Are you tired of navigating the complexities of expense reporting? You're not alone! Many individuals and businesses face the challenges of managing and authorizing expenses efficiently. In this article, we'll dive into a simple and effective letter template that makes the expense reporting authorization process smooth and hassle-freeâkeep reading to discover how you can streamline your approach!

Purpose and Objective

Expense reporting authorization facilitates the systematic approval and management of expenditures within organizations, enhancing financial oversight. Organizations implement expense reporting processes to maintain budgetary control, ensuring that expenses align with fiscal policies and objectives. The primary objective involves streamlining the approval workflow, reducing processing times, and minimizing errors in transactions. By establishing clear guidelines for expense categories, such as travel (incurring costs like airfare, accommodation, and meals), office supplies (including stationery, equipment, and furniture), and related costs, organizations foster transparency and accountability among employees. Ultimately, effective expense reporting supports informed decision-making and financial planning, contributing to overall operational efficiency.

Authorized Personnel

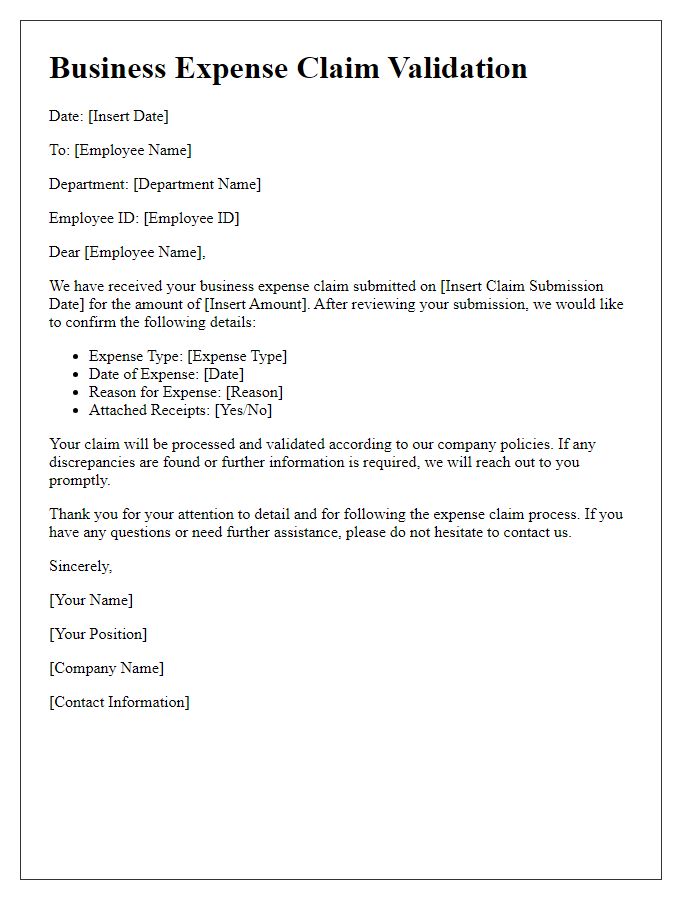

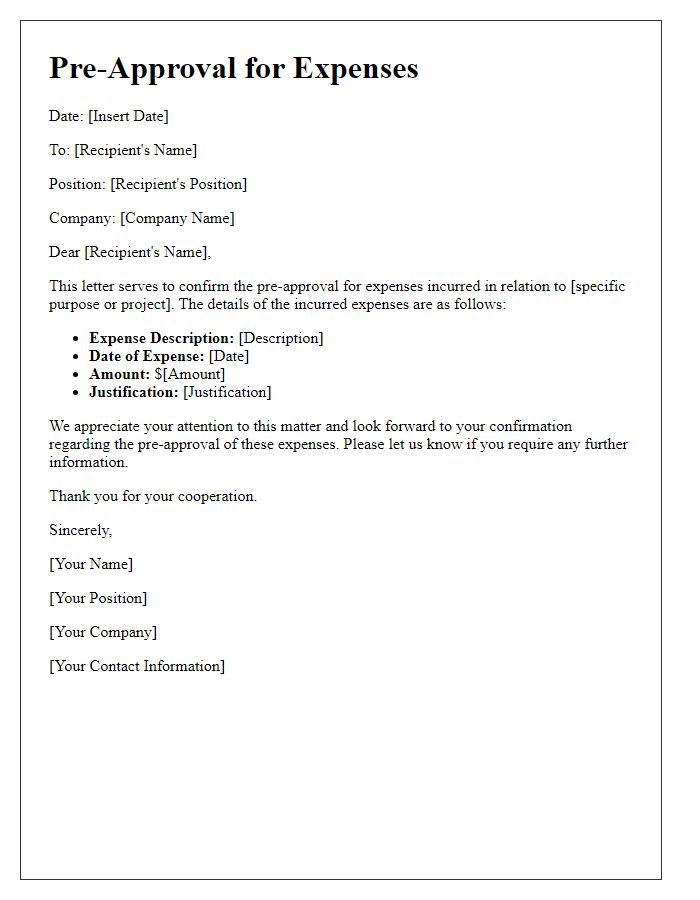

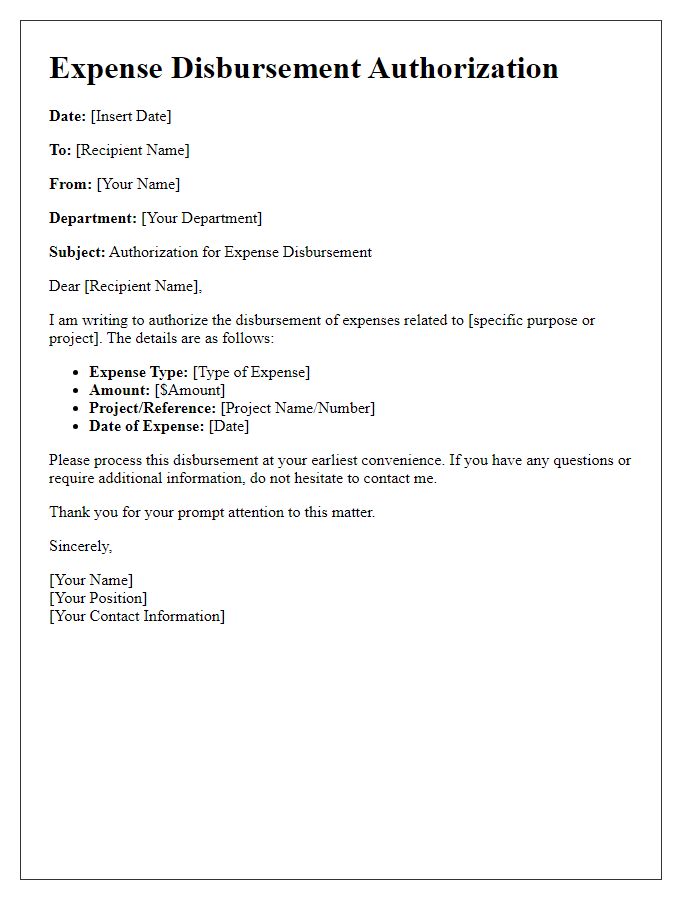

Expenses in corporate environments require meticulous tracking and authorization processes to ensure fiscal responsibility. Authorized Personnel, often a defined role within an organization, possess the power to approve expenditures related to business operations. Such personnel might include department heads or financial officers responsible for budget allocations. Precise documentation, including receipts and invoices, must accompany expense reports to verify the legitimacy of claims. Specific thresholds, such as $500 for travel expenses or $200 for office supplies, often dictate authorization levels. Timely submission of expense reports, typically within 30 days of incurring expenses, is essential for maintaining transparency and accuracy in financial records. Furthermore, adherence to company policies regarding allowable expenses is crucial to avoid discrepancies or potential audits.

