Hey there! We've all been in situations where life gets in the way and things slip through the cracks, right? If you've ever found yourself needing to apologize for a late payment, you're not alone, and it's completely understandable. In this article, we'll provide you with an easy-to-follow letter template that will help you express your regret while maintaining a positive relationship with your creditor. So, let's dive in and find the right words together!

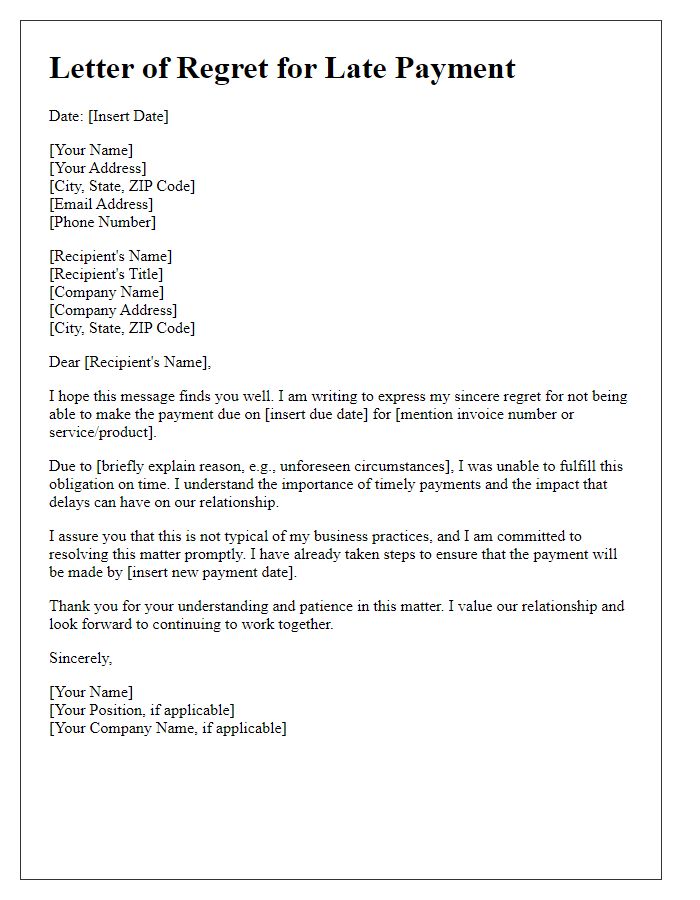

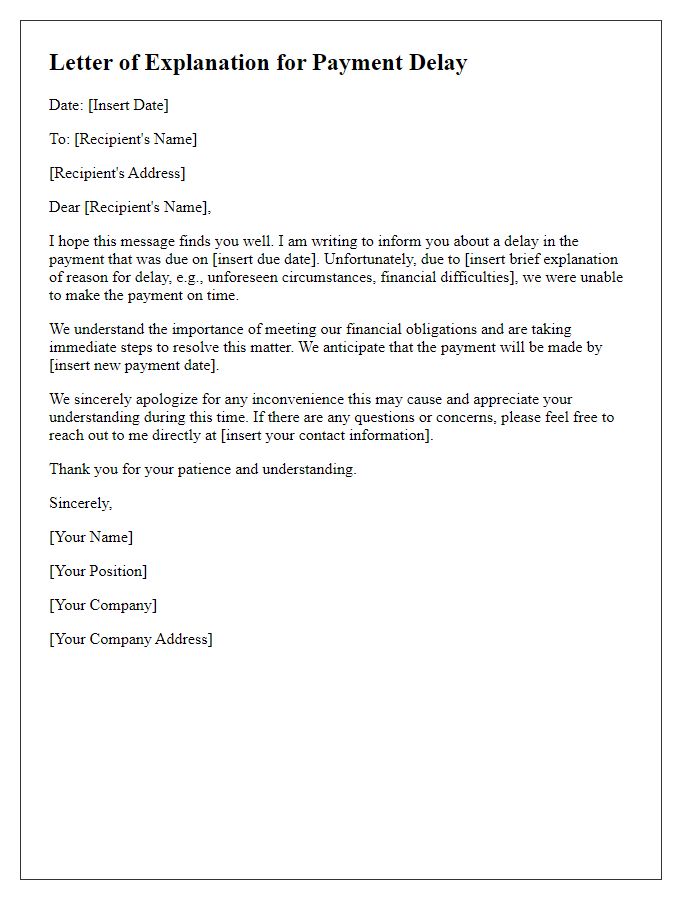

Acknowledgment of delay

Acknowledging delays in payment can impact business relationships. Timely payments, typically expected within 30 days, maintain financial trust and operational continuity. Late payments can result in financial strain for service providers or vendors, causing possible disruptions in future services or increased late fees. For instance, a business may face charges up to 1.5% per month on overdue amounts, depending on the terms outlined in contracts. Whether due to unexpected expenses, cash flow challenges, or administrative oversights, clear communication about such delays is crucial for preserving professional partnerships.

