Are you considering enhancing your coverage options or exploring new insurance solutions? Crafting a compelling insurance brokerage proposal can make all the difference in securing the best terms for your needs. In this article, we'll walk you through a practical template that highlights key elements, ensuring your proposal stands out to potential clients. So, let's dive in and discover how to create an engaging and effective letter that captures attention!

Personalized Salutation

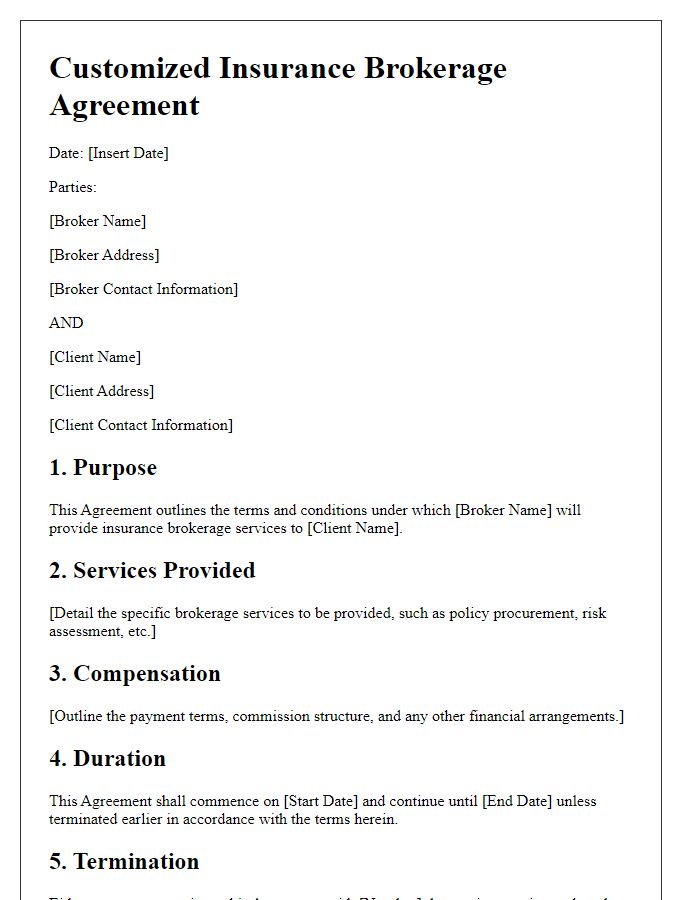

The insurance brokerage proposal highlights a tailored approach to meet specific client needs, emphasizing comprehensive coverage options for various industries such as real estate, healthcare, and technology. The proposal outlines key services like risk assessment, policy comparison, and claims management, ensuring optimal financial protection against unforeseen events. Notable companies within the brokerage firm's portfolio include global leaders in their respective fields, providing a robust foundation of experience. Additionally, the proposal includes statistical data on market trends and insurance cost advantages, aiming to illustrate potential savings and benefits for clients. Regular consultation sessions, annual reviews, and dedicated account managers are also offered to enhance client relationships and maintain adaptable insurance solutions.

Client Needs Assessment

The Client Needs Assessment process in insurance brokerage involves a comprehensive analysis of individual or business requirements to ensure adequate coverage. A detailed questionnaire may include inquiries about current policies, risk tolerance levels, and specific assets worth insuring, such as property valued at over $500,000 or high-risk activities. Conducting face-to-face consultations in locations such as local offices or clients' homes enhances understanding of unique needs. Industry regulations and recent claim data can also play a pivotal role in identifying gaps in coverage. Gathering information on client demographics, including age range (e.g., 30-50) and business sector (e.g., healthcare or technology), establishes a tailored approach to propose relevant insurance solutions.

