Are you feeling the pressure of tax season looming over your business? If so, you're not alone; many entrepreneurs find themselves needing a little extra time to gather their financial documents and ensure accurate reporting. Fortunately, requesting a tax extension is a straightforward process that can provide the relief you need to manage your obligations effectively. Curious about how to craft the perfect letter for this extension? Read on for essential tips and templates to help you get started!

Business Information (Name, Address, Business ID)

When seeking a business tax extension, essential information such as the business name, physical address, and unique Business Identification Number (EIN) must be included. The business name represents the official name registered with state authorities, typically utilized in legal and financial documentation. The address indicates the primary location where operations occur, often comprising a street number, street name, city, state, and ZIP code, ensuring correspondence reaches the appropriate entity. The Business Identification Number serves as a vital reference for tax authorities, facilitating tracking of the business's tax obligations and filing history, usually consisting of nine digits issued by the Internal Revenue Service (IRS). Accurate inclusion of these details ensures compliance with tax regulations and seamless processing of the extension request.

Tax Identification Number

Acquiring a business tax extension can offer additional time to submit necessary documents and tax returns, especially for entities registered under the IRS (Internal Revenue Service) Tax Identification Number (TIN) system. Businesses operating in various sectors, from retail to manufacturing, may seek extensions to ensure compliance with tax regulations due by April 15 each year, or September 15 for S Corporations and partnerships. Filing for an extension involves completing IRS Form 7004, which provides a six-month grace period, allowing businesses to strategize financial records and minimize errors, thus avoiding potential penalties. Maintaining proper documentation and adhering to deadlines is crucial for sustaining credibility with tax authorities and fostering smooth financial operations.

Reason for Extension Request

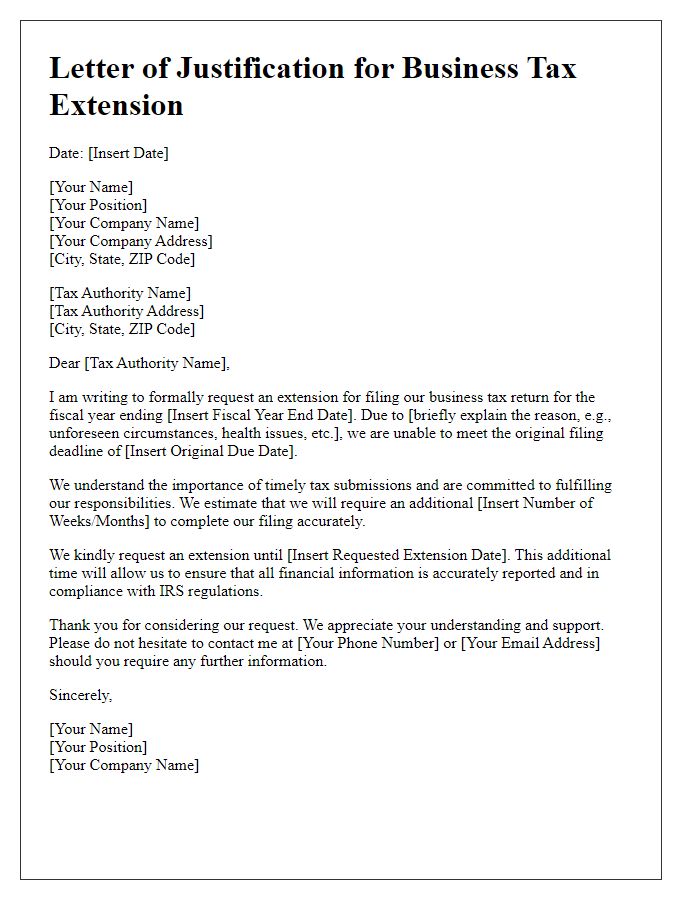

Businesses often require a tax extension due to various reasons, such as insufficient financial documentation, complex tax situations, or unexpected events like natural disasters. Insufficient financial documentation may arise from delayed reports from accountants, inadequate bookkeeping, or missing receipts. Complex tax situations can involve multiple income sources, extensive deductions, or intricate business structures requiring additional time to accurately report. Unexpected events, like the devastating floods in Houston in 2017, can hinder the timely preparation of tax returns. Seeking an extension allows businesses until October 15 to file their returns, preventing potential penalties for late submissions and ensuring compliance with IRS regulations.

