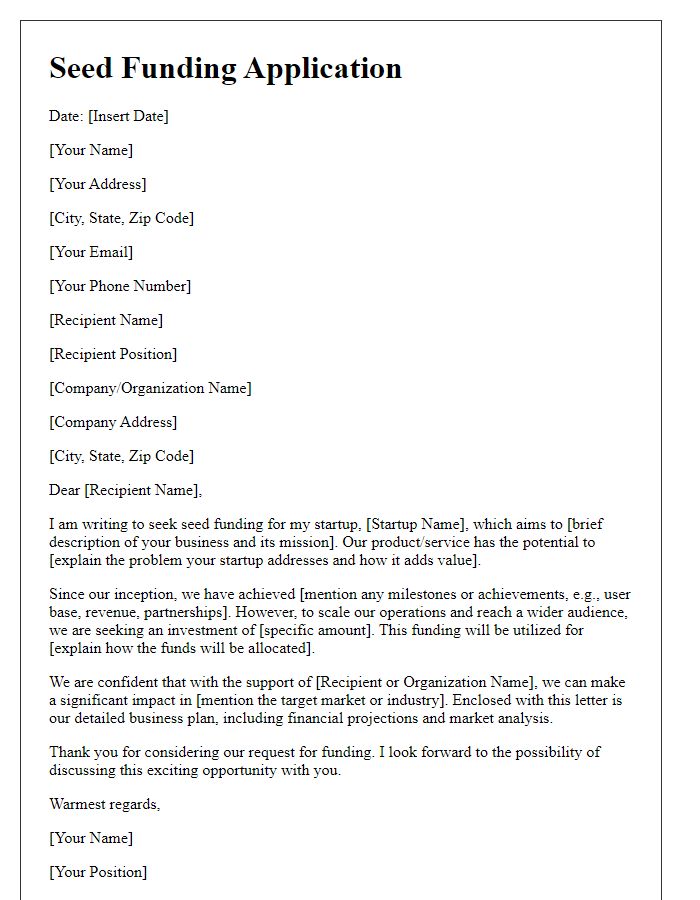

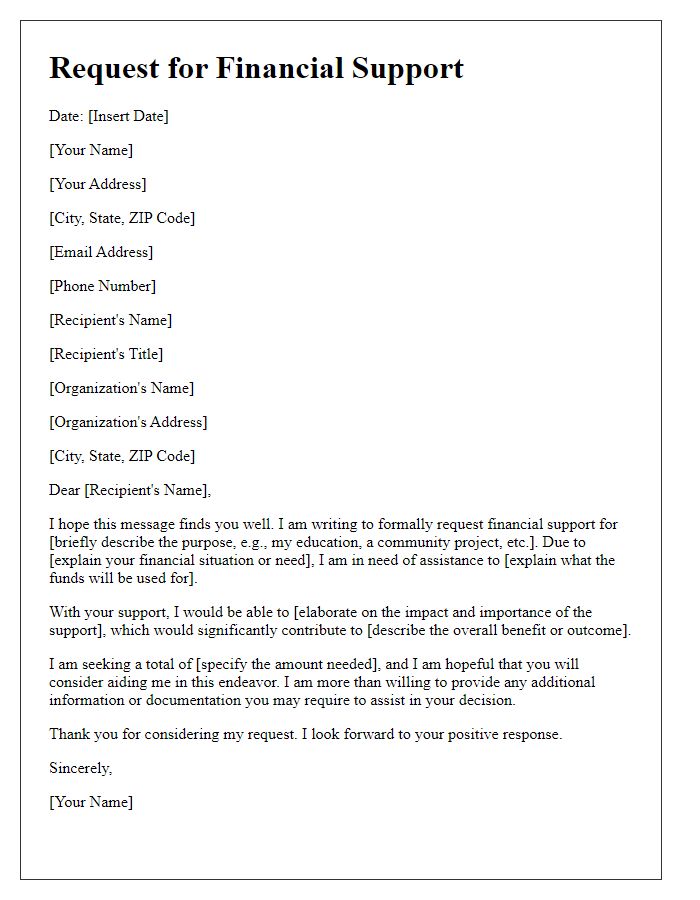

Are you ready to take your business to the next level? Securing investment funding can be a game-changer, but crafting the perfect letter to potential investors requires a delicate balance of persuasion and professionalism. In this article, we'll explore essential tips and templates that will help you articulate your vision and engage your audience effectively. Ready to dive in and learn how to turn your funding dreams into reality?

