Hey there! We all know that sometimes life gets busy, and payment reminders can easily slip through the cracks. That's why we've crafted a friendly and straightforward letter template to help you gently nudge your clients about outstanding payments. It's designed to maintain a positive relationship while ensuring you get the funds you deserve. Curious to see how it works? Let's dive into the details!

Clear Subject Line

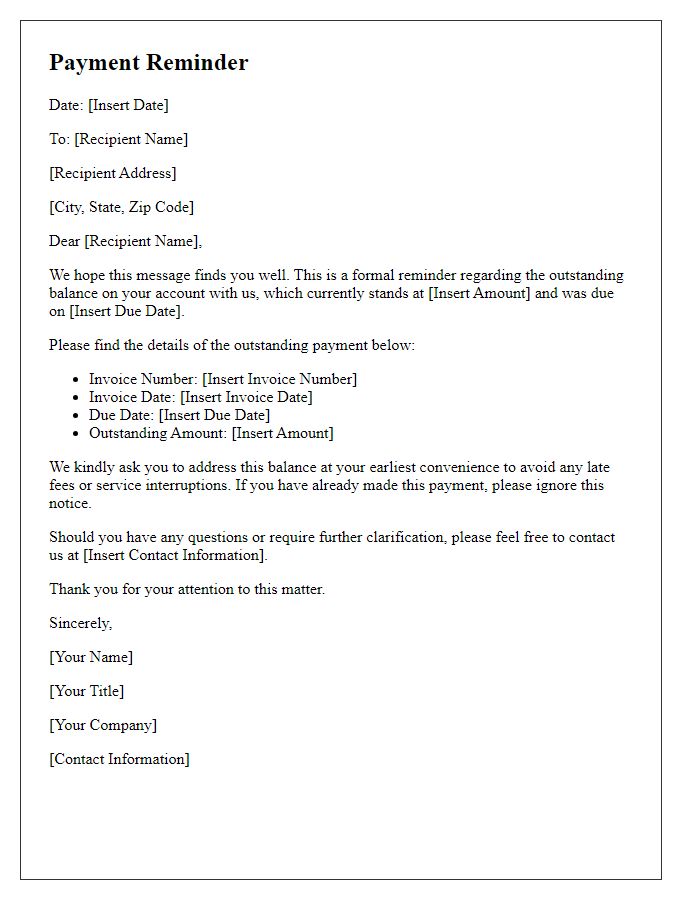

Timely payment reminders are crucial for maintaining cash flow in small businesses. A clear subject line, such as "Payment Reminder: Invoice #12345 Due," can significantly enhance visibility and prompt action. This straightforward subject line details the specific invoice number (12345) and the urgency related to a due date, ensuring clients immediately recognize the purpose of the email. Sending the reminder several days prior to the due date also increases the likelihood of receiving payment on time, thus improving operational liquidity.

