Are you interested in expanding your business horizons through cross-border trade? A well-structured letter can set the stage for fruitful discussions and agreements with international partners. This template serves as a guide to convey your intentions clearly and effectively while nurturing relationships. Ready to take your trade endeavors to the next level? Read on to explore the essential elements of crafting the perfect letter for your association's cross-border trade agreement!

Jurisdiction and Legal Compliance

Cross-border trade agreements necessitate stringent jurisdiction and legal compliance guidelines, ensuring adherence to regulations governing international commerce. Jurisdictions, such as the European Union (EU) or the United States (U.S.), impose specific trade laws, tariffs, and customs duties that must be meticulously followed by all parties involved. Legal compliance includes understanding country-specific regulations, such as the Foreign Corrupt Practices Act in the U.S. or the General Data Protection Regulation (GDPR) in the EU, which protect against unethical practices and ensure data privacy. Additionally, dispute resolution mechanisms must be clearly defined, outlining arbitration procedures and jurisdictions in case of legal disputes, fostering a transparent and secure trading environment for all participants.

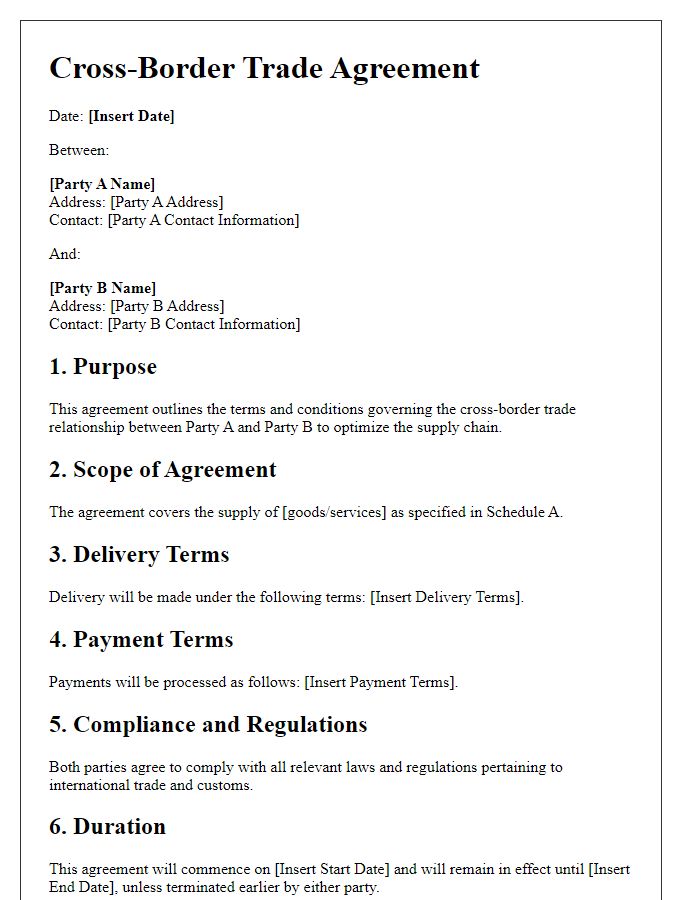

Terms and Conditions of Trade

The cross-border trade agreement facilitates smooth transactions between involved parties across countries, ensuring compliance with local laws and regulations. Key components include detailed definitions of goods and services, delineation of responsibilities for each party, and precise payment terms, typically ranging from 30 to 90 days post-invoice. Compliance with international trade regulations, such as the Customs Act of 1972 in India or the Trade Act of 1974 in the United States, is mandatory to prevent delays and fines. Dispute resolution mechanisms, such as arbitration or mediation, are outlined to address any potential conflicts, particularly in case of non-compliance. The agreement's duration, often set for one to five years, may include renewal options based on mutual consent. Moreover, confidentiality clauses protect sensitive business information shared during negotiations or transactions, ensuring trust between the entities.

Dispute Resolution Mechanisms

Dispute resolution mechanisms play a crucial role in cross-border trade agreements, ensuring fair resolution of conflicts between participating nations. Often, these mechanisms include arbitration processes administered by institutions such as the International Chamber of Commerce (ICC) or the United Nations Commission on International Trade Law (UNCITRAL), providing structured procedures for resolving disputes without resorting to litigation in domestic courts. Key elements typically include rules on jurisdiction, timelines, and confidentiality to protect sensitive commercial information. Various countries implement specific frameworks to facilitate these mechanisms, with notable examples being the United States-Mexico-Canada Agreement (USMCA) and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), which outline steps to address trade-related disagreements effectively. These frameworks aim to maintain economic stability and foster good relations among trading partners.