Expense Categories

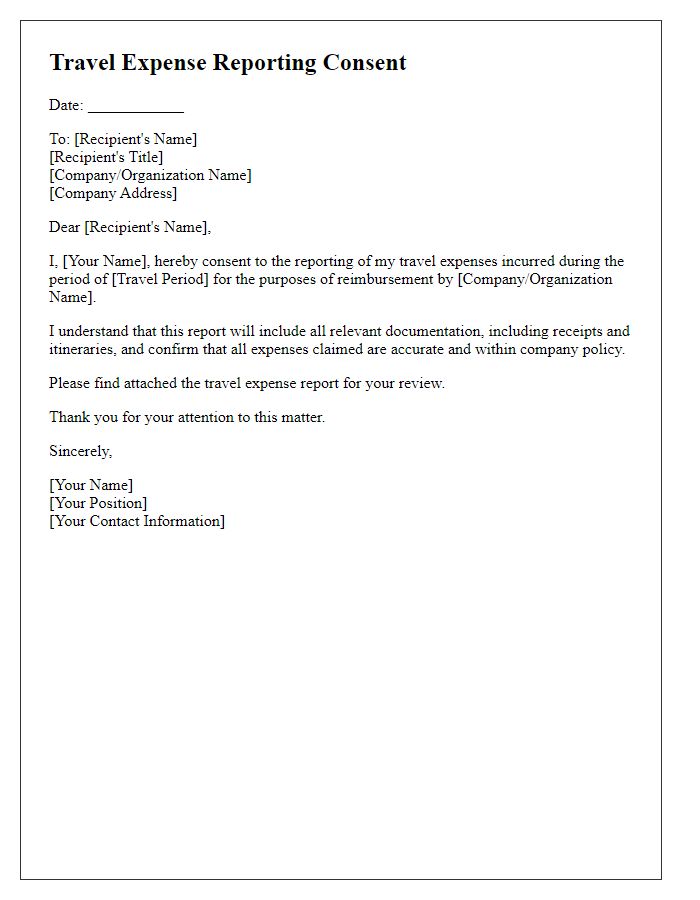

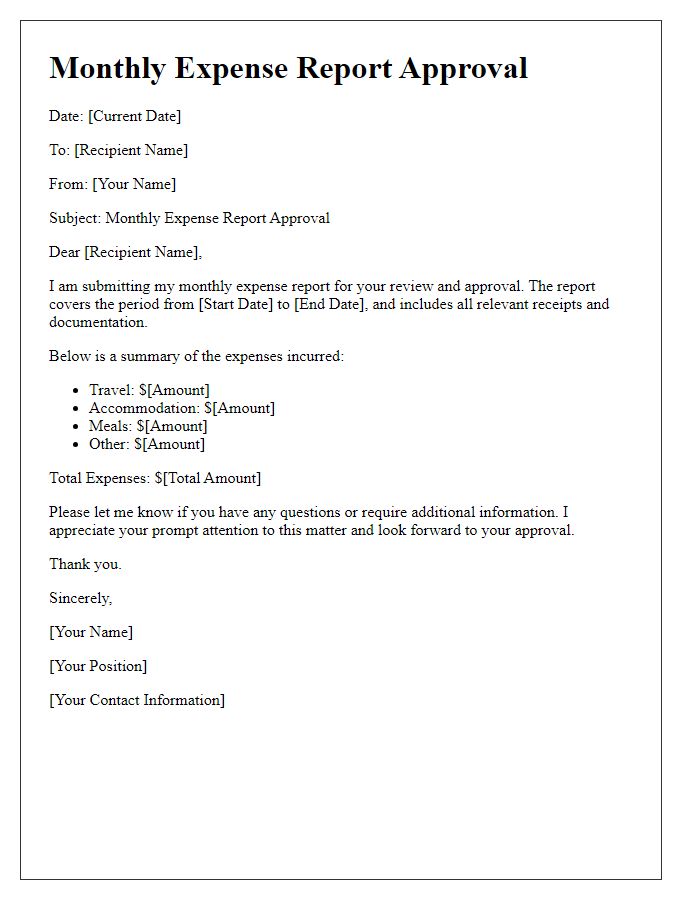

Expense reporting authorization is essential for maintaining budget oversight within organizations. Common expense categories include Travel Expenses (such as flights and hotel accommodations), Meals and Entertainment (business dinners and client meetings), Office Supplies (stationery, printers, and technology), and Professional Development (seminars, workshops, and training sessions). Accurate documentation of these expenses is crucial for compliance with organizational policies and regulations. Furthermore, assigning appropriate budget codes to each category facilitates easier tracking and reconciliation during audits. Ensuring timely approval from department heads can streamline the reimbursement process, enhancing employee satisfaction and operational efficiency.

