Are you tired of the endless paperwork and confusion surrounding expense report submissions? Well, you're in luck! We've crafted a user-friendly letter template that simplifies the process, making it easier for you to organize and present your expenses. If you're looking for a straightforward approach to submitting your expense reports, keep reading to discover how our template can streamline your experience!

Clear Subject Line

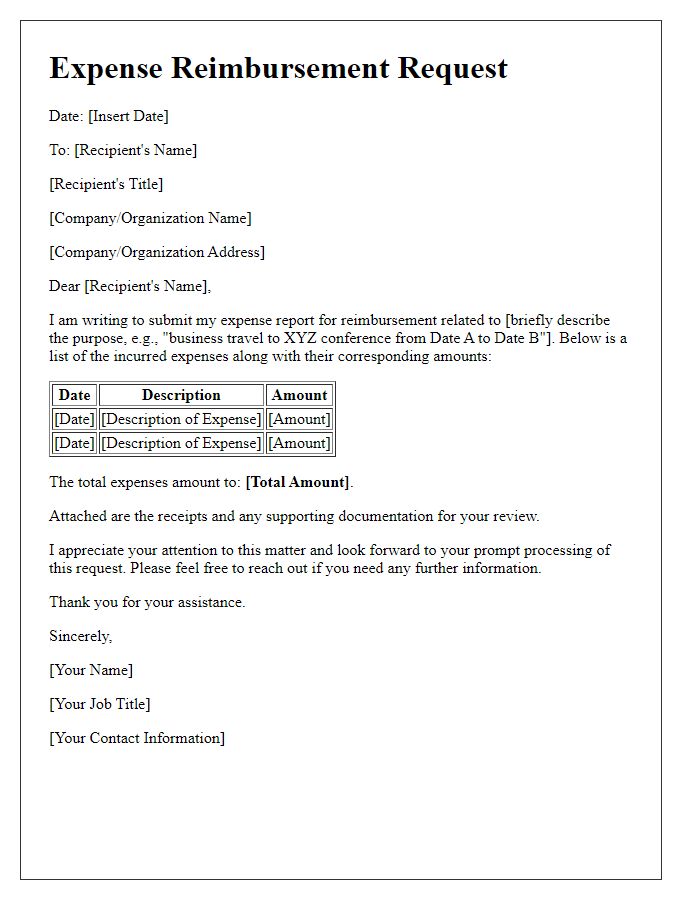

Expense report submissions require meticulous documentation for financial tracking and reimbursement purposes. The subject line should clearly indicate the nature of the submission, such as "Monthly Expense Report for September 2023." This clarity ensures efficient processing within the accounting department. Each expense entry, categorized by type (e.g., travel, meals, accommodations), requires detailed descriptions including dates, receipts, and associated transaction IDs. The inclusion of relevant business trip details, like location (e.g., San Francisco, California) and purpose (e.g., client meeting), adds context necessary for validation. Accurate categorization aids in budget adherence and enhances transparency in corporate spending.