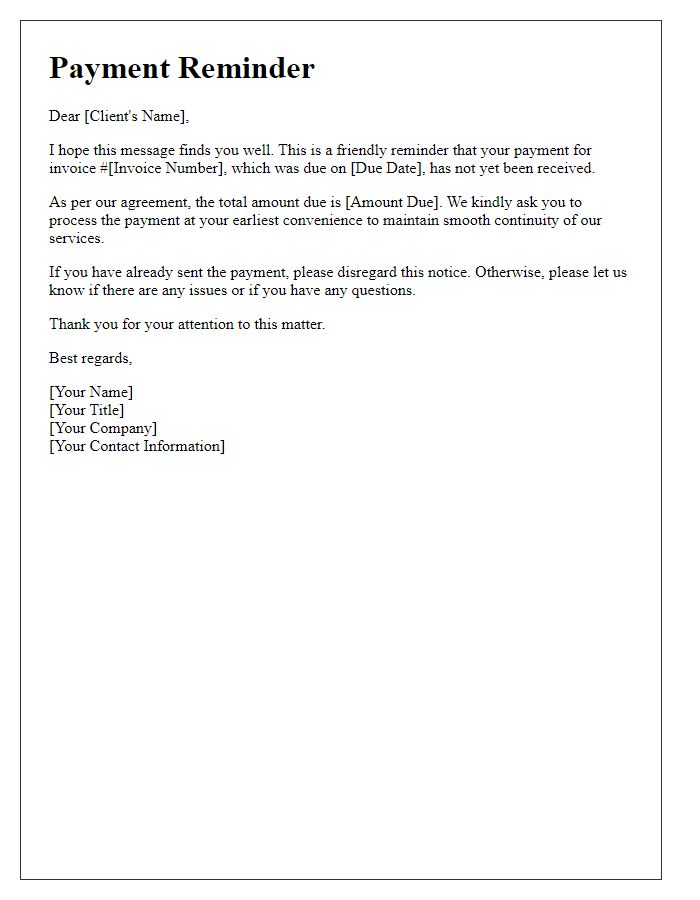

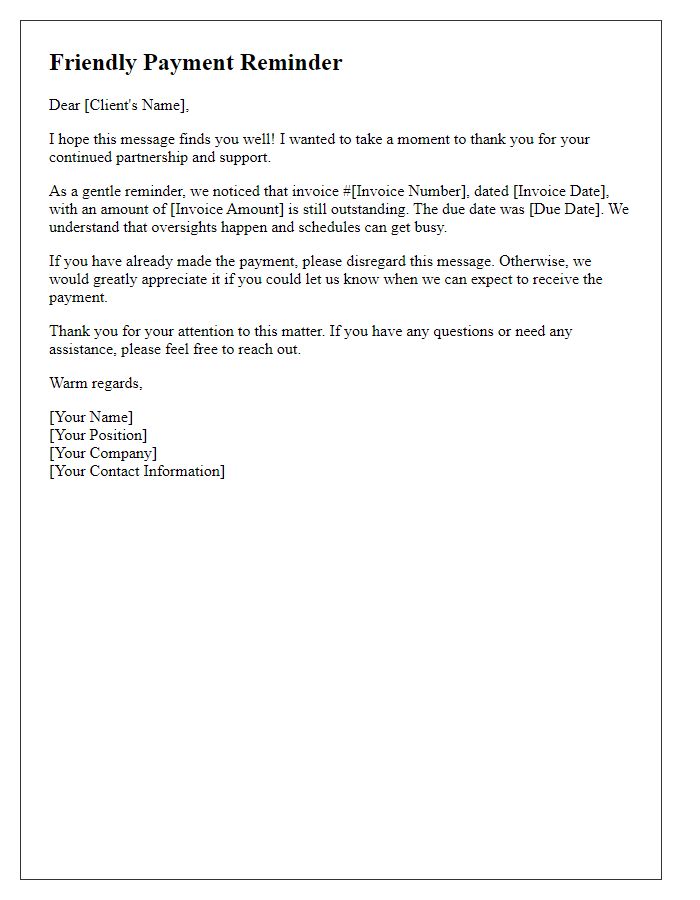

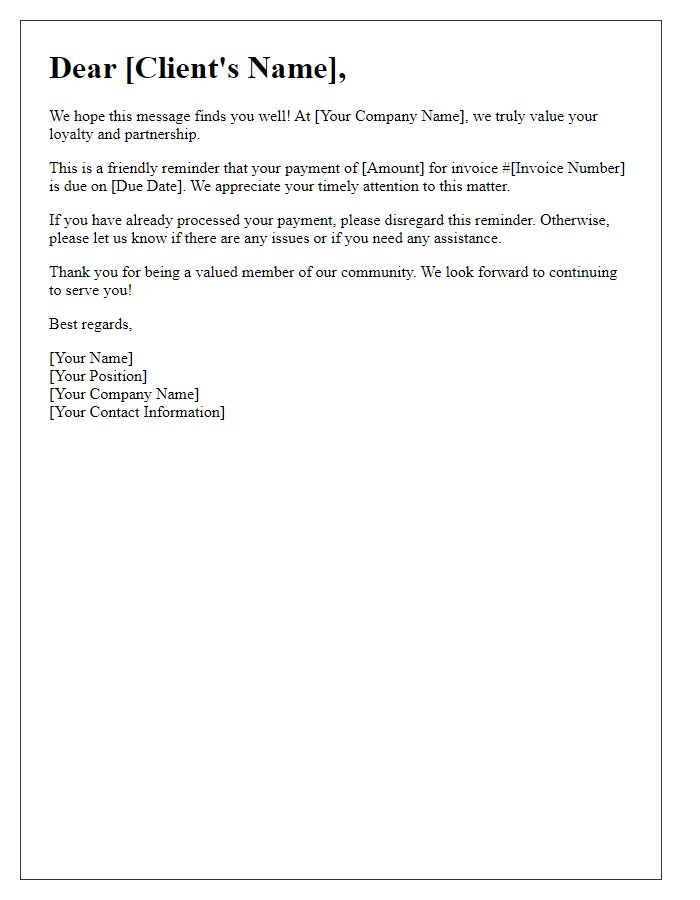

Polite and Professional Tone

The outstanding invoices can impact cash flow for small businesses, making timely payments essential for operations. For instance, a company may have issued invoices dated September 1, 2023, with a net payment due by September 30, 2023. Late payments usually result in a domino effect, delaying payroll or disrupting resource allocation. Clients often appreciate clear reminders, as a policy of sending gentle nudges two weeks before the due date can foster better rapport and understanding. A professional tone, combined with an appreciation for the client's business, can enhance communication and contribute positively to the relationship while ensuring that financial obligations are met.

