Have you ever found yourself in a bit of a bind due to an inaccurate invoice? It's a situation that can often lead to confusion and frustration for both parties involved. In this article, we'll explore a thoughtful approach to crafting an apology letter that not only addresses the mistake but also helps maintain a positive relationship with your client. Join us as we share tips and templates to ensure your message is clear and professional.

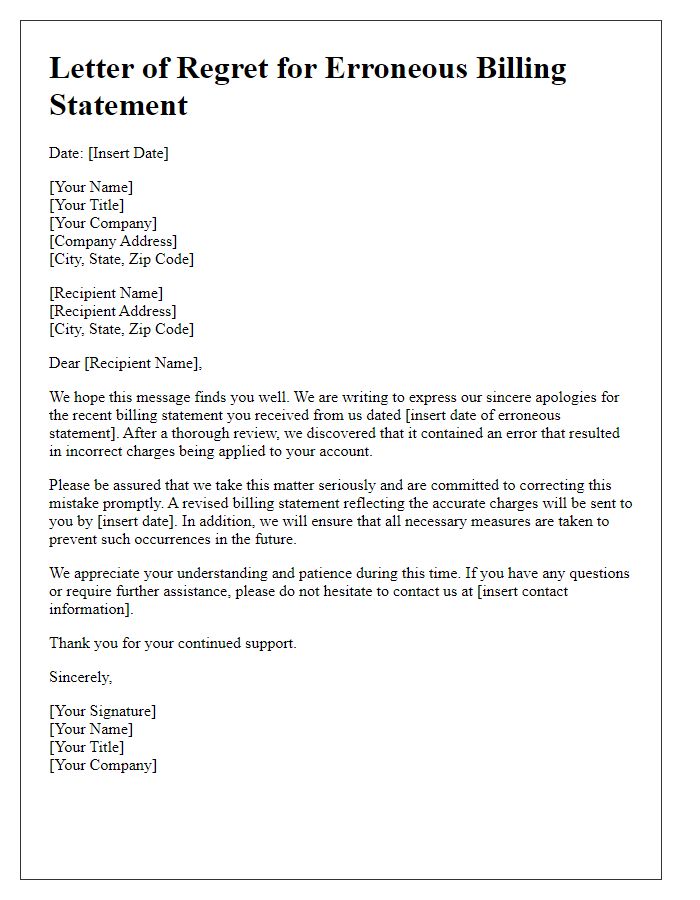

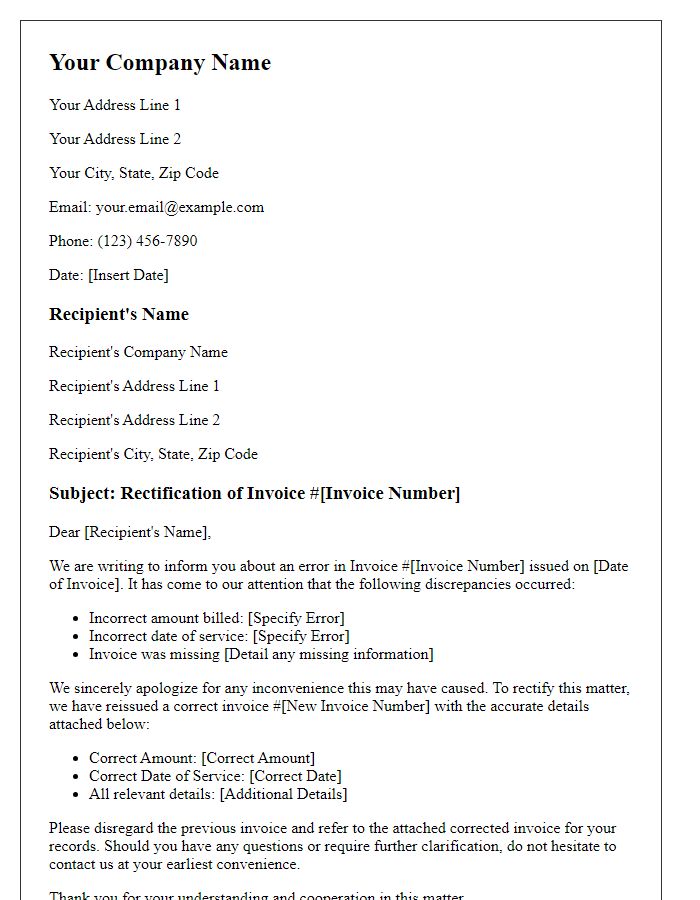

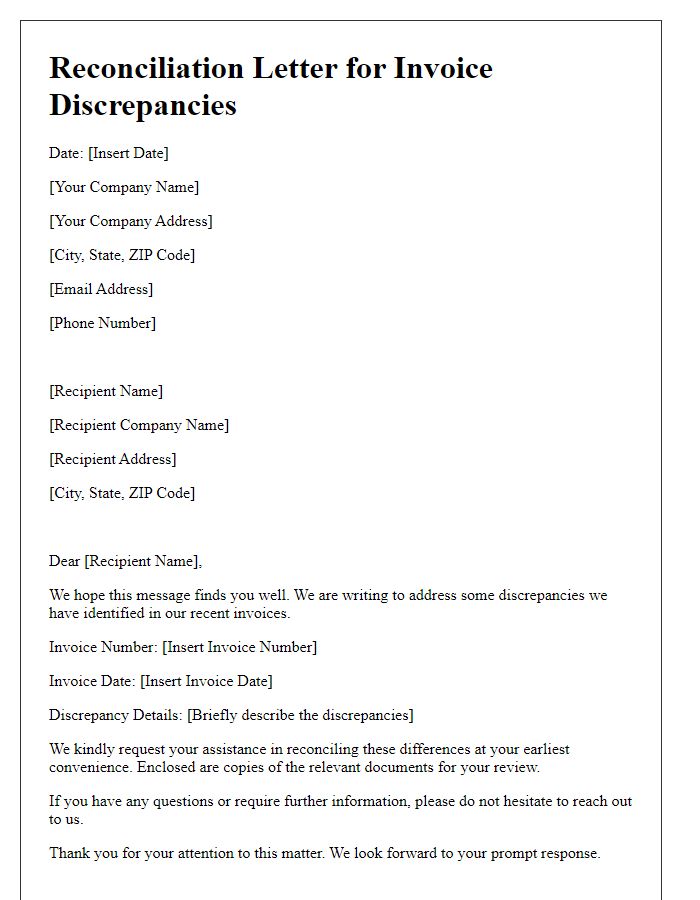

Header: Company name, contact information, date.

