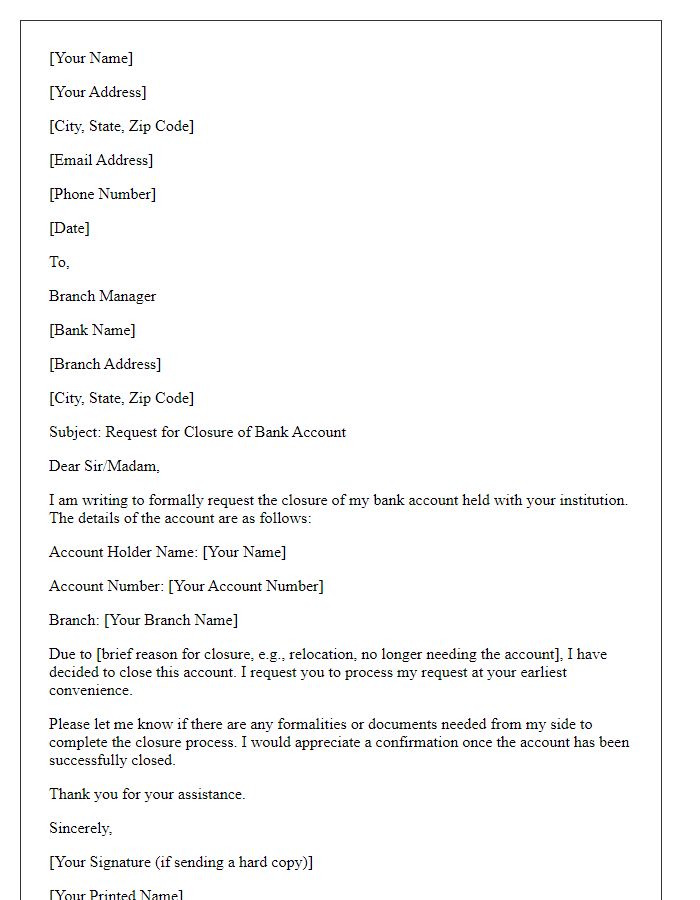

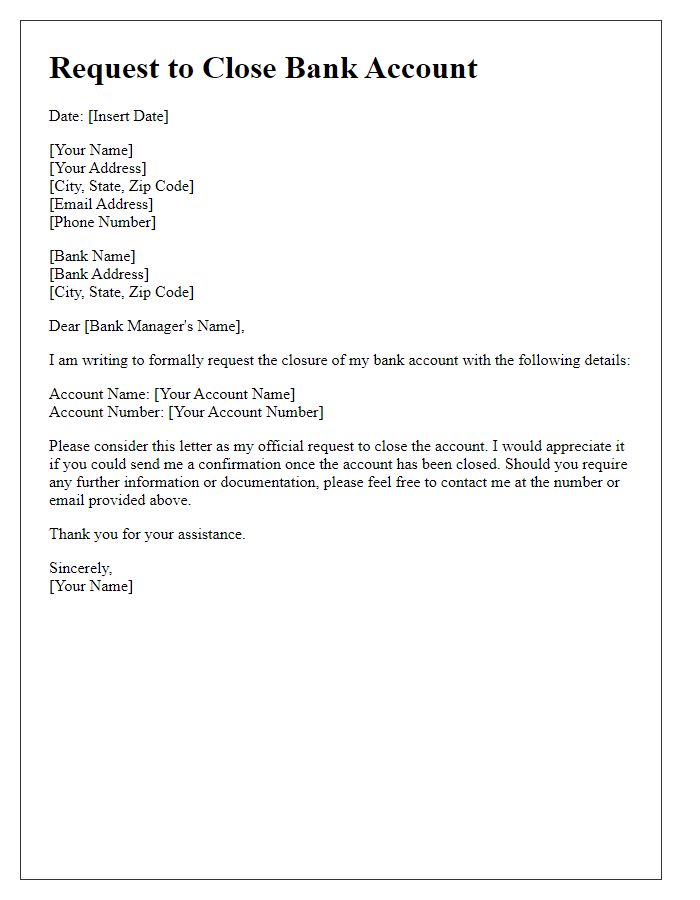

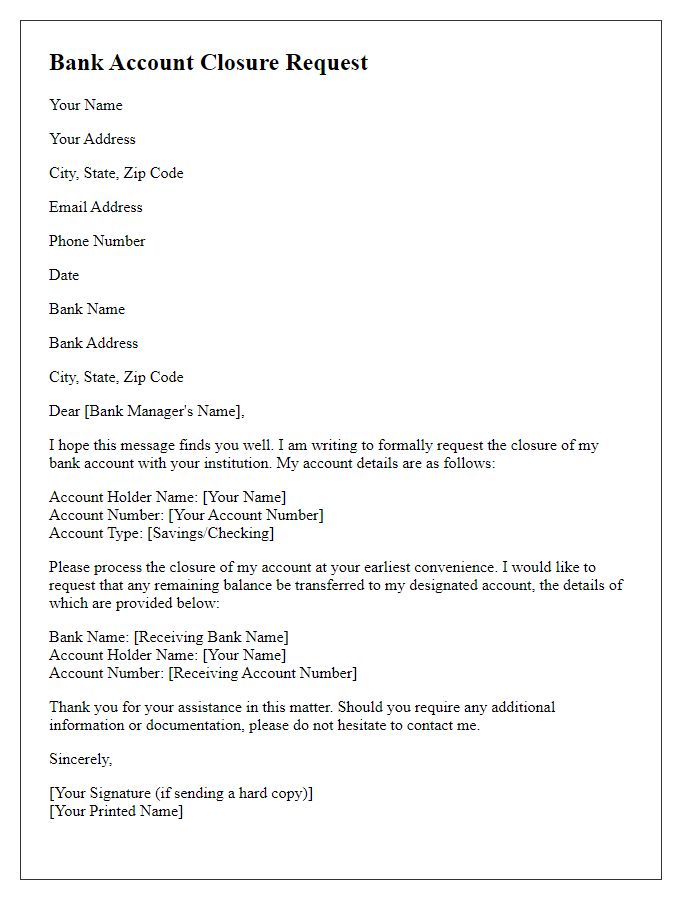

Account Information

Canceling a bank account requires careful attention to specific details to ensure a smooth process. Bank account information should include the full account holder's name, the account number, and the type of account (such as checking or savings). It is important to mention the date of cancellation request, as well as any outstanding balance information, to avoid complications. Additionally, specifying the reason for cancellation could assist the bank in understanding client needs. Contact details, including phone number and email address, must be provided for further follow-up. Documenting the request by retaining a copy for personal records is also advisable to ensure proper communication and validation with the financial institution.