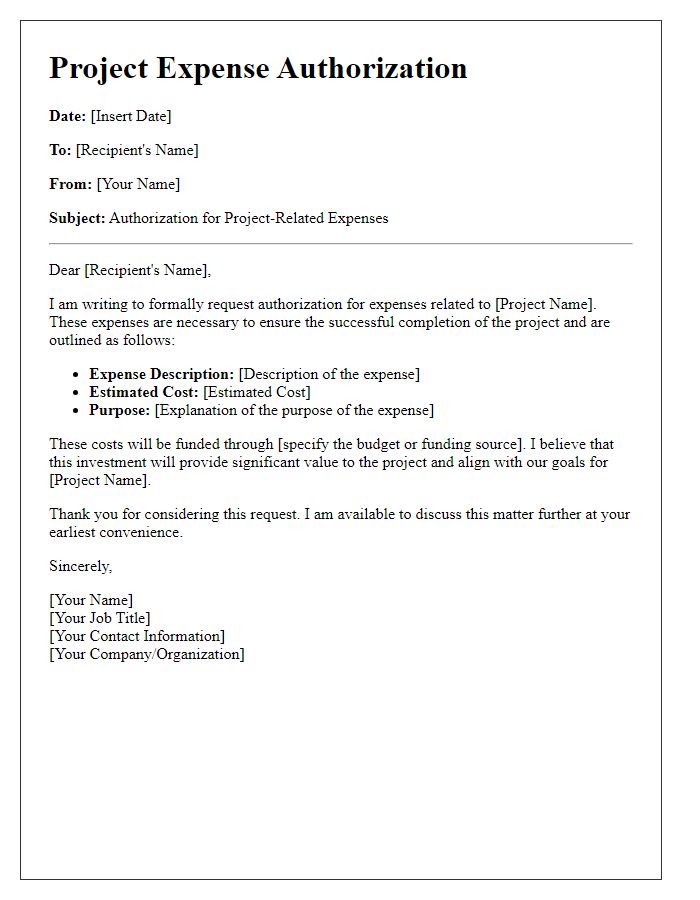

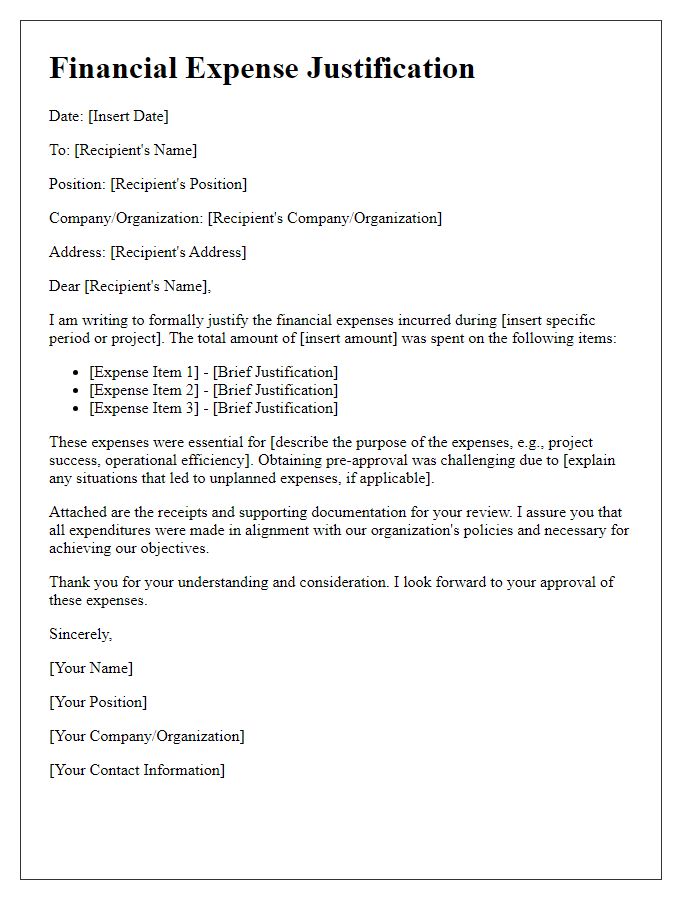

Reporting Procedure

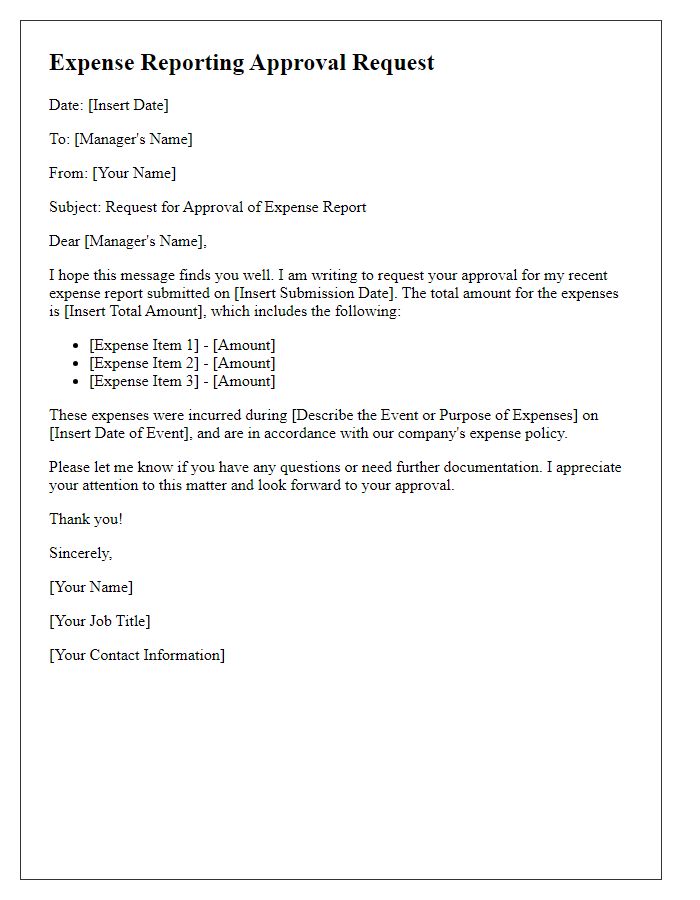

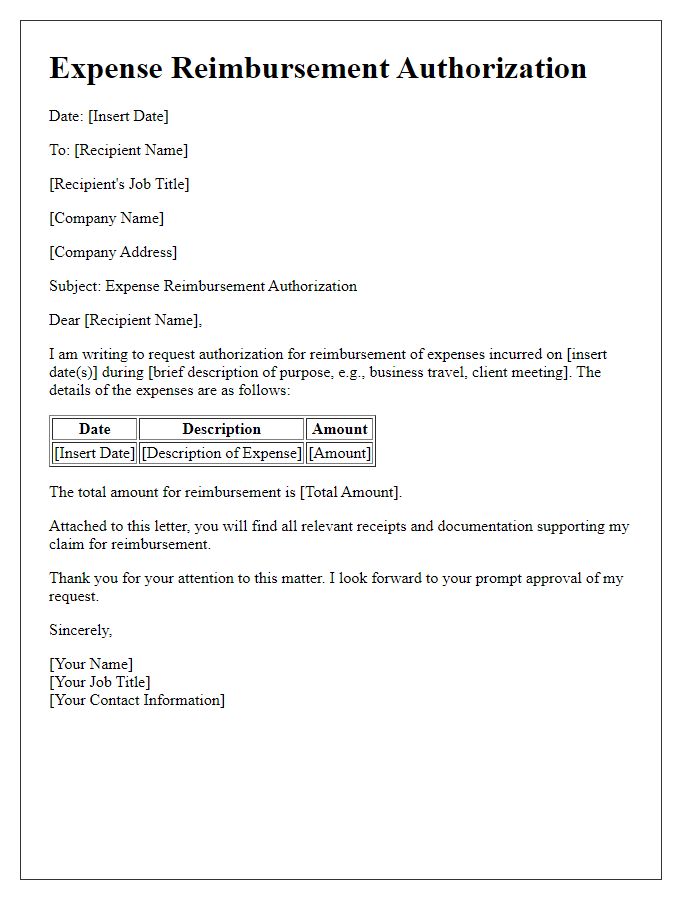

Expense reporting procedures require meticulous documentation and adherence to organizational policies. Employees must submit expense reports on a designated platform, usually within five business days following the incurred expenses. Each report should clearly itemize expenses, including specifics such as date, location (e.g., conference held in San Francisco), purpose (e.g., client meeting), and receipts as proof of payment. Certain thresholds may necessitate managerial