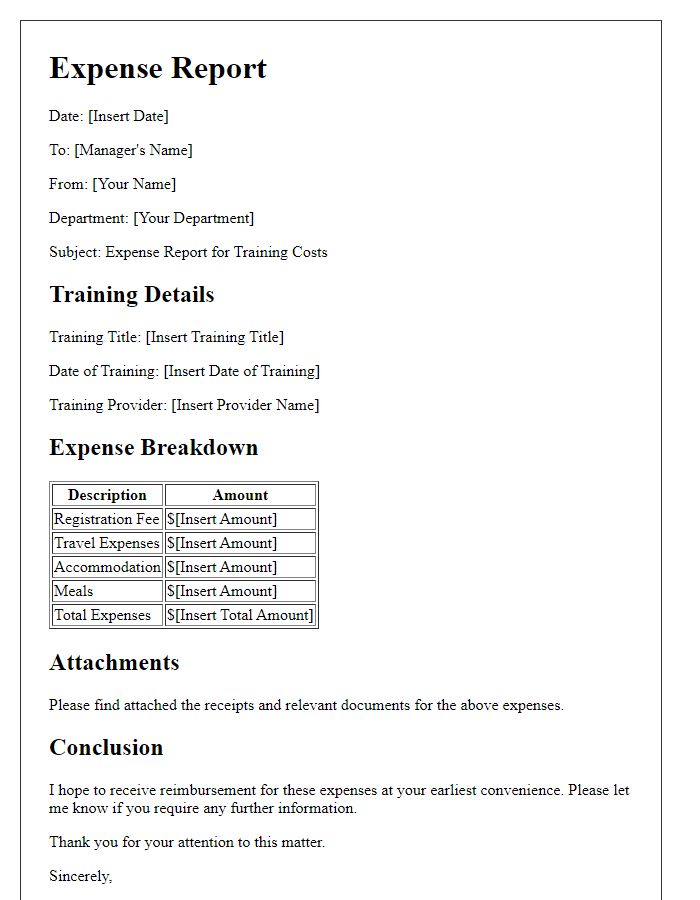

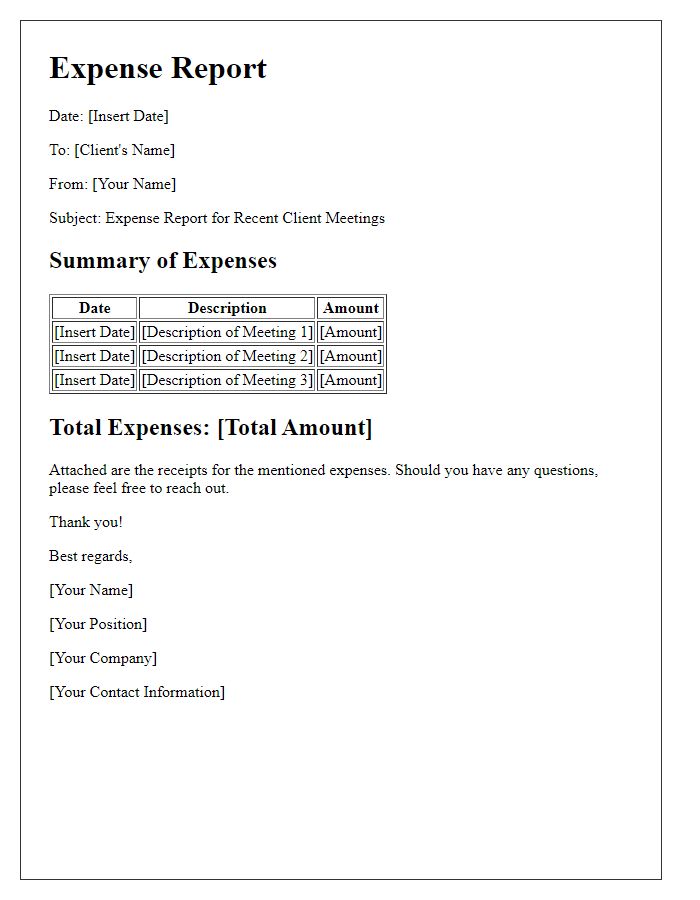

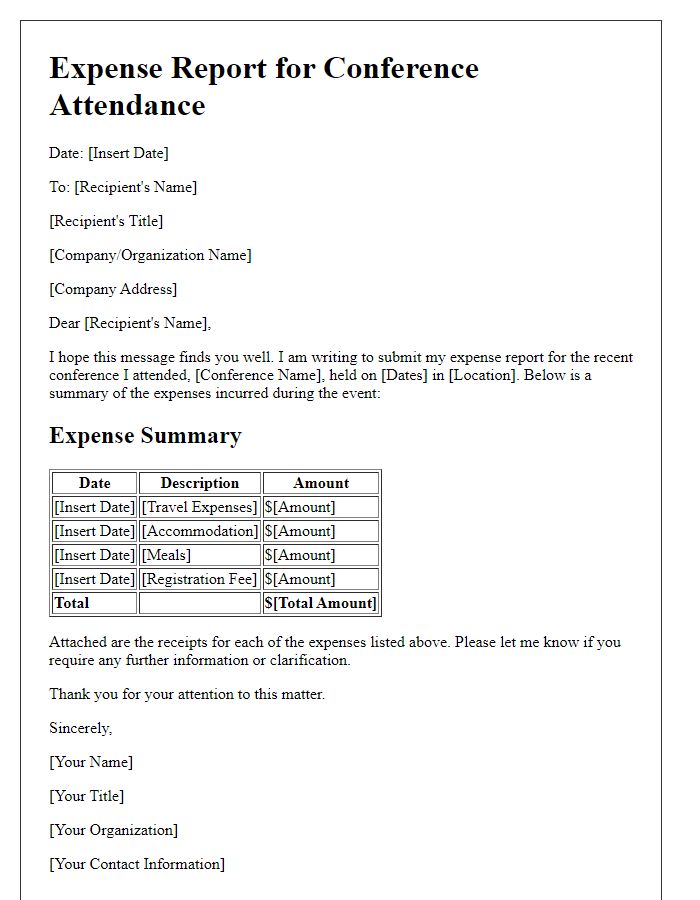

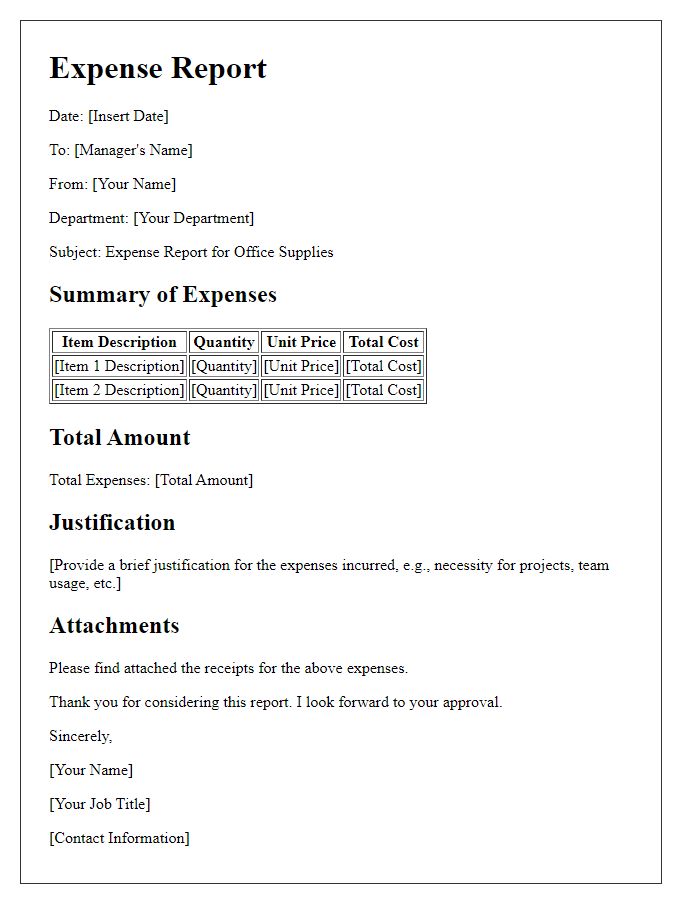

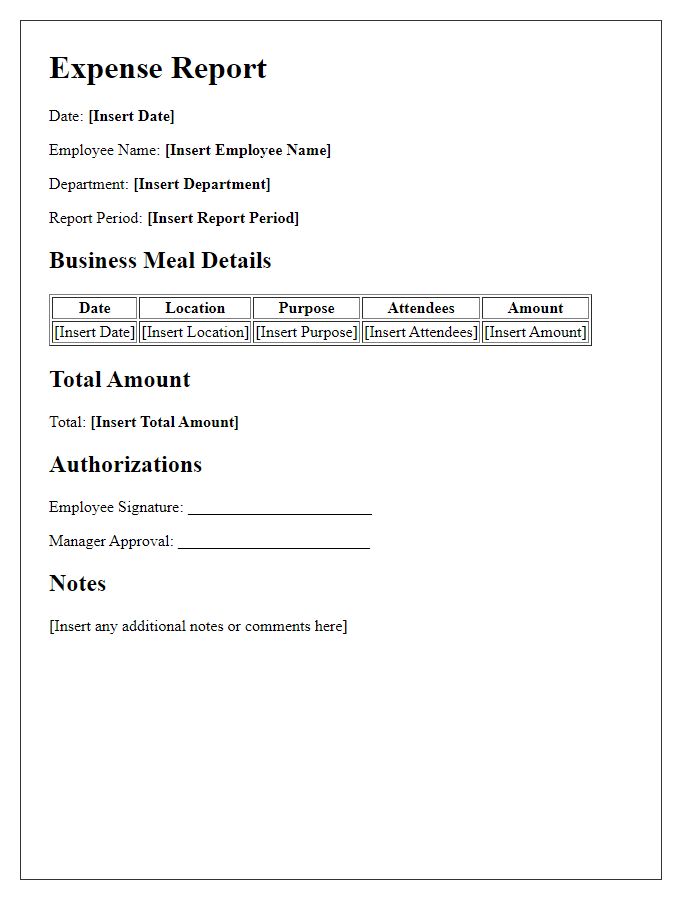

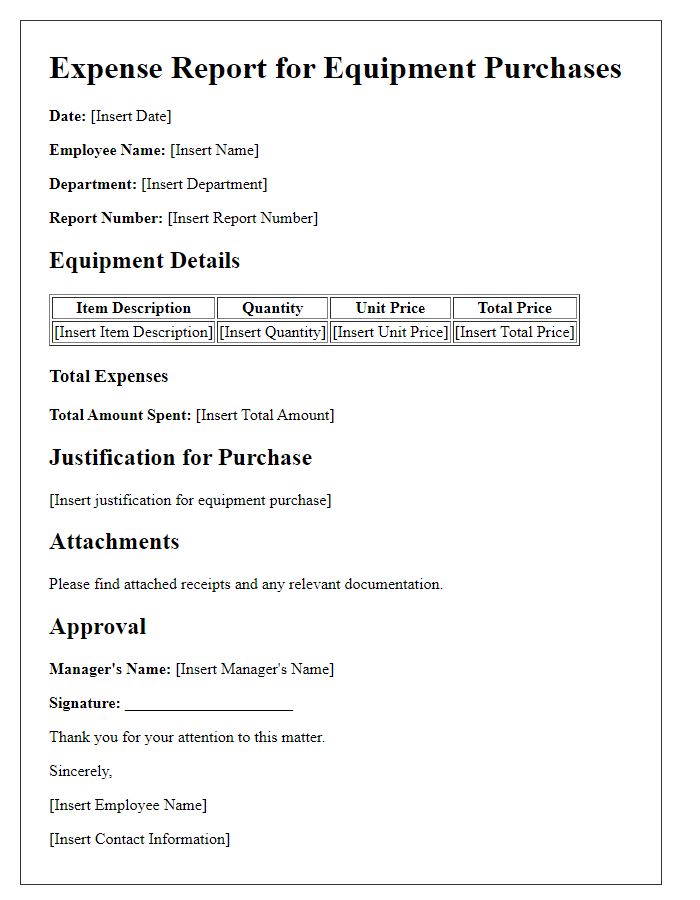

Detailed Expense Breakdown

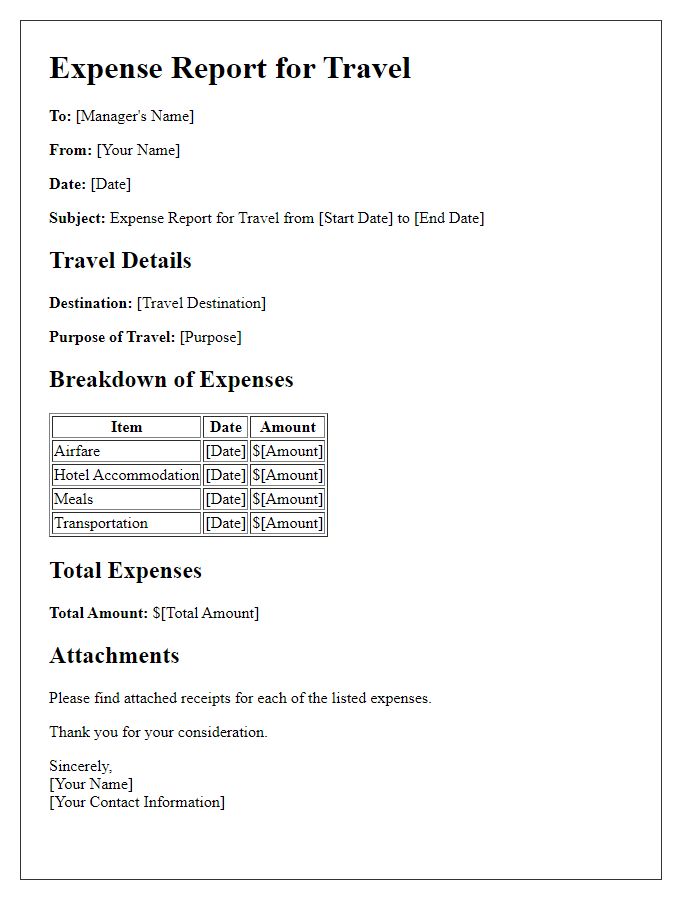

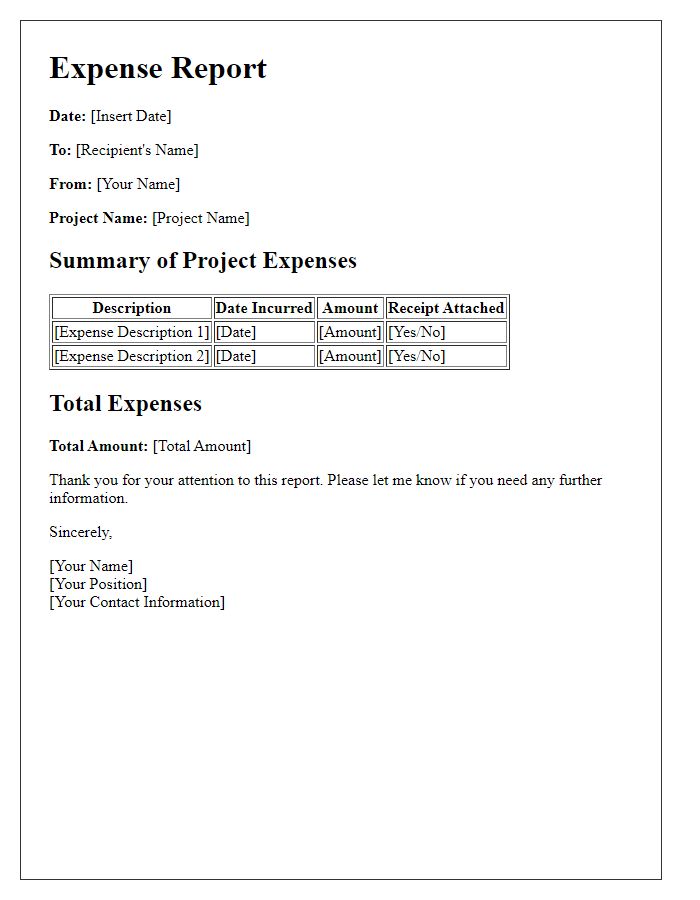

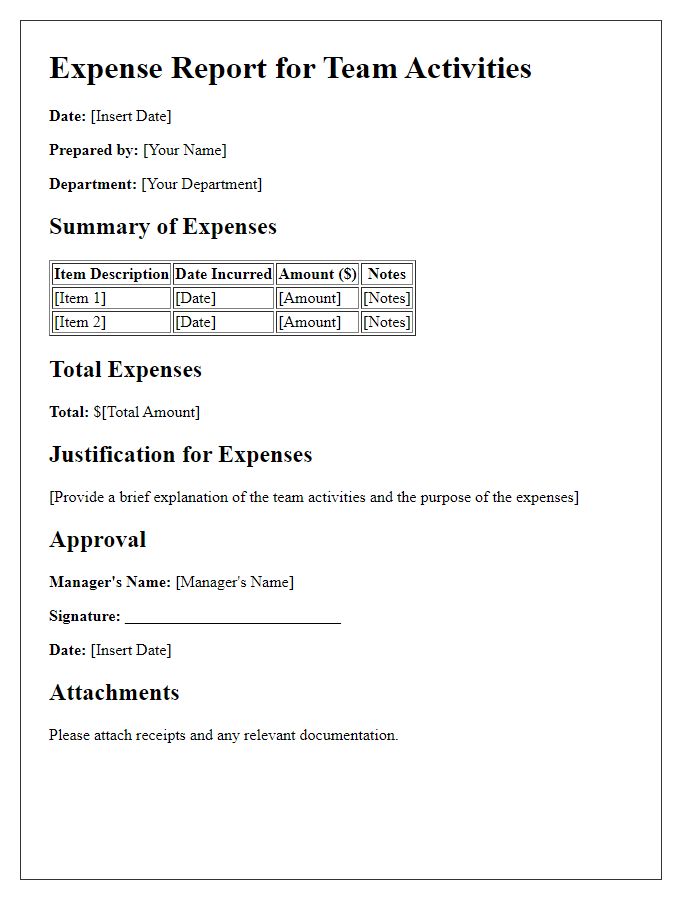

Detailed expense breakdown provides a comprehensive view of incurred costs during a specific period or event. For business trips, include transportation (airfare costs around $300), accommodation (hotel rates averaging $150 per night), meals (average daily meal expense of $75), and miscellaneous