Are you tired of chasing down overdue invoices? It's a common challenge for many businesses, but tackling this issue doesn't have to be daunting. By sending a friendly yet assertive letter, you can prompt your customers to settle their accounts while maintaining a positive relationship. Ready to learn how to craft the perfect letter to address those overdue invoices? Read on for some helpful tips!

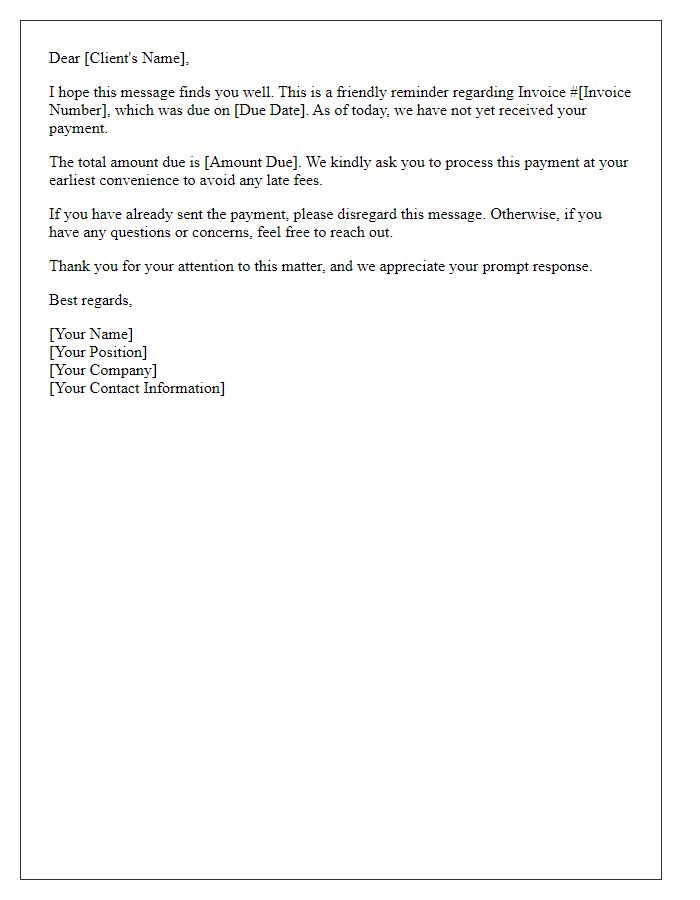

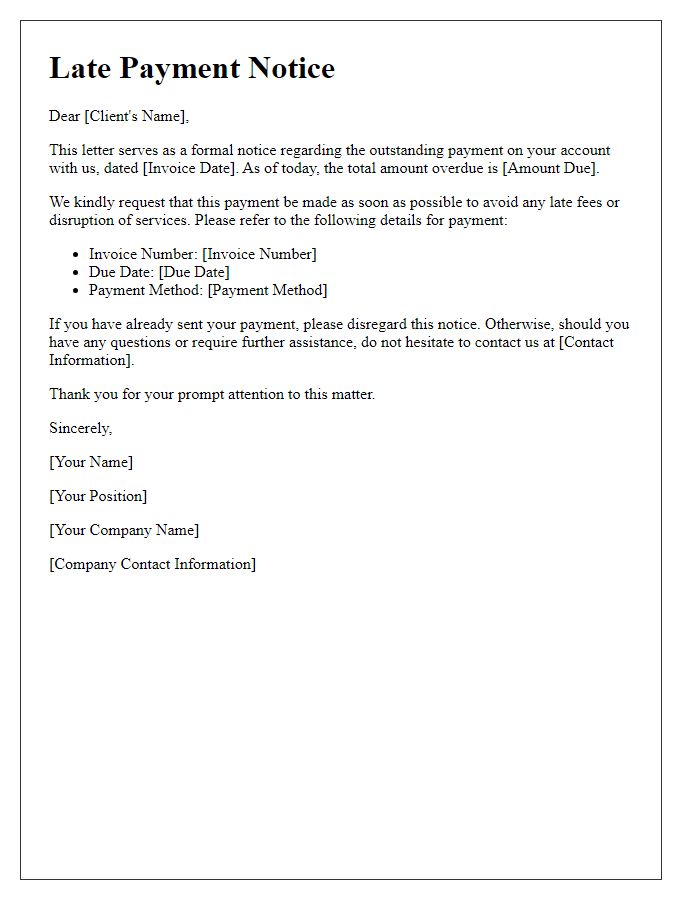

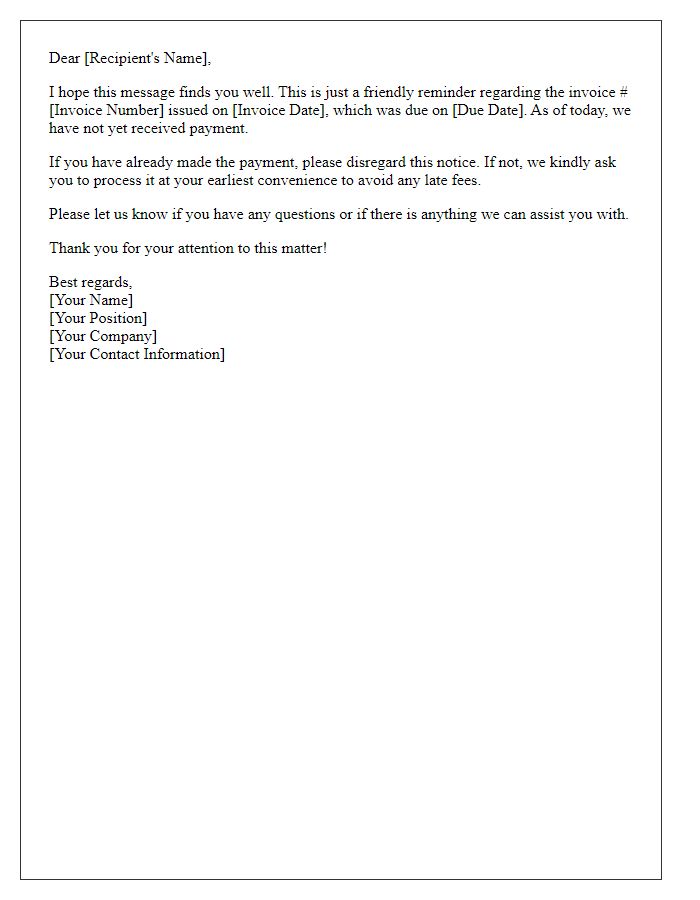

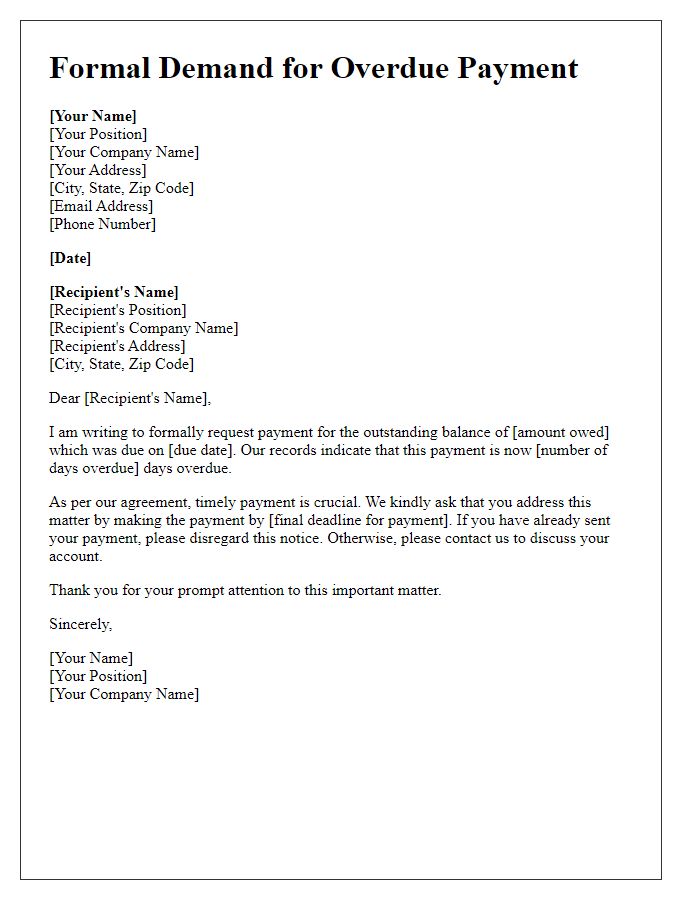

Professional Tone and Language

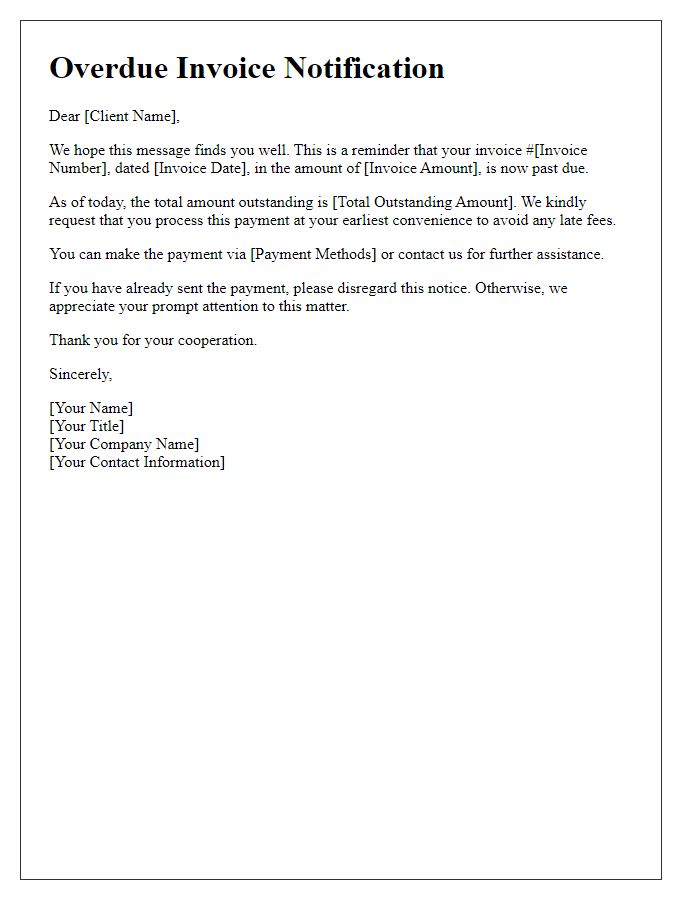

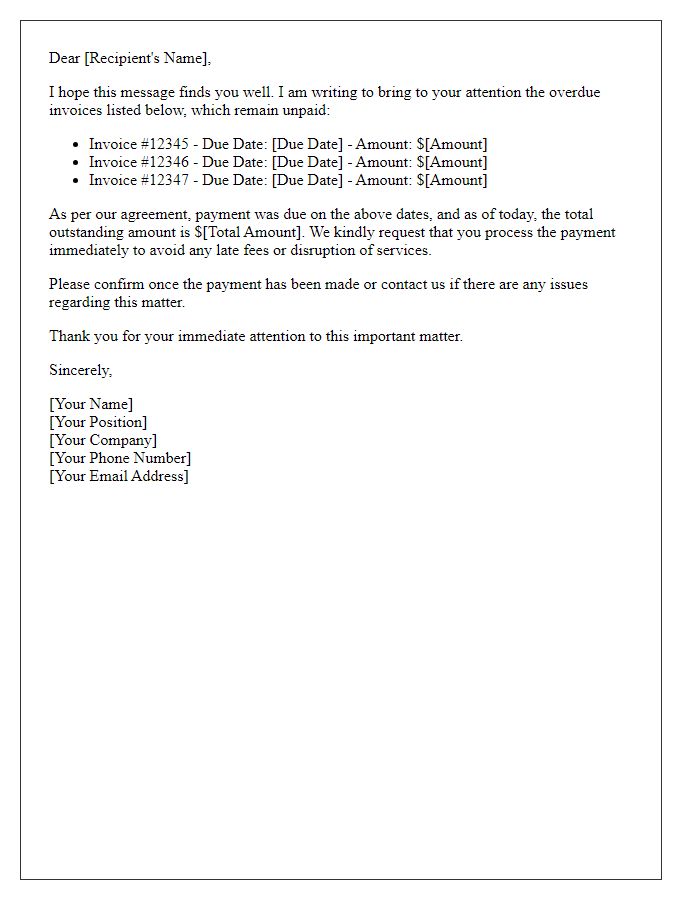

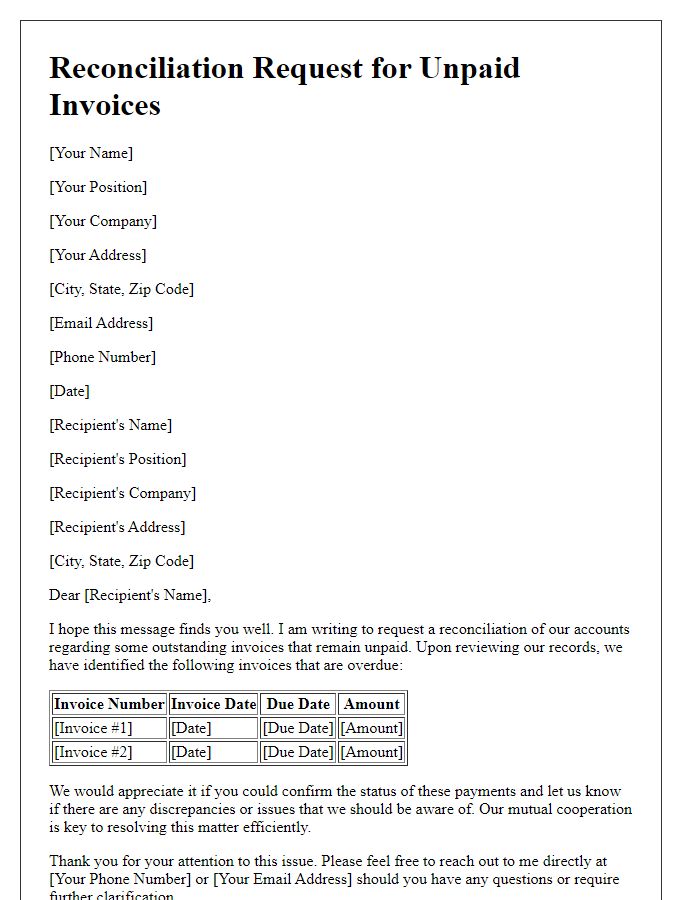

A company's accounts receivable team can face challenges managing overdue customer invoices, often resulting in delayed cash flow and strained business relationships. Tactful communication is crucial in such situations. For instance, professional language should include specific invoice details, such as invoice number (e.g., INV12345), original due date (e.g., January 15, 2023), and the outstanding amount (e.g., $1,500) for clarity. Respecting the client's position while addressing overdue balances is important; consider expressing understanding of potential cash flow issues for the client, while firmly emphasizing the necessity of timely payments for service continuity. Effective documentation of prior communications, such as reminders sent (first reminder on January 20, 2023) can fortify your position, showcasing diligent follow-up efforts while maintaining a professional tone.

