Are you looking to streamline your financial transaction processes? An authorization letter template can be a game-changer, ensuring that all your transactions are approved and documented with ease. In this article, we'll explore the essential elements of a financial transaction authorization letter, offering you tips on how to customize it for your needs. So, let's dive in and simplify your financial communications!

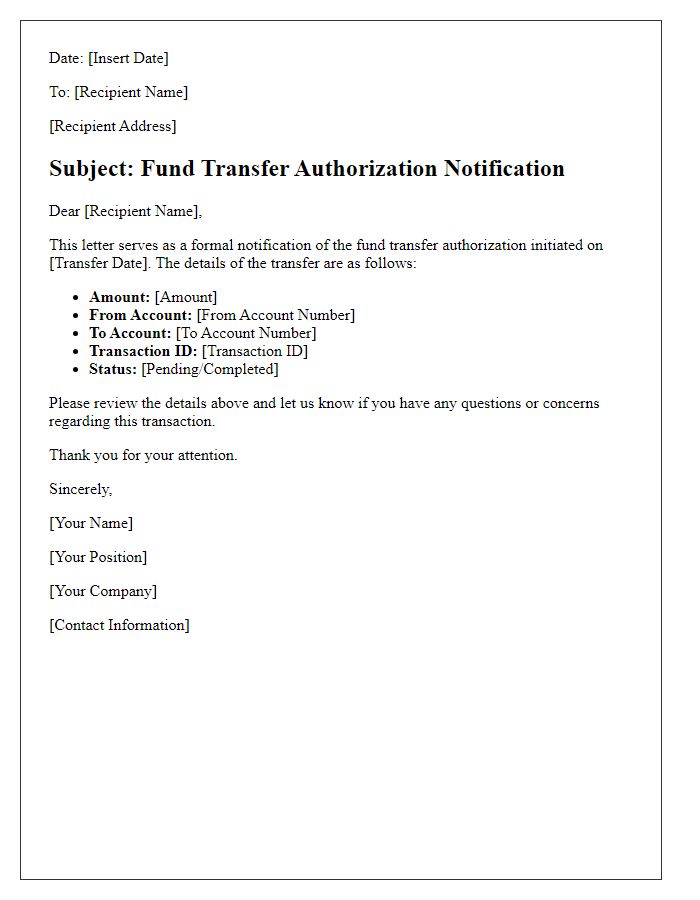

Clear Identification of Parties

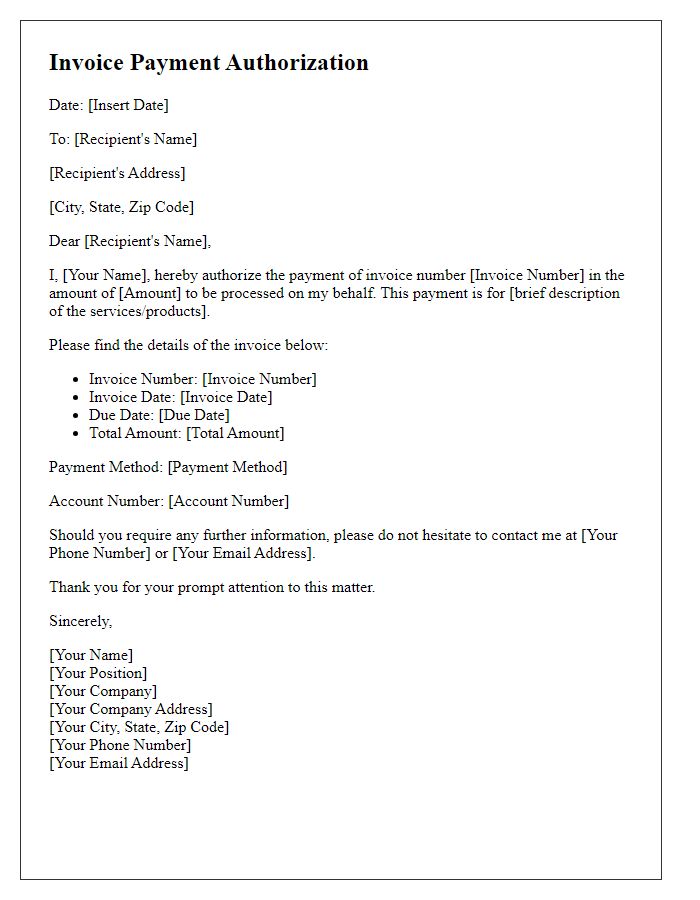

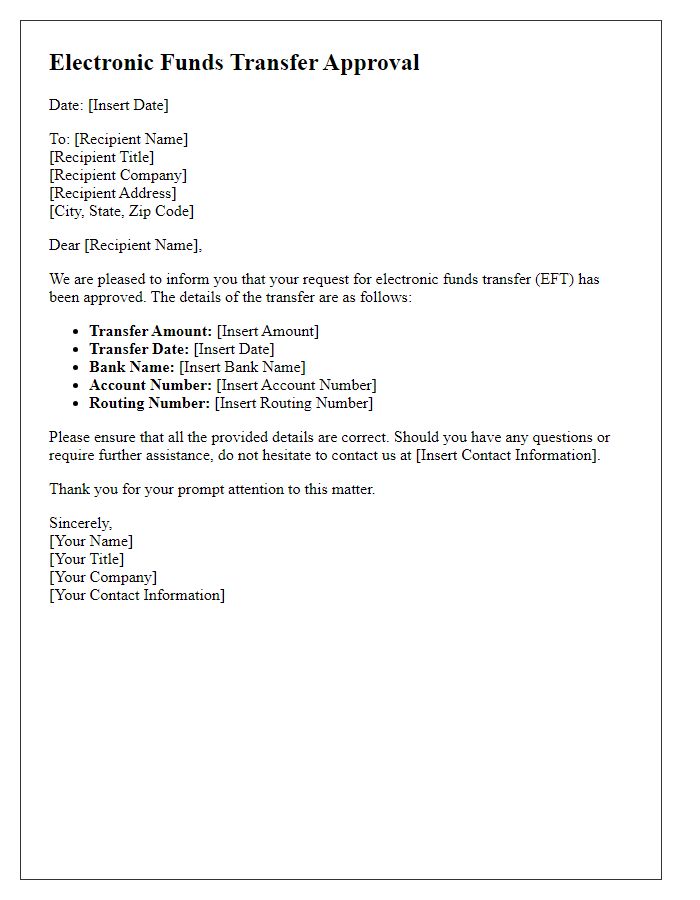

Clear identification of parties in a financial transaction authorization is crucial for ensuring transparency and accountability. The principal party, often termed the 'issuer' (individual or organization initiating the transaction), must provide full legal name, registered business address, and Tax Identification Number (TIN). The secondary party, referred to as the 'recipient' (individual or business receiving funds), requires similar identification details. Additional elements such as account numbers (for banks or financial institutions) ensure accurate processing. Clear delineation of roles fosters trust and mitigates risks associated with financial fraud, safeguarding both parties' interests during the transaction process.

