Are you navigating the sometimes tricky waters of payment terms with your business partner? It's crucial to ensure that both parties are on the same page to foster a strong professional relationship. Clarifying these terms can prevent misunderstandings and pave the way for seamless transactions. If you're interested in learning how to effectively communicate your payment expectations, read on for some helpful tips!

Clear Subject Line

Clarifying payment terms is crucial for maintaining a healthy business relationship. Clear payment terms, such as net 30 or 60-day agreements, help prevent misunderstandings. Specific details about invoice submission dates ensure timely processing. A written agreement, detailing the currency used (USD or EUR), payment methods (bank transfer, PayPal), and late fees, adds clarity. Regular communication about any adjustments to these terms preserves trust between partners. Establishing a mutual understanding of expectations encourages smooth financial transactions and prevents disputes over payments.

Formal Salutation

Payment terms between business partners are crucial for maintaining healthy financial relationships. Clear agreements specify due dates, such as Net 30 (payment due within 30 days), and penalties for late payments which can include interest fees (often around 1.5% per month) or late charges. The importance of specifying payment methods, such as bank transfers or checks, is essential to avoid ambiguities. Including details about invoice requirements, like itemization of services or goods provided, adds transparency. In some cases, partnerships also outline early payment incentives that might offer discounts (typically around 2-5%) for settling invoices ahead of schedule, fostering trust and encouraging prompt payments.

Direct Explanation of Payment Terms

In a business partnership, understanding and clarifying payment terms is essential for maintaining healthy financial relationships. Payment terms, often detailed in contracts, stipulate when payments are due, the methods allowed for payment, and any penalties for late payments. Standard payment intervals range from net 30 days to net 60 days, which means payment is expected within 30 or 60 days after the invoice date. Additionally, payment methods can include bank transfers, credit card payments, or checks, creating flexibility in how transactions are conducted. It is crucial for both partners to review and agree upon these terms to avoid potential disputes that could disrupt operations or lead to financial strain. Open communication about these financial agreements ensures clarity and fosters trust between partners.

Details on Due Dates and Penalties

In business transactions, understanding the payment terms is crucial for maintaining healthy partnerships. Clear due dates, often specified in the contract, help in scheduling financial forecasts; for example, invoices might be due 30 days after issue. Penalties, such as late fees (e.g., 1.5% per month) for overdue payments, incentivize timely transactions. Companies often implement grace periods (typically 5-10 days) before penalties are enforced, fostering goodwill while ensuring compliance. Additionally, communication channels should be established for addressing potential disputes regarding payment terms, enhancing overall trust and transparency in the business relationship.

Contact Information for Queries

Timely payment terms are crucial for maintaining smooth business operations between partners and ensuring financial stability. Clear communication regarding payment expectations, such as invoice submission timelines and payment methods, is essential to avoid misunderstandings. Additionally, specifying contact information for queries regarding payments, including the names and email addresses of key financial personnel, enhances transparency and allows for prompt resolution of any issues or discrepancies that may arise during the payment process. Providing a dedicated phone number for urgent matters can also facilitate quicker responses, fostering a stronger partnership.