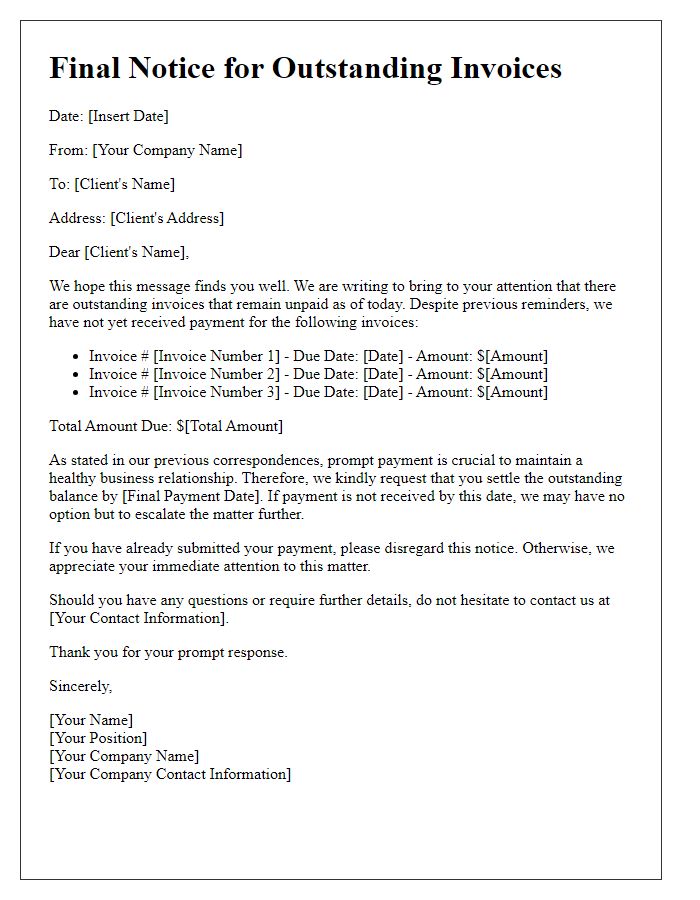

Clear Invoice Details and Amount

An overdue customer invoice can disrupt cash flow for businesses, particularly affecting small enterprises striving to maintain healthy financial operations. Detailed invoice information, including invoice number (unique identifier), issuance date, due date, and total amount due (often outlined clearly at the bottom), is crucial for effective communication. Timely reminders to customers emphasize the necessity of payment, providing a breakdown of services or products rendered (dates and descriptions) that justifies the amount owed. A professional tone balanced with urgency encourages prompt action, minimizing delays in revenue recovery. In some industries, adhering to payment terms (often ranging from net 30 to net 60 days) is essential for maintaining good relationships and ensuring future business transactions.

Deadline for Payment

Overdue customer invoices pose significant challenges for businesses, impacting cash flow and financial stability. Businesses often experience a deadline for payment which typically ranges from 30 to 90 days after an invoice date. For example, a payment due on January 15 signifies a proactive approach needed by February 15 to mitigate late fees. The implications of overdue invoices extend beyond financial metrics; they may strain customer relationships, especially if follow-ups remain unaddressed. Implementing a reminder system, such as sending automated emails five days prior to the deadline, can enhance payment recovery efforts. Properly documenting these invoices, including invoice numbers, dates, and amounts owed, is essential for clarity and professionalism in communication with clients.

