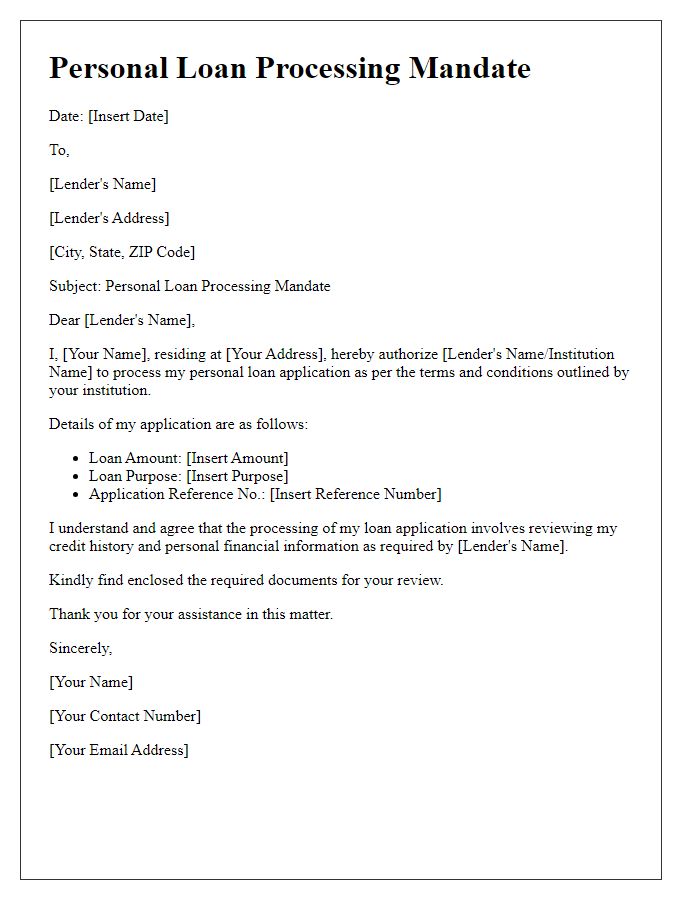

Are you considering applying for a personal loan but feeling overwhelmed by the paperwork? You're not alone! Navigating the authorization process for personal loan applications can be tricky, but understanding the necessary steps can make it much easier. Stick around to explore our guide on creating an effective personal loan processing authorization letter, and ensure your application stands out!

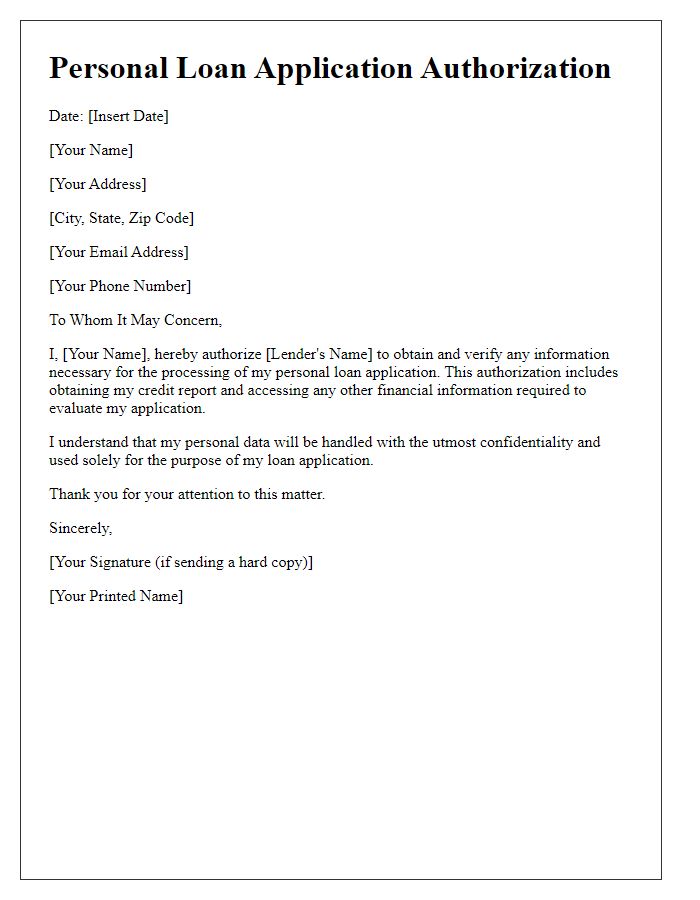

Clear Identification of Parties

The Personal Loan Processing Authorization letter serves to clearly identify the involved parties, typically the borrower and the lending institution. The borrower, an individual seeking financial assistance, will be named along with their physical address and contact information to ensure complete identification. The lending institution, a recognized bank or financial entity, will also be detailed, including its official name, branch location, and contact details. This document forms the foundation for a valid agreement, establishing a legitimate relationship while authorizing the lender to process the loan application on behalf of the borrower. Accurate identification ensures compliance with legal requirements and enables efficient communication throughout the loan processing journey.