Clear Value Proposition

A clear value proposition articulates the unique benefits and features of a product or service that resonate with target customers. For instance, sustainable packaging solutions, such as biodegradable materials sourced from corn starch, present an eco-friendly alternative to traditional plastic packaging often made from petroleum-based products. In 2022, over 60% of consumers expressed a preference for environmentally responsible brands, driving market demand. Market analysis suggests that companies adopting such innovations could see revenue growth exceeding 30% annually. Additionally, adherence to regulations (such as the European Union's directive on single-use plastics effective in July 2021) positions businesses favorably within a competitive landscape. Furthermore, partnerships with key retailers could enhance distribution channels, maximizing reach and visibility in the marketplace.

Compelling Financial Projections

Compelling financial projections play a crucial role in persuading potential investors about the viability and profitability of a business venture. Clear estimates of revenue growth indicate strong market potential, with many startups projecting up to 300% annual growth in markets like technology or renewable energy. Important metrics such as gross profit margins, which can range from 50% to over 80% in industries like software, highlight the efficient cost structure. Additionally, break-even analysis establishes when the business model will become profitable, often within 12 to 24 months for successful startups. Cash flow forecasts are necessary to showcase operational sustainability, revealing how businesses will manage expenses and reinvest in growth. By presenting these detailed financial expectations, businesses can build investor confidence in their strategic vision and capability to deliver substantial returns, often aiming for a return on investment (ROI) of 20% to 40%.

Detailed Business Plan

A detailed business plan serves as a blueprint for attracting investment funding, outlining strategic objectives and financial projections for potential investors. This document includes sections such as market analysis, which identifies key demographic segments in targeted markets, including age, income, and purchasing behavior of potential customers. The competitive analysis highlights primary competitors in the industry, detailing their market share and product offerings. Financial projections should cover at least three years, showcasing revenues, expenses, and profit margins, with specific numbers reflecting growth potential. Additionally, the marketing strategy must outline channels, such as social media platforms like Instagram and Facebook, to effectively reach and engage potential customers. Operational plans should address location specifics, such as rent costs in urban areas, workforce requirements, and supply chain logistics. By presenting a comprehensive overview, the business plan aims to not only secure funding but also pave the way for future successful operations and growth.

Unique Selling Points

Unique selling points (USPs) often highlight the distinctive advantages of a business. For instance, a tech startup focused on renewable energy solutions may emphasize its patented solar panel technology, which boosts efficiency by 30% compared to traditional panels. This innovation leads to cost savings for consumers, resulting in an average reduction of $500 on annual energy bills. The startup operates in California, a state recognized for its stringent environmental regulations and incentives promoting clean energy adoption. Additionally, partnerships with large-scale distributors can enhance market reach, further differentiating the company in a competitive landscape. These aspects collectively contribute to a robust investment proposition.

Strong Team Credentials

A strong team composed of seasoned professionals significantly enhances the potential for business success, particularly in emerging sectors like renewable energy. Members often possess diverse backgrounds, including advanced degrees from prestigious institutions, such as Harvard University or Stanford University, and years of relevant experience in the industry. Notably, this includes former executives from leading companies in the sector, such as Tesla or Siemens, showcasing expertise in both management and technical innovation. Relationships with influential stakeholders, such as venture capital firms or government entities, further empower the team's ability to secure funding and navigate regulatory landscapes. A track record of previous successful projects, with a demonstrated ability to deliver results under tight deadlines, reinforces the team's credibility and appeal to investors seeking reliable partnerships in capital allocations.

Comments