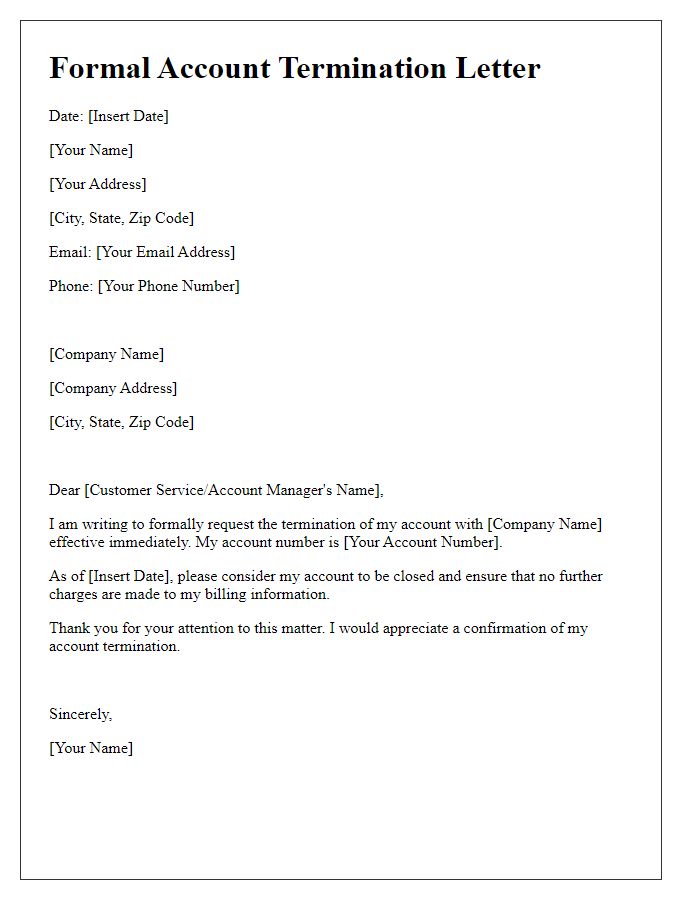

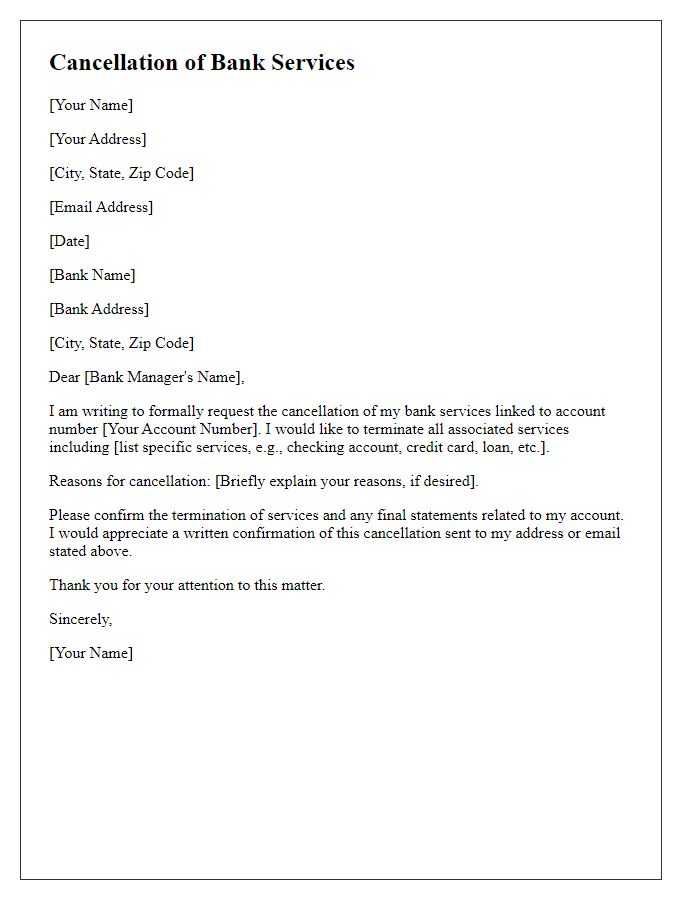

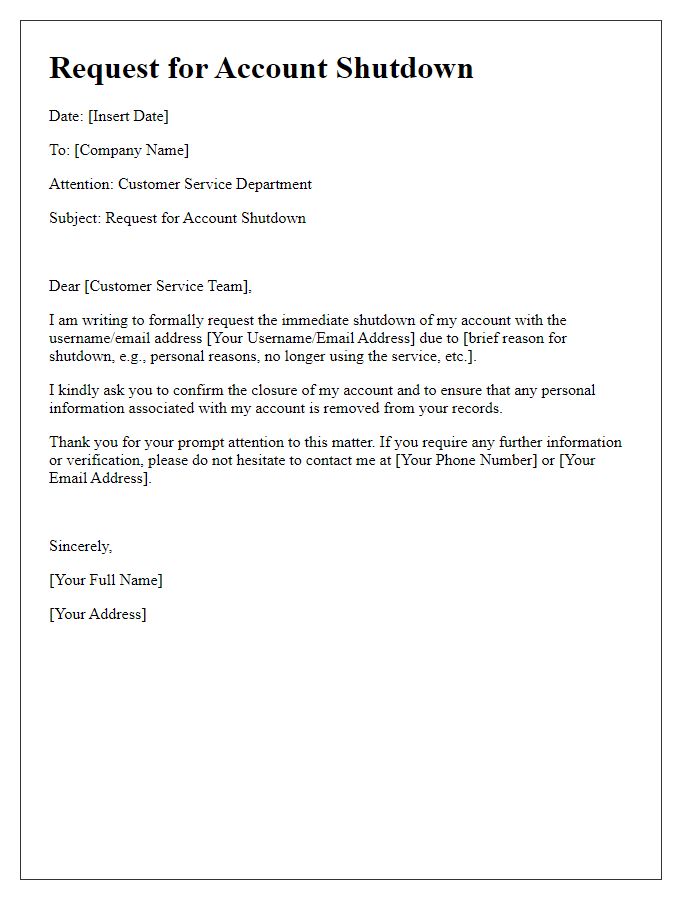

Cancellation Request

To cancel a bank account, provide specific details in the request. Include the account number associated with the bank account, the name of the bank (such as Wells Fargo, Chase, or Bank of America), and a formal statement indicating the intention to close the account. Mention the date by which the account should be closed, ensuring all pending transactions and fees are settled beforehand. Additionally, request a written confirmation of the account cancellation for personal records. Be aware of any potential fees or outstanding balance that may affect the closure process.