Letter Template For Clarifying Business Partner Payment Terms Samples

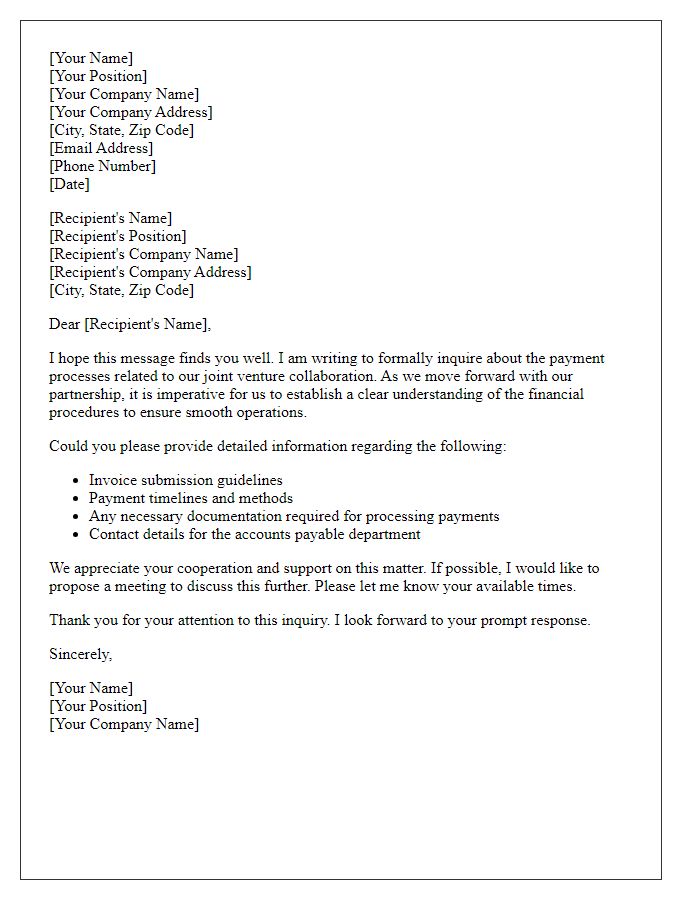

Letter template of inquiry regarding payment terms for business partnership.

Letter template of request for clarification on payment conditions with partner.

Letter template of confirmation needed for payment agreement with business associate.

Letter template of explanation request on payment schedule for partnership.

Letter template of seeking details on payment timelines from business collaborator.

Letter template of follow-up concerning agreed payment terms for partnership.

Letter template of discussion regarding payment obligations with business partner.

Letter template of need for payment terms clarification in partnership agreement.

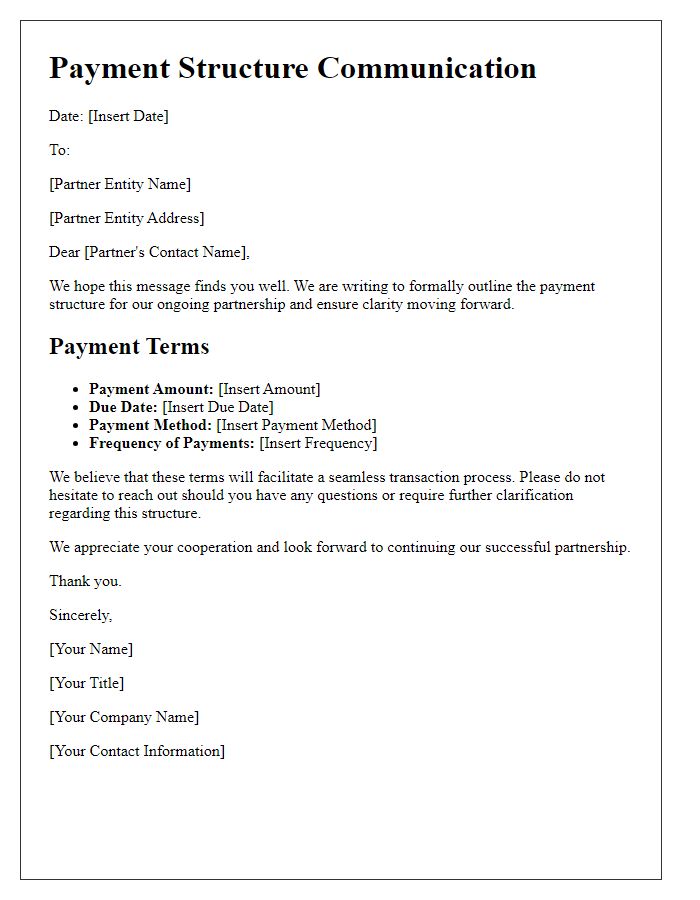

Letter template of communication addressing payment structures with partner entity.

Comments