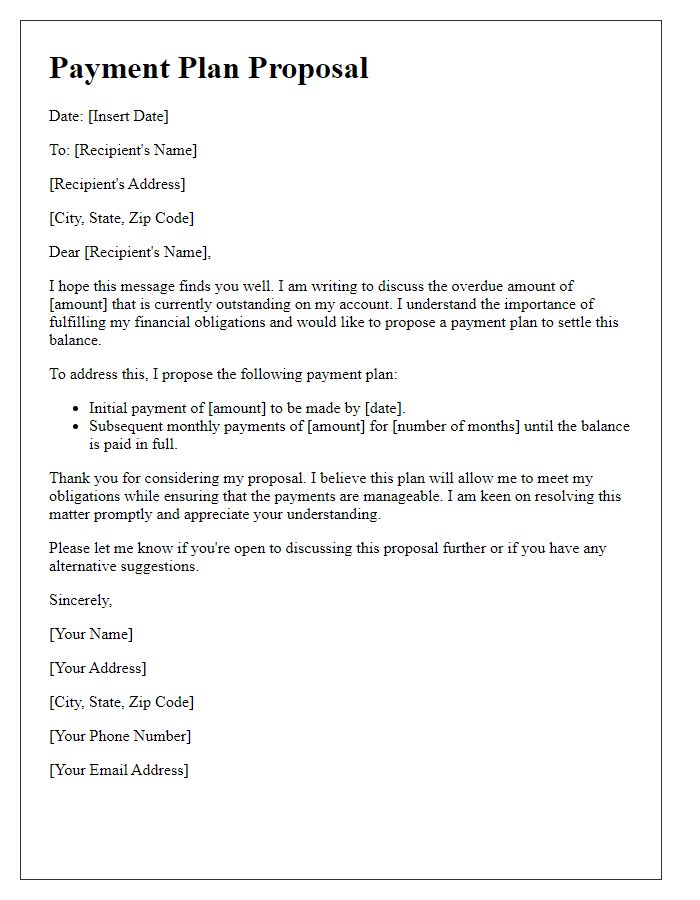

Consequences of Non-Payment

Overdue customer invoices can lead to significant consequences for businesses, including cash flow issues that directly affect operational capabilities. Late payments, often exceeding 30 days from the due date, can result in the accumulation of interest charges, typically ranging from 1% to 2% per month depending on the agreement. Consequences may also include strained relationships with suppliers who rely on timely payments for their own operations. Persistent non-payment can lead to escalated actions such as collections, legal proceedings, or the involvement of debt recovery agencies, impacting credit ratings in systems like Dun & Bradstreet. Additionally, businesses risk losing valuable customers, as monetary disputes can degrade trust and loyalty, subsequently leading to diminished sales and revenue streams.

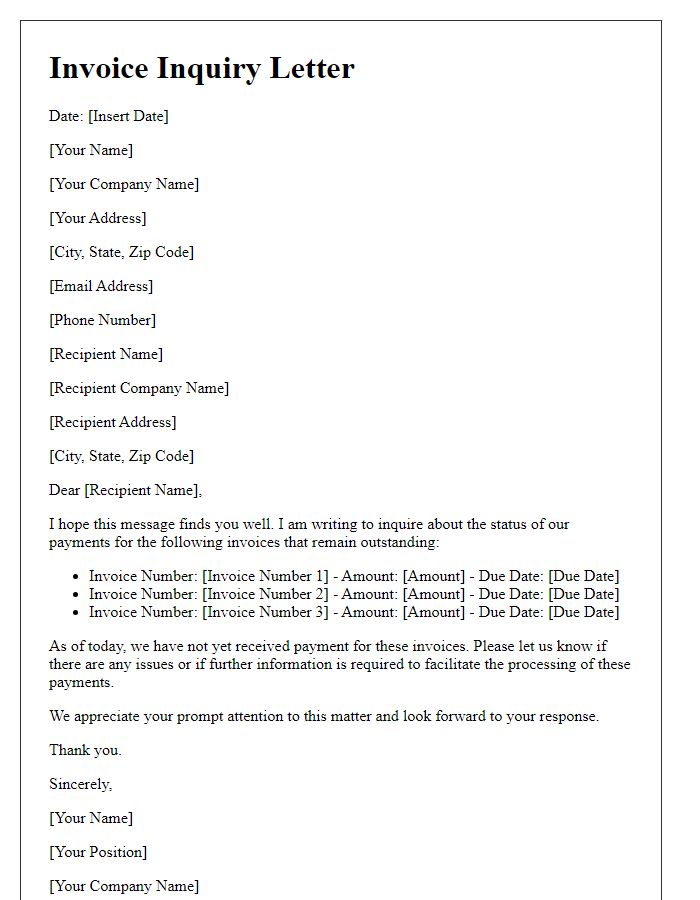

Contact Information and Payment Options

Overdue customer invoices pose significant challenges to businesses, impacting cash flow and operational efficiency. Timely communications are essential for maintaining healthy financial relationships. Clear contact information, including phone number (e.g., +1-800-555-0199) and email address (e.g., billing@company.com), helps facilitate swift inquiries regarding payment status. Providing multiple payment options, such as credit card processing (Visa, MasterCard, or American Express), bank transfers (ACH transfers), and online payment platforms (PayPal, Stripe) can alleviate payment delays. Additionally, outlining deadlines (such as 30 or 60 days past due) emphasizes urgency, aiding the collection process and encouraging prompt payment from customers.

Comments