approval, particularly for expenses exceeding $100. Completing an expense report also involves coding expenses to corresponding budget categories, ensuring accuracy for financial tracking. Timely submissions aid in efficient reimbursement processing, enhancing employee satisfaction. Proper training on company policy enhances compliance and minimizes discrepancies.

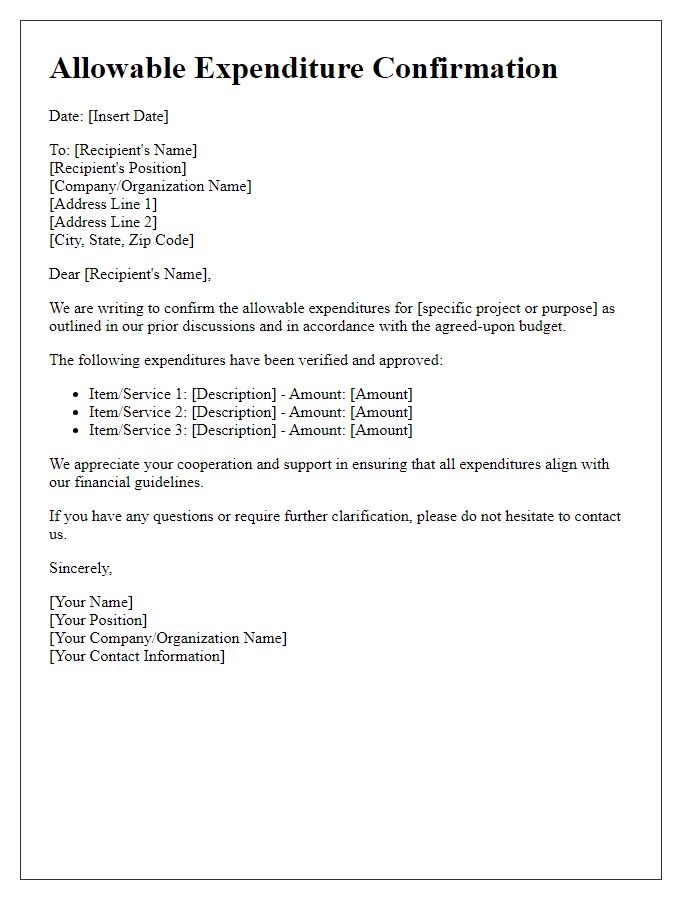

Approval Process

Expense reporting authorization involves several steps to ensure proper financial oversight. Employees submit expense reports detailing itemized costs, such as travel, meals, and lodging, typically formatted using company-approved templates. Managers or designated finance personnel review these submissions, ensuring expenses align with company policy, which often includes thresholds for allowable expenditures, such as $50 for meals or $100 for travel. Approved reports then undergo final review by the finance department, which may involve cross-referencing receipts and verifying budget availability. Once fully approved, reimbursements are processed through the accounting software, such as QuickBooks or SAP, ensuring timely compensation to employees for their incurred expenses. This structured process is crucial for maintaining transparency and effective budget management within organizations.

Comments