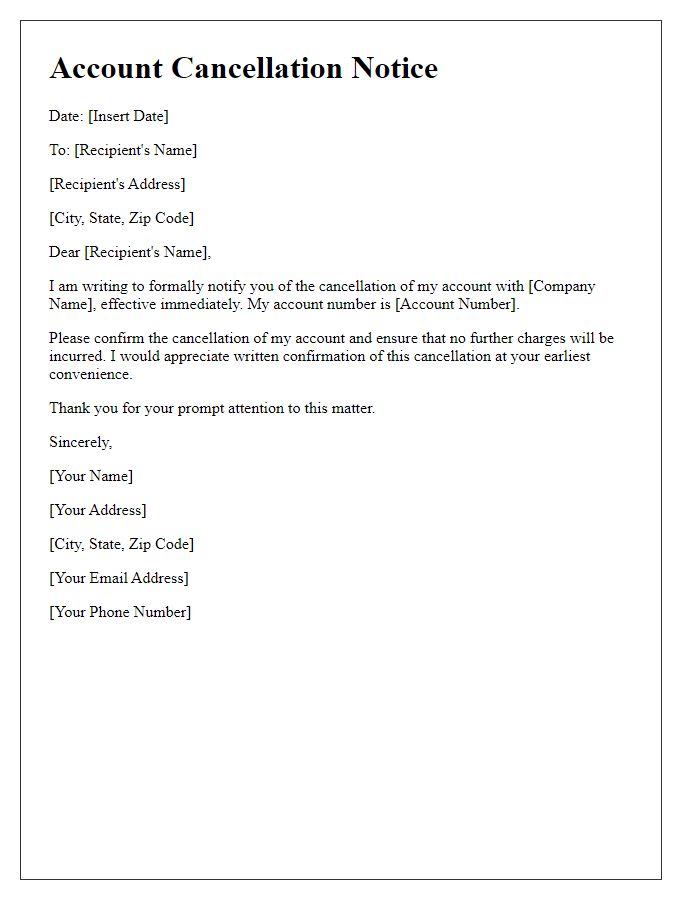

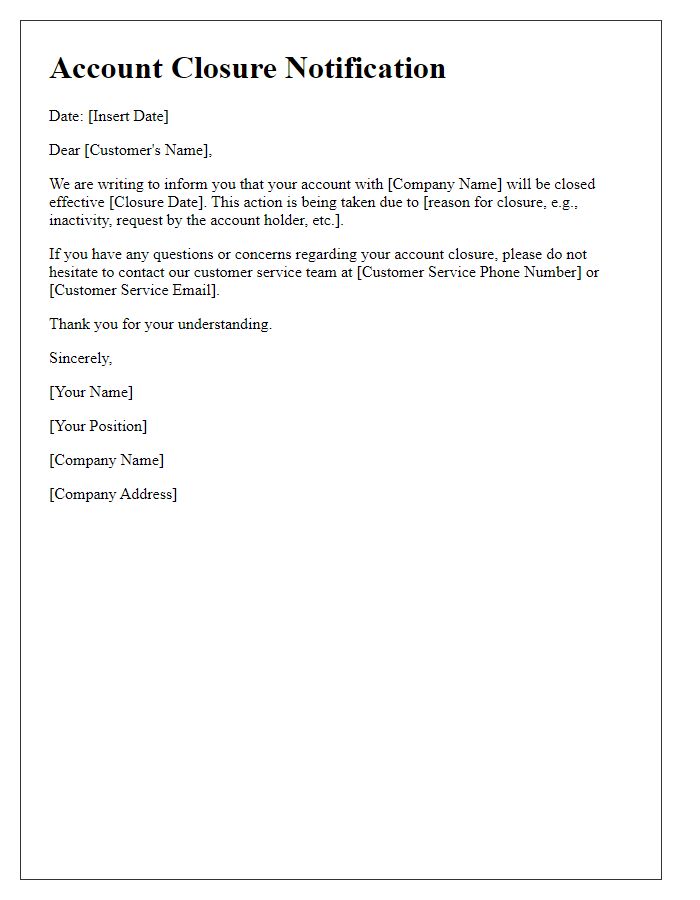

Effective Date

A bank account cancellation notice requires clarity regarding the account's effective closure. An account closure request must include the account details, such as the account number and type of account (e.g., checking, savings) to avoid confusion during administrative processes. When specifying the effective date, ensure it allows for account reconciliation, potentially two weeks from the request date, to manage pending transactions, outstanding checks, or scheduled payments. Providing contact information for any follow-up inquiries is also essential, ensuring prompt communication regarding the account's status and any final statements needed for records.