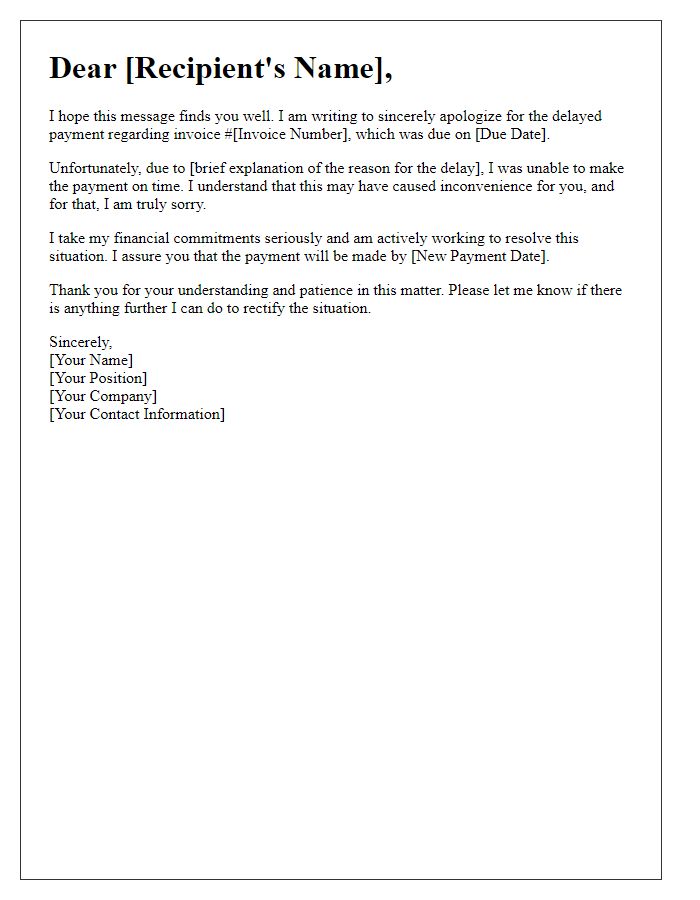

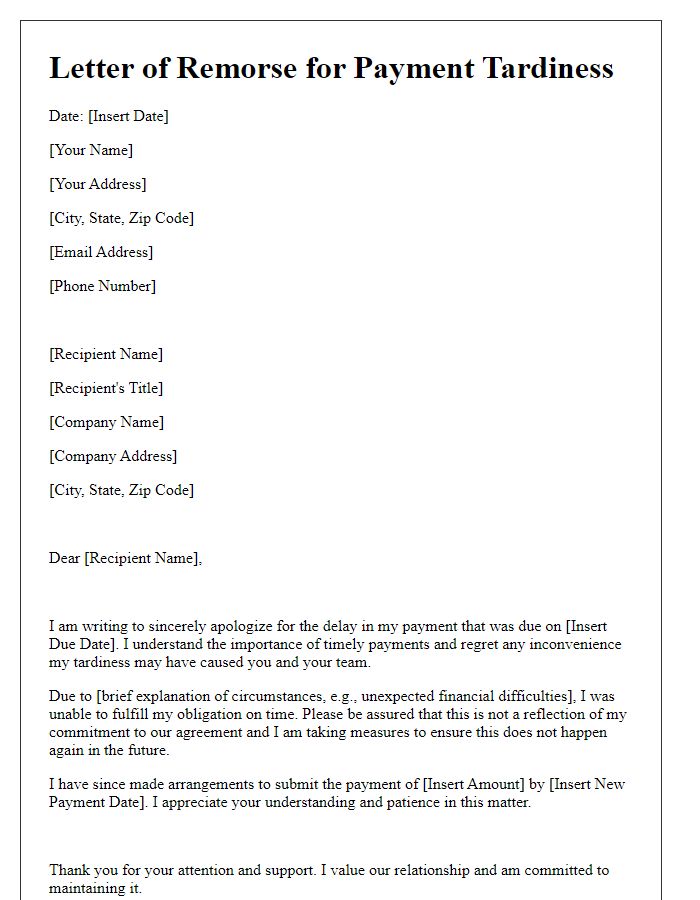

Expression of regret

Late payments can cause significant stress for both parties involved. Delays often stem from unforeseen circumstances such as cash flow shortages or unexpected expenses. When payments are overdue, it can strain business relationships, potentially resulting in late fees or damaged credit ratings. Acknowledging the importance of timely payments fosters trust and credibility in financial transactions. Crafting a sincere message of regret can help to re-establish rapport and demonstrate commitment to future punctuality. Apologizing provides an opportunity to clarify the situation and outline a plan to remedy the delay, ensuring that both parties feel valued and respected.