Specific Amount Due

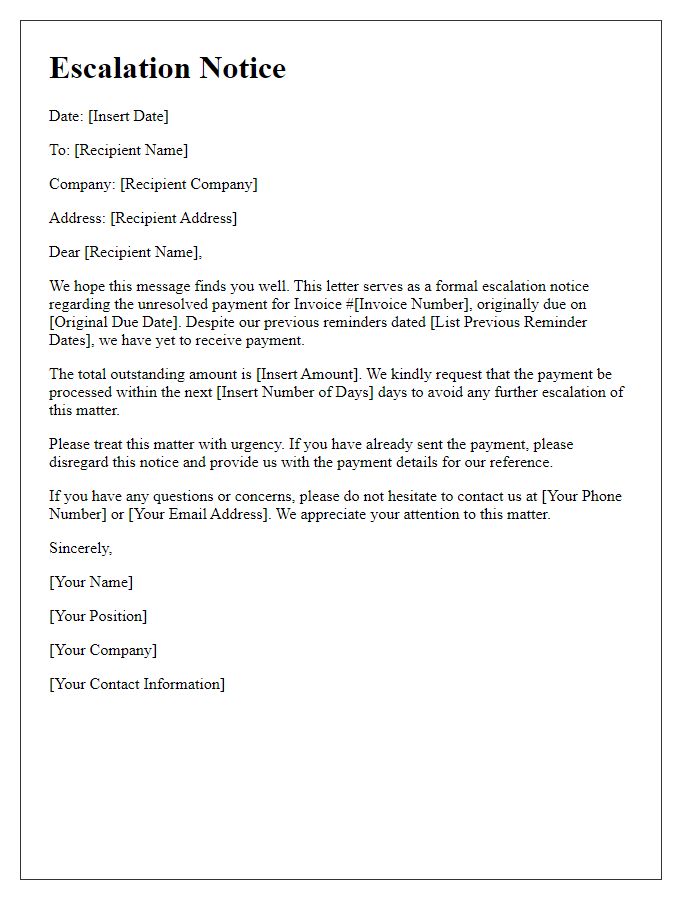

Businesses often encounter situations where clients may delay payments, necessitating effective reminders. A payment reminder should incorporate essential details like the specific amount due, the original invoice date, and a clear due date. Ensure to mention any applicable late fees, which may incentivize timely payments. Use a professional tone, thanking the client for prior business while expressing the importance of resolving the outstanding balance promptly to maintain a good working relationship. Clear communication helps prevent misunderstandings and fosters trust between the business and its clients.