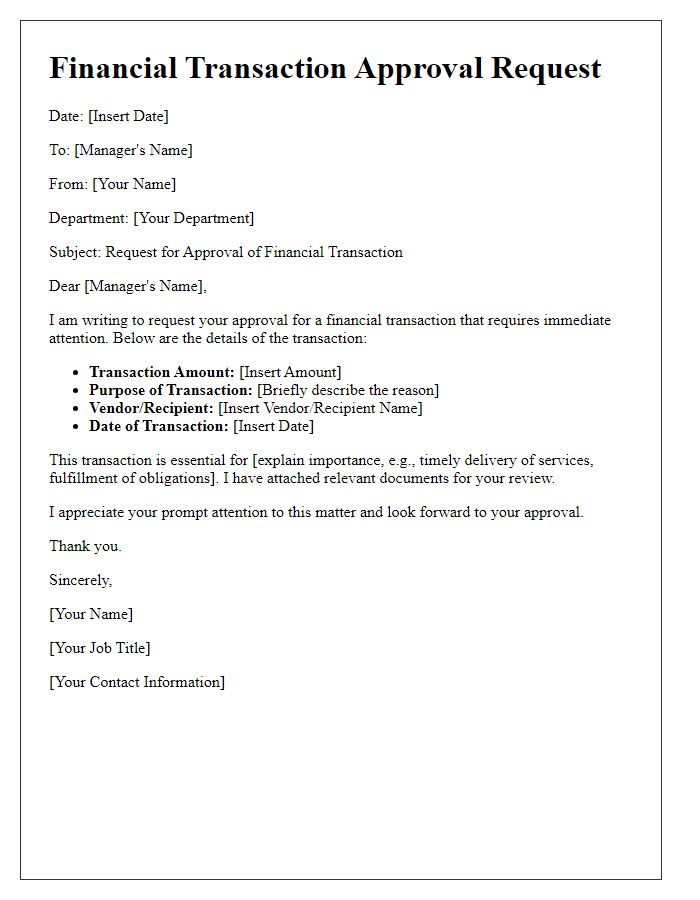

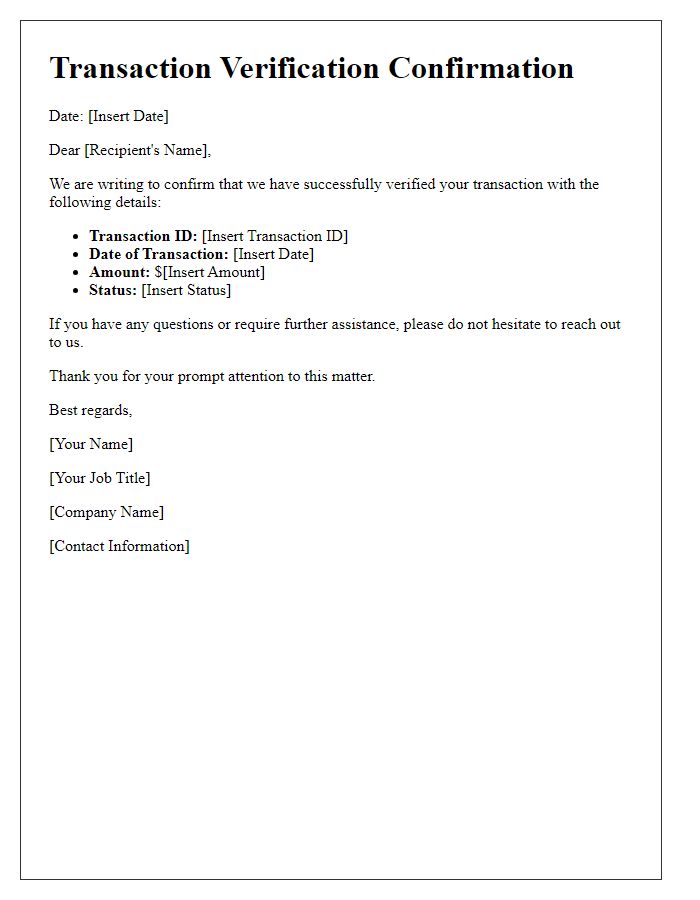

Detailed Transaction Description

A financial transaction authorization is crucial for ensuring secure and validated monetary exchanges within banking systems. This process involves the submission of comprehensive details regarding the transaction, including amounts (in U.S. dollars or other currencies), involved parties (such as account names or business entities), and transaction types (for instance, wire transfers or credit card payments). Specific dates (such as transaction initiation and expected settlement periods) also hold significance. Furthermore, referencing transaction identification numbers provides clarity and traceability. Different regulations, such as those mandated by the Financial Crimes Enforcement Network (FinCEN), can influence the level of detail required in these authorizations, ensuring compliance and protection against fraud.