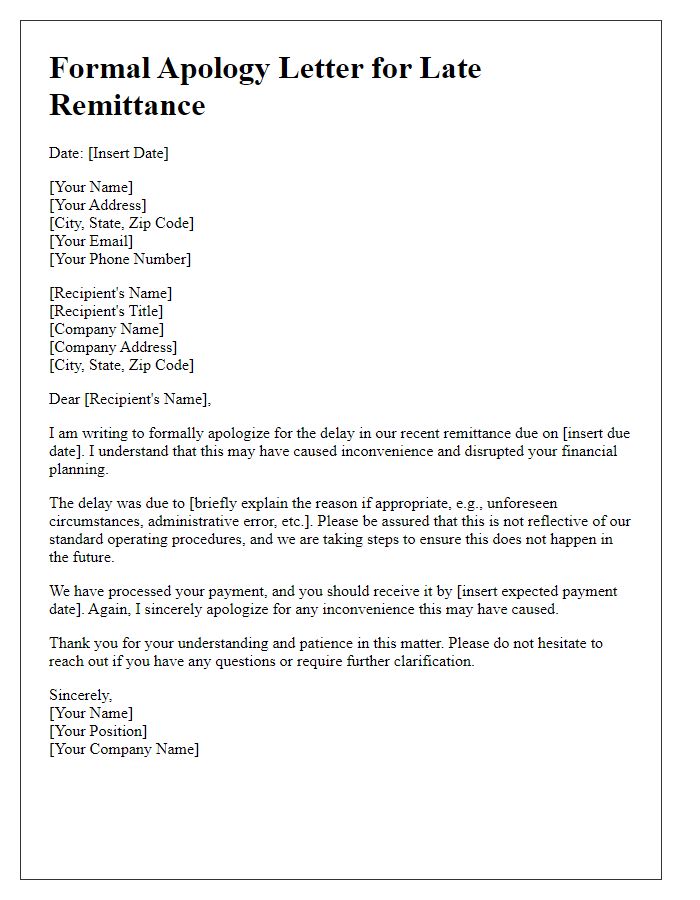

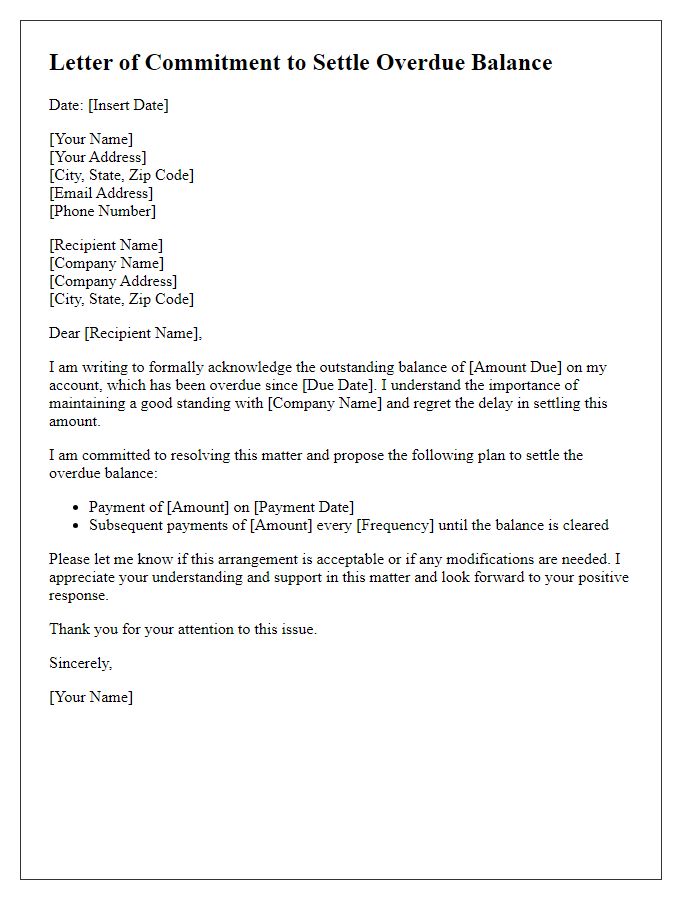

Explanation of circumstances

Due to unforeseen circumstances surrounding a medical emergency, the payment scheduled for September 15, 2023, was delayed. A sudden hospitalization for a family member resulted in unexpected financial strain, complicating the timely management of expenses. The missed deadline is regrettable, as previous payments were consistently made on time, reflecting a strong payment history with your company. The commitment to resolve this issue remains steadfast, with plans in place to ensure the outstanding balance of $500 will be cleared by October 30, 2023. Appreciation for understanding and patience during this difficult time is genuine.