Extended Tax Payment Details

Businesses may encounter financial challenges, necessitating the need for an extended tax payment deadline. The Internal Revenue Service (IRS), the United States government agency responsible for tax collection, allows businesses a six-month extension, shifting due dates from April 15 to October 15 for various tax filings. Key requirements include submitting IRS Form 7004, which is necessary for an automatic extension request. Additionally, estimated tax payments should still be made by the original due date to avoid interest penalties. Outstanding balances may accrue interest at a rate of approximately 3% per annum, while failure to file could incur penalties as high as 5% of unpaid taxes per month. Tax professionals often assist in navigating these complexities.

Signature and Contact Information

Businesses often require an extension for tax filings to ensure accurate reporting and compliance with the Internal Revenue Service (IRS) regulations. The signature section of a business tax extension typically includes the responsible party's name (such as the Chief Financial Officer or business owner) along with their title. Contact information, including the business phone number and email address, is crucial for IRS correspondence. Form 7004, for example, must be submitted electronically or by mail by March 15 for calendar year corporations. Confirming entity details such as Employer Identification Number (EIN) ensures proper processing by the IRS, contributing to timely approval of the extension.

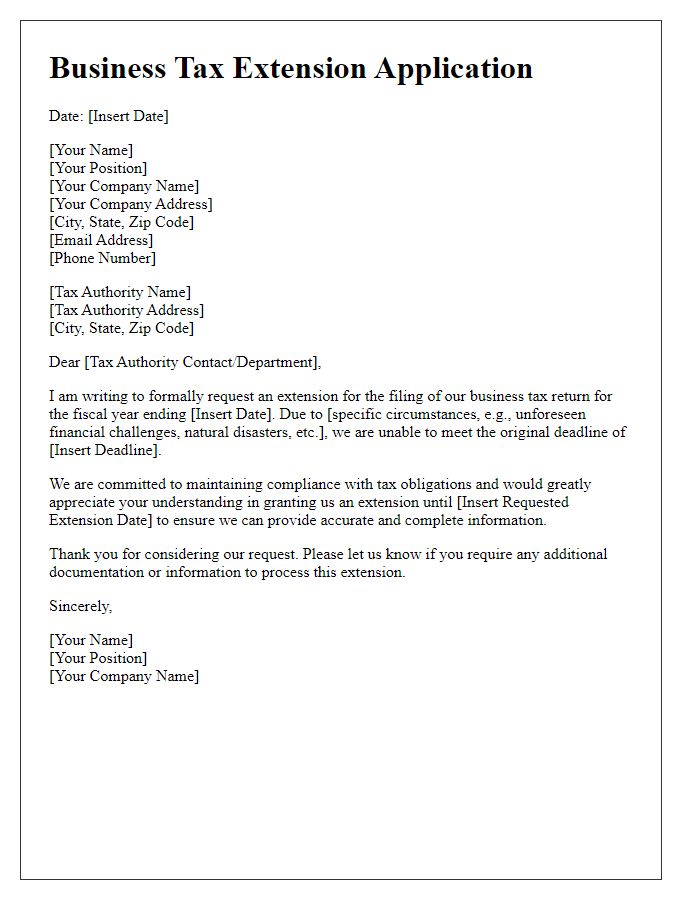

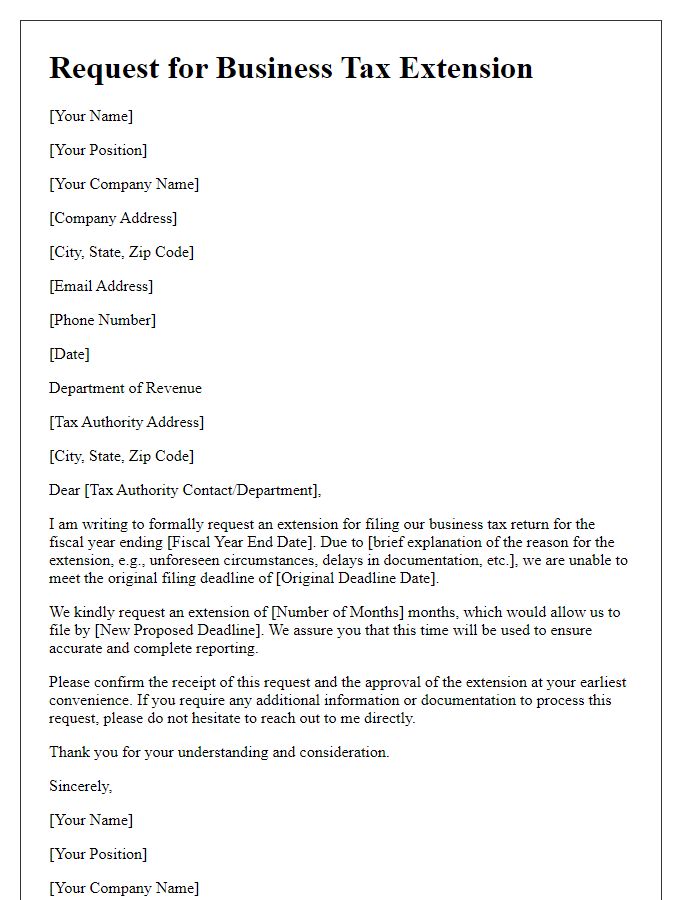

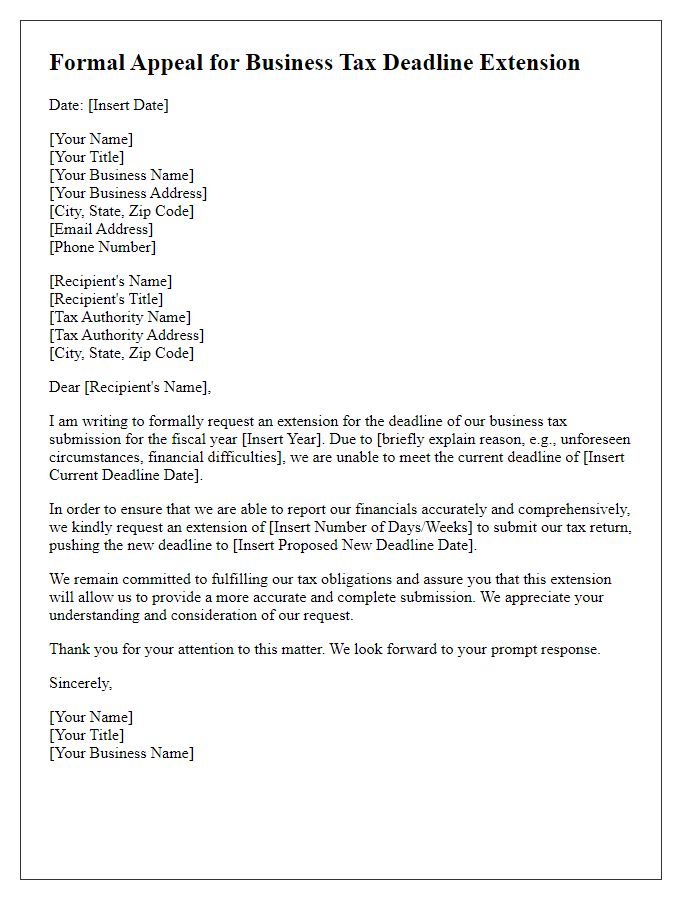

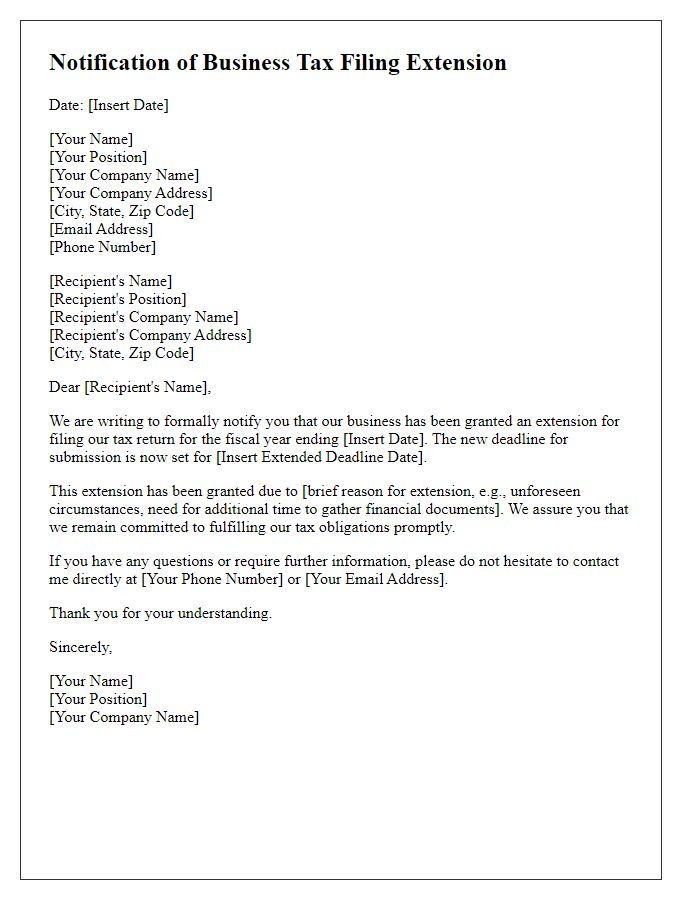

Letter Template For Business Tax Extension Samples

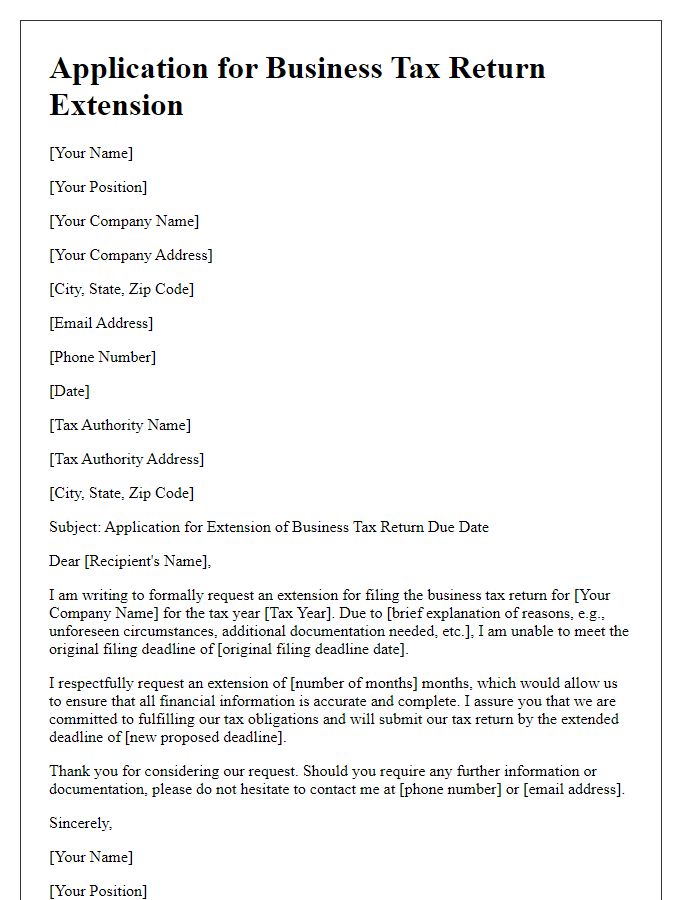

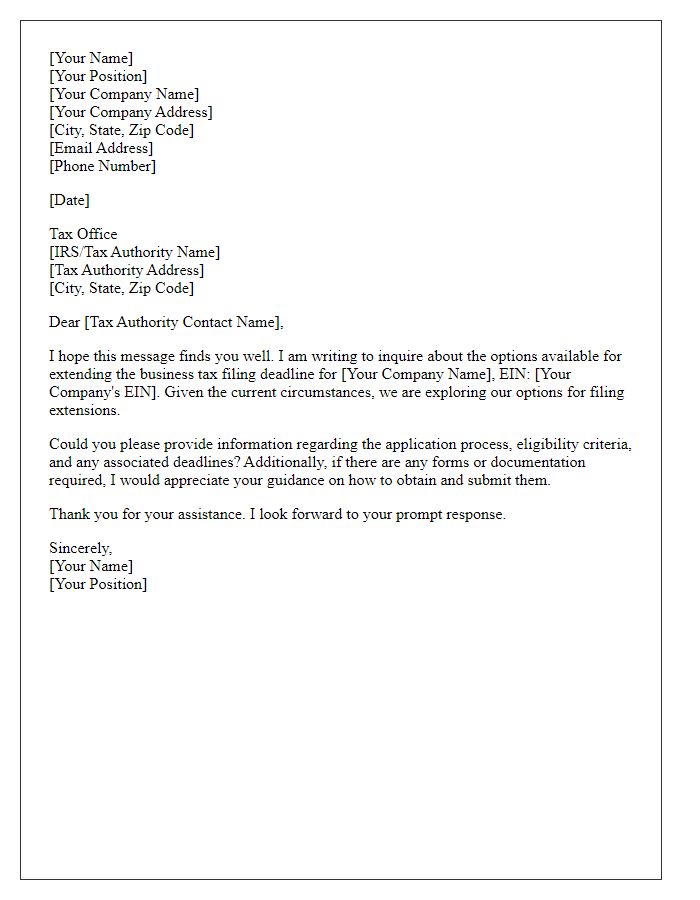

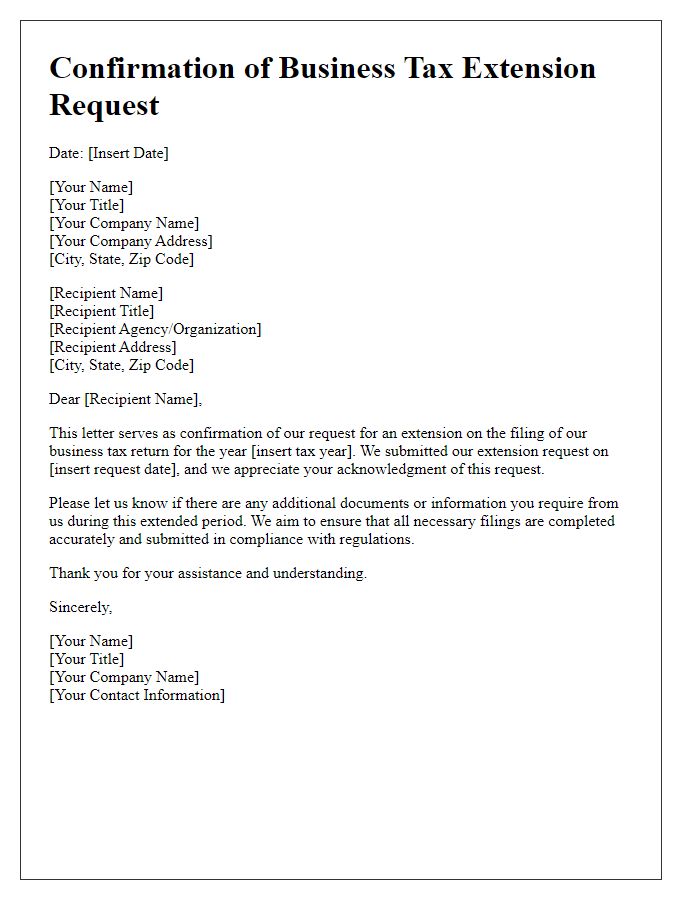

Letter template of business tax extension application for specific circumstances

Comments