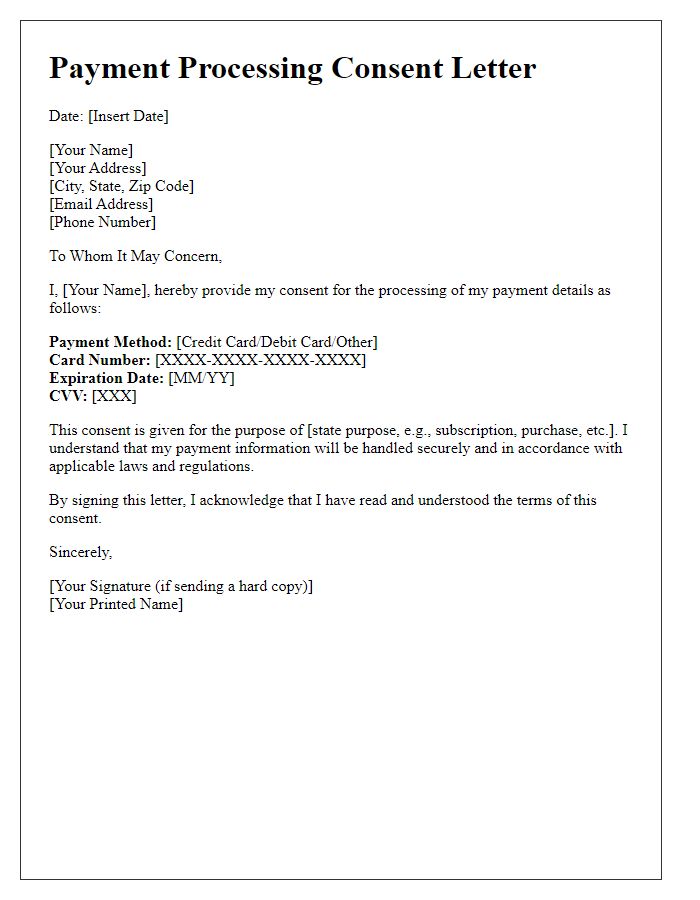

Specific Authorization Terms

Specific authorization terms for financial transactions outline the guidelines and requirements ensuring secure processes. These terms typically include defined limits on transaction amounts (e.g., approvals exceeding $10,000), the necessary documentation (e.g., invoices or contracts), and the eligible parties involved (e.g., authorized signatories or personnel). Security measures may require two-factor authentication or encryption methods to protect sensitive data. Additionally, transactions scheduled post-business hours may necessitate enhanced scrutiny before approval to mitigate risks associated with fraudulent activities. Compliance with relevant regulations, such as the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) guidelines, remains crucial in maintaining transparency and accountability.

Secure Contact Information

A financial transaction authorization requires secure contact information to ensure verification and protection of personal data. Important elements include the sender's name, account number (often a unique identifier for bank accounts), transaction amount (specified in local currency), and date of transaction (to establish timeline and prevent fraud). Additional details such as the recipient's bank name (which could be a major institution like JPMorgan Chase or Bank of America) and contact number for immediate verification enhance security measures. Utilizing encrypted communication methods, such as SSL (Secure Sockets Layer), protects sensitive information during transmission, minimizing risks of unauthorized access. Incorporating two-factor authentication also strengthens the authorization process, requiring a secondary confirmation to complete the transaction and safeguard against potential breaches.

Signature and Date

Financial transaction authorization requires clear communication of intent and accountability. A letter authorizing a financial transaction should include vital details such as the amount, date, and recipient (e.g., John Doe, account number ending in 1234). Signatures should be original, moist ink on paper, ensuring authenticity, while the date applied should reflect the transaction's approval timeframe. For electronic submissions, scanned signatures may suffice, but verification measures must be in place. It is crucial to ensure compliance with institutional policies regarding financial transactions, upholding integrity in financial dealings.

Comments