Payment Due Date

Payment reminders serve as essential communication in business transactions. As an account receivable strategy, timely reminders increase the chances of receiving payments on or before the due date. For instance, a payment reminder dated 30 days after invoice issuance may specify the due date clearly, encouraging prompt action from clients. These reminders often include invoice numbers, total amounts due, and details of services provided (e.g., consulting services or product deliveries). Establishing a professional tone is vital, maintaining a positive client relationship while emphasizing the importance of adhering to agreed payment schedules.

Contact Information for Queries

Payment reminders are essential for maintaining healthy cash flow in businesses. Clients often appreciate a clear and professional communication approach. Contact information for queries should include details such as the business's official email address (e.g., info@businessname.com), a dedicated phone number (e.g., +1-800-555-0199), and potentially a physical address (e.g., 123 Business St, Suite 456, City, State, ZIP) where clients can direct their inquiries. Providing a direct contact person, such as a finance manager or accounts receivable specialist, with their specific email (e.g., john.doe@businessname.com) facilitates prompt responses and enhances client trust. Including operation hours (e.g., Monday to Friday, 9 AM to 5 PM) indicates availability, reassuring clients that support is accessible when needed.

Letter Template For Payment Reminder To Clients Samples

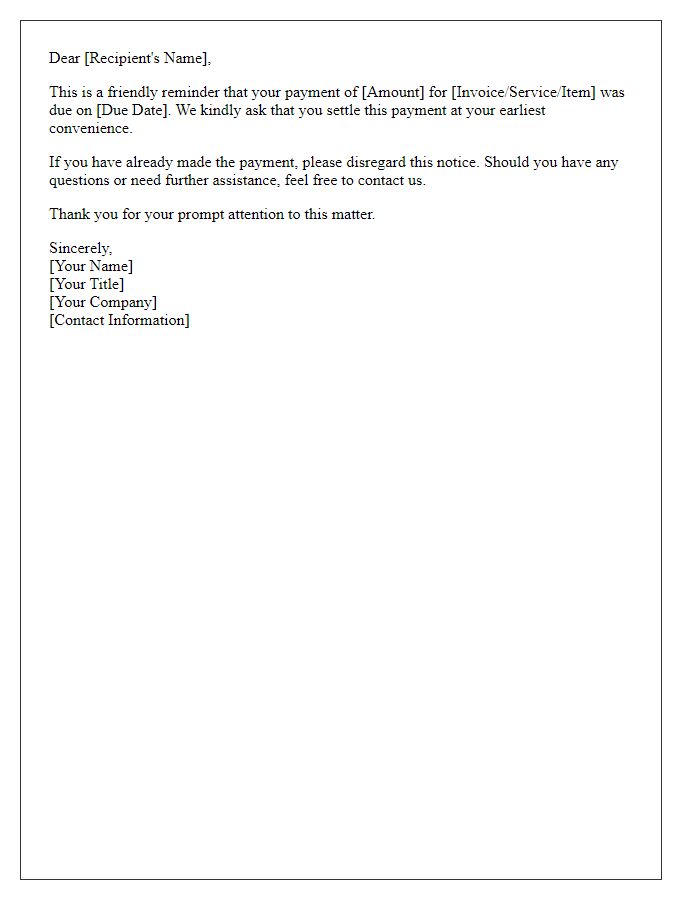

Letter template of professional payment reminder for recurring invoices.

Comments