expenses (such as parking fees or event registration fees totaling $50). Each category should be clearly itemized, specifying the date of expenditure and the purpose, such as client meetings or conferences. Including receipts, invoices, and any supporting documentation ensures transparency and aids in the approval process for reimbursement. Properly detailing these expenses is crucial for maintaining accurate financial records and ensuring accountability within the organization.

Justification for Expenses

Submitting an expense report requires a thorough justification for incurred costs. Documentation, such as receipts from transactions at restaurants or hotels, provides transparency for business meals or lodging expenses. Travel expenses related to transportation, including flight tickets purchased from airlines like Delta or rental cars from companies such as Enterprise, necessitate clear explanations regarding the purpose of the journey, typically business meetings or conferences. Additionally, any expenses related to office supplies or software subscriptions, tailored for teams, need to show their necessity in facilitating work productivity. Timely submission of this report ensures compliance with company policies and efficient reimbursement processing.

Attached Supporting Documentation

Expense reports require thorough documentation for accountability and clarity. Submitted reports, including expenses from business activities such as travel, meals, or supplies, must include itemized receipts. Each receipt, whether from major airlines like Delta or dining establishments like Olive Garden, should clearly detail the date, amount spent, and nature of the expense. For instance, receipts indicating specific business meetings at hotels or conference centers must be included. Also, any reimbursement requests must highlight the purpose of each expenditure, aligning with company policies established in the employee handbook for financial transactions. Accurate documentation ensures transparent financial processes and prepares organizations for possible audits.

Submission Deadline adherence

Expense reports require timely submission to ensure proper reimbursement and budget tracking. Each department must adhere to the designated deadlines, typically set for the end of the month, with potential variations based on specific company policies. Failure to meet these deadlines may result in delayed processing and compensation, impacting financial planning. Employees should verify details of incurred expenses including receipts, amounts, and relevant dates to facilitate a smooth review process by financial officers. Additionally, tracking submission status through internal management tools can aid in accountability and ensure adherence to established deadlines.

Comments