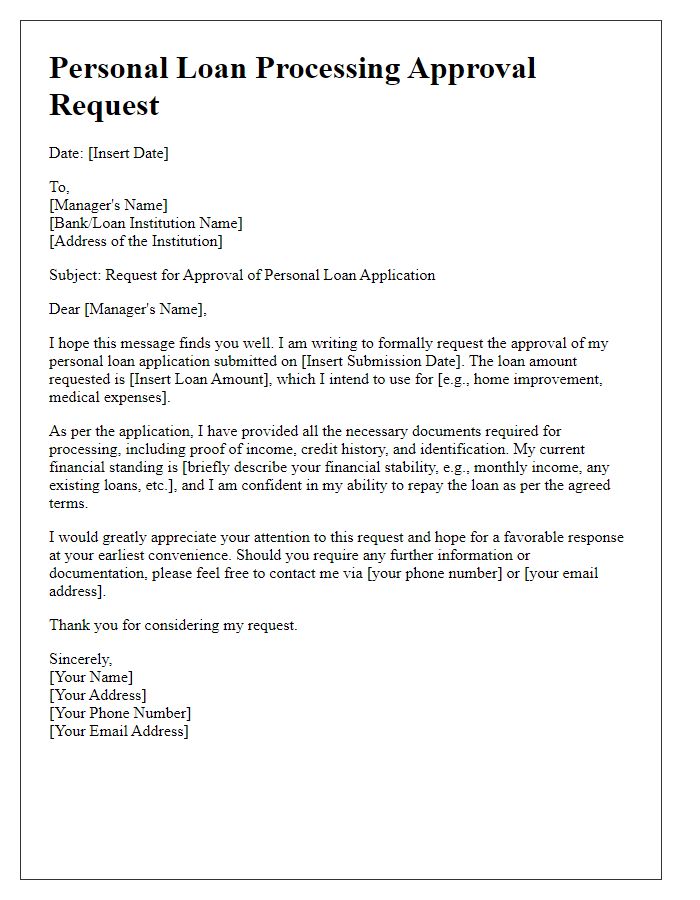

Detailed Loan Terms and Conditions

When applying for a personal loan, understanding the detailed loan terms and conditions is crucial. The principal amount (the original sum borrowed) typically ranges from $1,000 to $50,000, while the annual percentage rate (APR) may vary between 5% and 36%, depending on creditworthiness. Loan terms can span from one to seven years, impacting monthly payments and total interest paid. Lenders might require a credit score minimum of 620, influencing eligibility. Additionally, various fees such as origination fees (often 1%-5% of the loan amount) or late payment fees can be imposed, so reviewing these carefully ensures clarity. Prepayment penalties (fees for paying off the loan early) may also apply, affecting overall repayment strategies. Understanding these details ensures informed financial decisions and long-term planning.

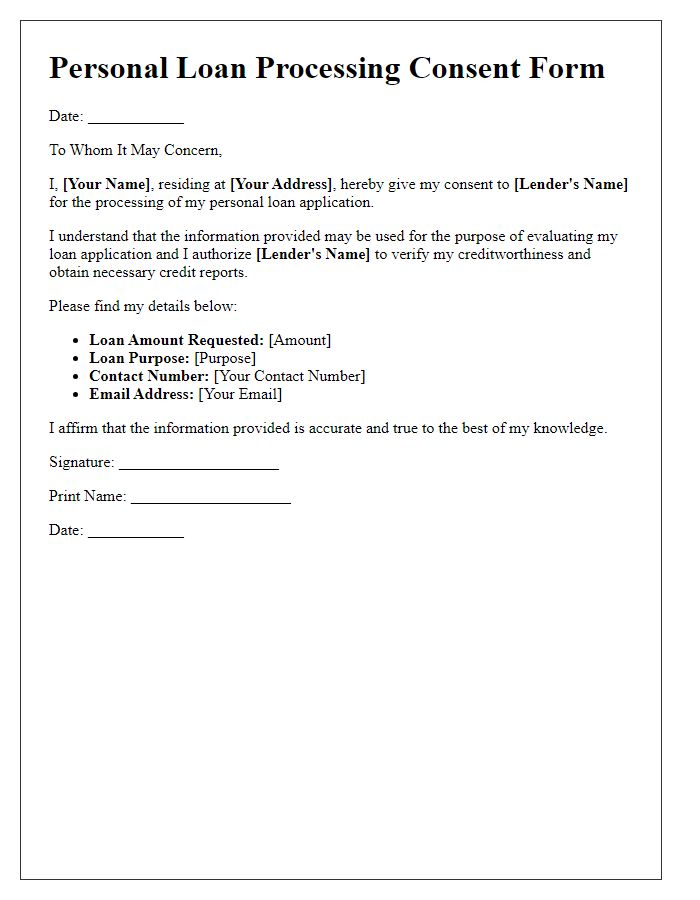

Authorization and Consent Language

Personal loan processing requires explicit authorization and consent from the borrower. This formal agreement entitles financial institutions to perform necessary credit checks and information verification. Loan applicants must provide personal identification details, such as Social Security Number and income statements, to facilitate the assessment of creditworthiness. Consent ensures that banks or lenders comply with legal requirements, including the Fair Credit Reporting Act, while protecting borrower privacy. Once authorized, applicants are subject to the processing timeline, which ranges from a few days to several weeks, depending on the lender's protocols and the complexity of the application.

Assurance of Confidentiality

Processing personal loan applications involves dealing with sensitive personal information, such as Social Security numbers, financial history, and employment details. Institutions, such as banks or credit unions, must adhere to strict confidentiality protocols to protect applicants. The Federal Credit Reporting Act (FCRA) mandates safeguarding consumer information during loan processing, ensuring that data is only accessed by authorized personnel. Additionally, financial organizations often utilize encryption methods to secure data transmission during online applications. Establishing trust is vital; thus, clear communication regarding privacy practices reassures applicants about their data protection during the entire loan processing journey.

Contact Information for Follow-Up

The authorization for personal loan processing often involves crucial details such as borrower's full name, Social Security number (typically a 9-digit number for identification), and the designated financial institution (such as Bank of America or Wells Fargo) along with their specific branch location. Dates are significant for timelines, with the loan processing starting date often noted as the application submission date. Additionally, contact information is pivotal, including phone numbers (usually a 10-digit format in the United States) and email addresses to facilitate communication. Relevant lines for follow-up inquiries or confirmations must provide clear access for both borrowers and lenders, helping streamline the loan approval process efficiently.

Comments