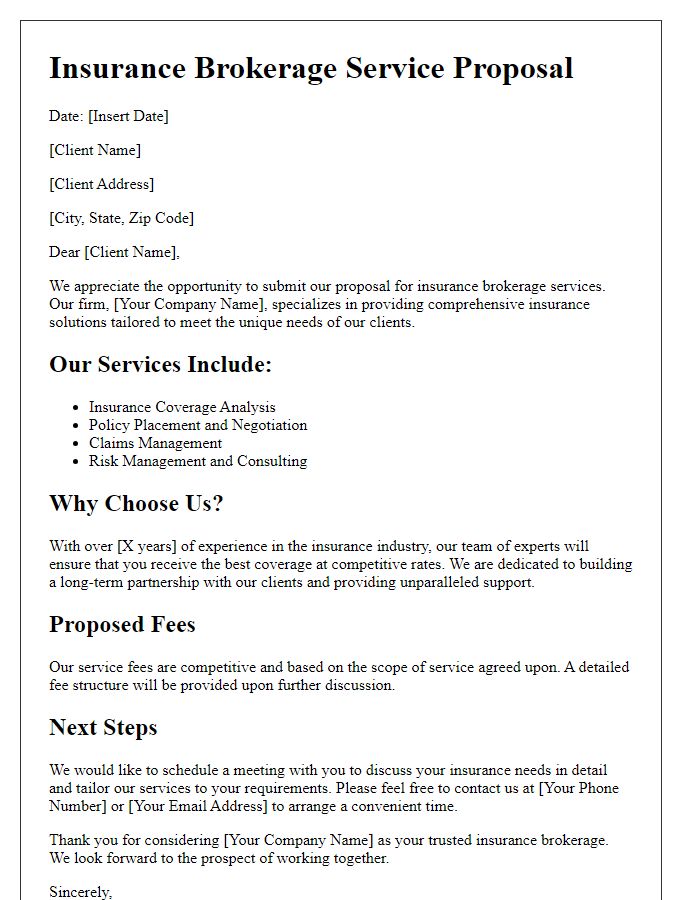

Services Offered

An insurance brokerage firm provides a wide range of specialized services designed to meet the diverse needs of individuals and businesses seeking protection from potential risks. Risk assessment involves a thorough analysis of various factors such as property values, liability exposures, and industry-specific hazards to determine appropriate coverage levels. Customized insurance placement helps clients secure policies tailored to their unique situations through partnerships with multiple insurers, ensuring competitive rates. Claims management support includes filing assistance, negotiation with insurers, and ensuring timely settlements, which can significantly reduce stress during the claims process. Additionally, ongoing policy reviews facilitate adjustments based on changes in client circumstances or risk environments, ensuring that coverage remains optimal and compliant with industry regulations. Educational resources, including workshops and webinars regarding emerging insurance trends and risk management strategies, further empower clients with the knowledge needed to make informed decisions.

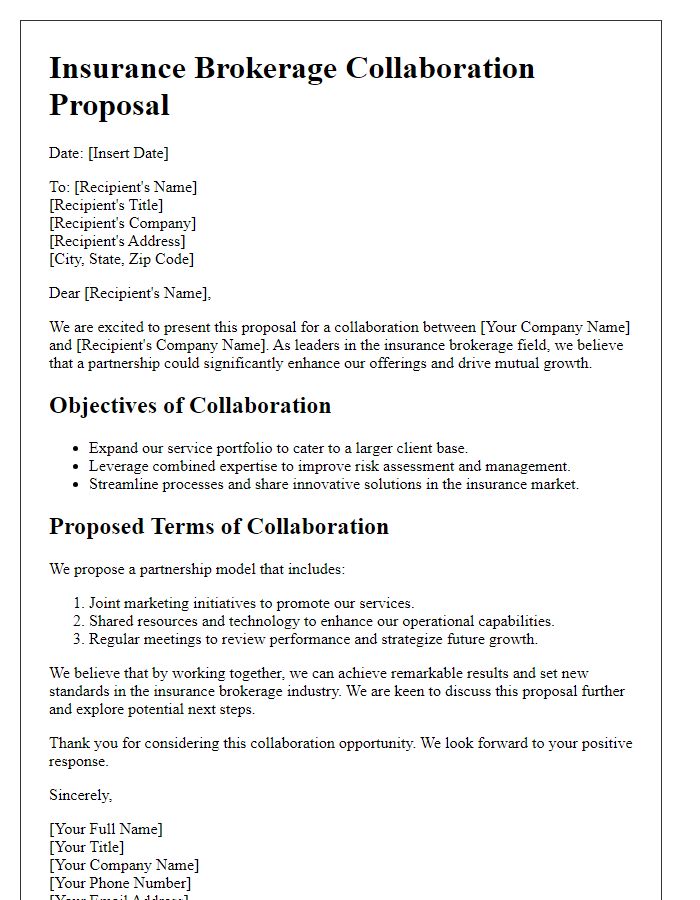

Competitive Advantage

Insurance brokerages often leverage competitive advantages to stand out in a saturated market. Unique service offerings, such as 24/7 customer support, enhance client satisfaction significantly. Utilizing advanced technology platforms, like AI-driven risk assessment tools, allows for accurate policy customization. Exclusive partnerships with reputable insurance providers create access to tailored coverage options for clients, including specialized sectors like health and automotive industries. Additionally, industry expertise and local market knowledge in regions such as California and New York can significantly influence client decision-making, fostering trust and long-term relationships. Transparency in pricing and claims processes further solidifies a brokerage's reputation as a client-focused service provider.

Call to Action and Contact Information

Crafting a compelling insurance brokerage proposal requires a strategic call to action that encourages potential clients to reach out for more information. For example, offering a complimentary consultation can serve as an enticing incentive. Potential clients are encouraged to connect with our experienced team at [Your Brokerage Name], located on [Main Street, City, State], to discuss personalized insurance solutions that meet their specific needs. Our dedicated contact line, (123) 456-7890, is available during business hours (Monday to Friday, 9 AM to 5 PM), ensuring swift communication. Email inquiries can be directed to info@[yourbrokeragename].com for any tailored insurance needs or questions, further enhancing our approach to customer service and satisfaction.

Comments