Currency and Payment Terms

A well-structured cross-border trade agreement often incorporates crucial sections like currency terms and payment conditions. Specifying the currency (such as USD or Euro) is vital, as it eliminates ambiguity in financial transactions. Additionally, detailing payment methods, whether via bank transfers, letters of credit, or PayPal, ensures both parties have clear expectations. Payment timelines might stipulate specific durations, like 30 days post-invoice receipt, influencing cash flow management for both businesses. Furthermore, including provisions for currency exchange rates and potential fluctuations protects against financial losses, allowing both parties to plan effectively. Consideration of applicable taxes, customs duties, and compliance with international regulations is essential for smooth operation in an increasingly interconnected global marketplace.

Intellectual Property Rights

The cross-border trade agreement between participating nations aims to enhance the protection of Intellectual Property Rights (IPR), crucial for fostering innovation and economic growth. Countries involved include Canada, Mexico, and the United States, with specific provisions protecting trademarks, copyrights, and patents. The agreement sets forth guidelines that facilitate cooperation in intellectual property enforcement, aiming to reduce counterfeiting and piracy, with specific emphasis on collaborative frameworks for legal recourse. Additionally, compliance with international treaties, such as the Berne Convention for the Protection of Literary and Artistic Works, ensures a unified approach to safeguarding creators' rights across borders. All member states commit to raising awareness about the importance of IPR among businesses and consumers, thus promoting a culture of respect for intellectual property and encouraging cross-border commerce.

Letter Template For Association Cross-Border Trade Agreement Samples

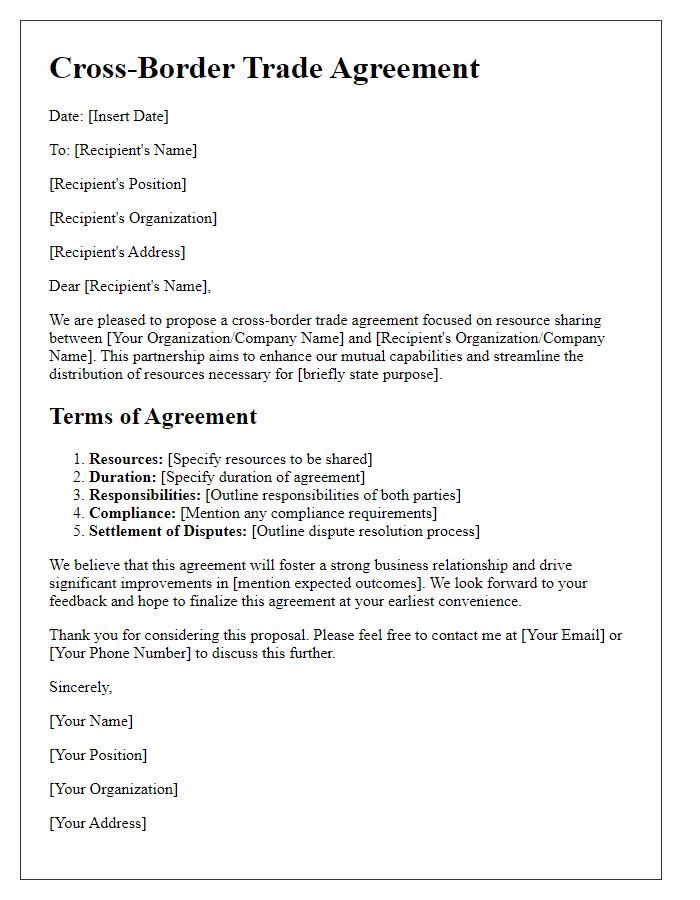

Letter template of cross-border trade agreement for business collaboration

Letter template of cross-border trade agreement for partnership expansion

Letter template of cross-border trade agreement for import/export facilitation

Letter template of cross-border trade agreement for regulatory alignment

Letter template of cross-border trade agreement for joint marketing initiatives

Letter template of cross-border trade agreement for economic cooperation

Comments