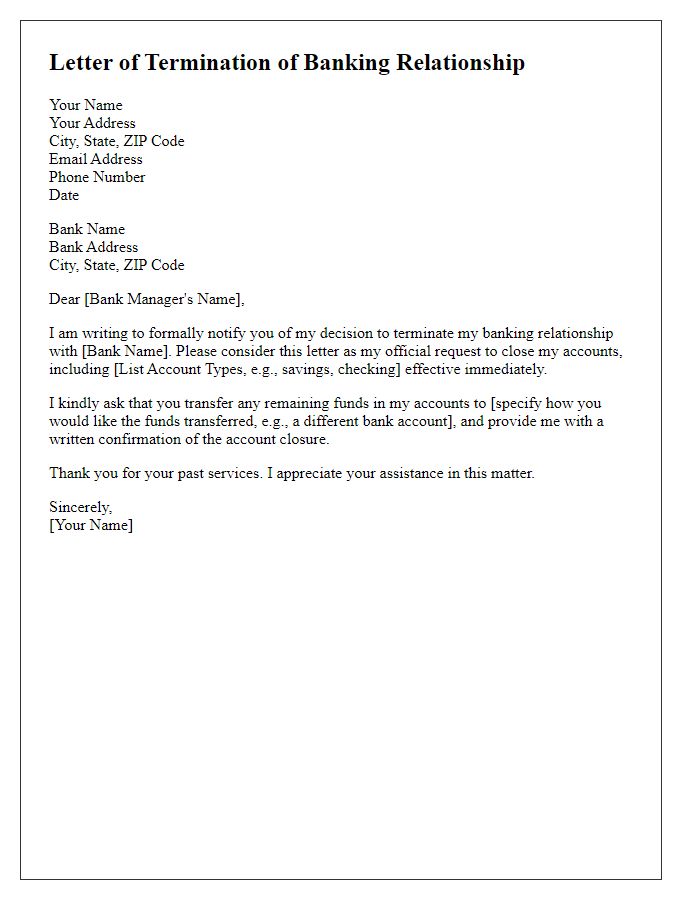

Refund of Balance

When initiating a bank account cancellation, it is essential to address critical details such as account information and refund processes. Bank account holders must specify their account number, which typically consists of 10-12 digits, to ensure accurate identification. The request for balance refund should mention the expected timeframe for processing, commonly ranging from 5 to 10 business days, depending on the bank's policies. Including personal details such as full name, address, and contact information enhances identification and facilitates smooth communication with bank representatives. Furthermore, referencing any relevant regulations or policies regarding balance refunds, such as those from the Financial Services Regulatory Authority, highlights a well-informed approach to the cancellation process.

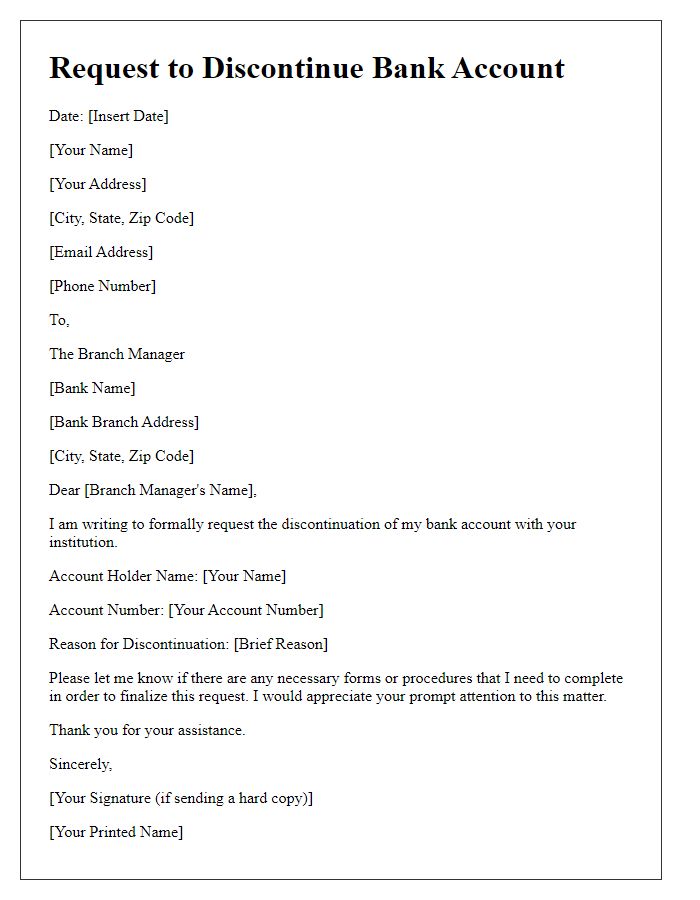

Contact Information

To cancel a bank account, customers should provide accurate contact information including their full name as it appears on the account, complete address including city and zip code, phone number, and email address. Including account details, such as the account number and type of account (e.g., checking or savings), ensures the bank can process the cancellation swiftly. Customers may also reference specific branches (like the Downtown Branch of XYZ Bank) they previously interacted with for personalized assistance or confirmation. Activate further verification through a secure method like providing social security number or identification for identity verification.

Comments