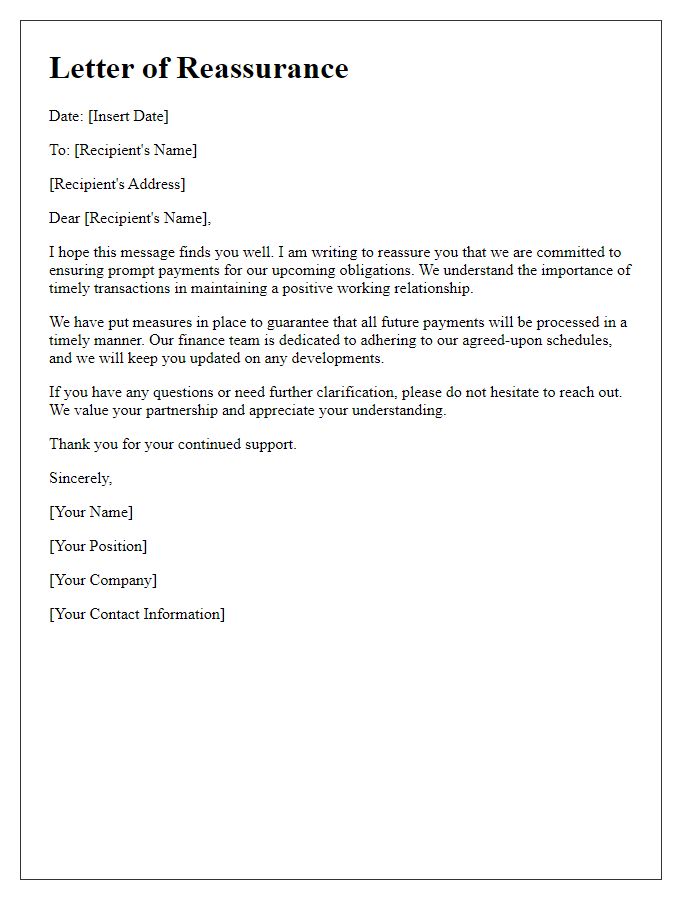

Assurance of future compliance

Late payments can create financial strain on relationships between businesses and their vendors. To ensure trust, timely payment is crucial. Recent instances (such as the last quarter of 2023) have shown delays affecting necessary operations. Maintaining communication with stakeholders regarding payment schedules can enhance accountability. Commitment to future compliance involves creating a revised payment plan or setting budgetary limits that promote adherence. Building an efficient invoicing system and scheduling regular reviews can prevent future discrepancies. By implementing these strategies, businesses ensure healthy cash flow and foster stronger partnerships moving forward.

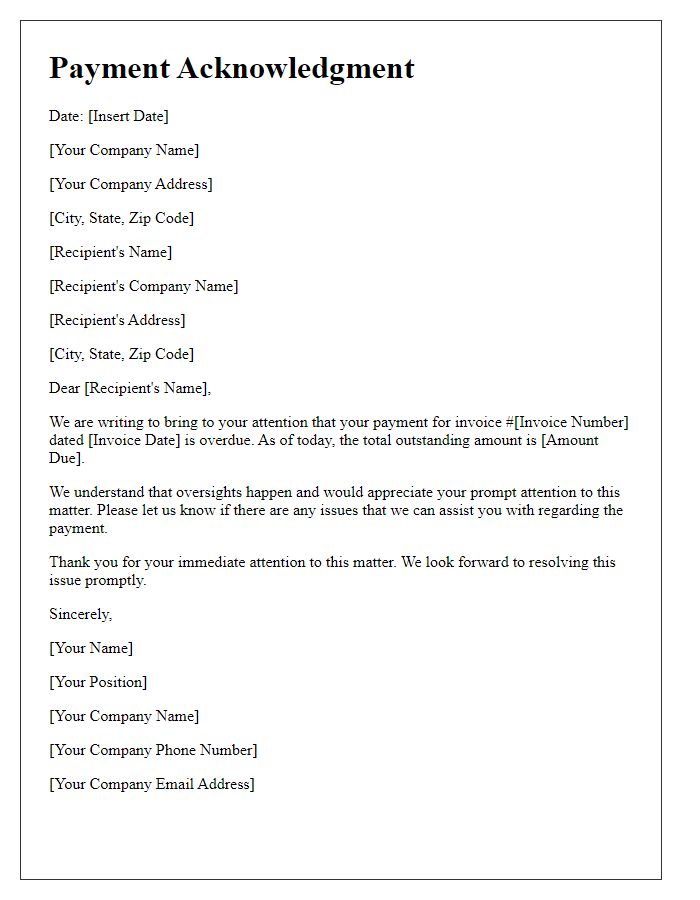

Offer of rectification or compensation

Late payments can strain relationships between service providers and clients. Different industries, from construction to retail, often establish terms with specific due dates, such as net 30 or net 60 days. Failing to meet these financial obligations may incur additional fees, potentially damaging trust. Clients must remain informed about the consequences of delays. Options for rectification often include immediate payment followed by a formal apology and reassurance against future occurrences. Additionally, businesses may consider offering compensation, such as discounts on future services or enhanced payment terms, reinforcing commitment to the working relationship. These steps can restore confidence, ultimately benefiting both parties in the long run.

Comments