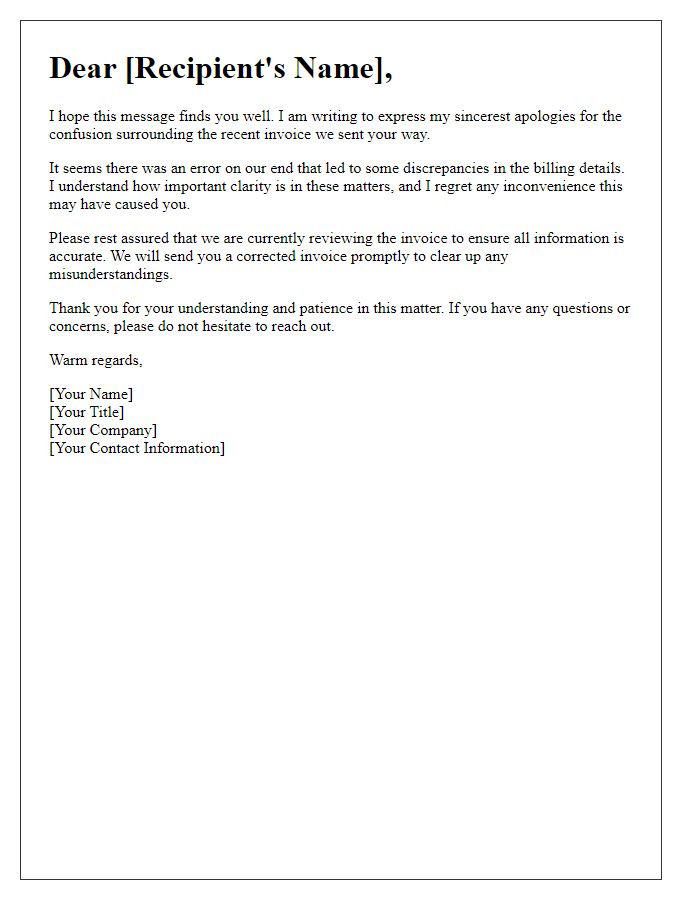

Apologies for the confusion caused by the incorrect invoice issued by our company, XYZ Ltd., located at 123 Business Avenue, Suite 400, Cityville, CA 90210. On October 1, 2023, an invoice numbered 4567 was mistakenly generated showing an erroneous amount of $1,200 instead of the correct amount of $1,020. This error occurred due to a data entry mistake in our billing software. Our accounting team is currently rectifying this issue and will issue a corrected invoice promptly. We appreciate your understanding and patience in this matter.

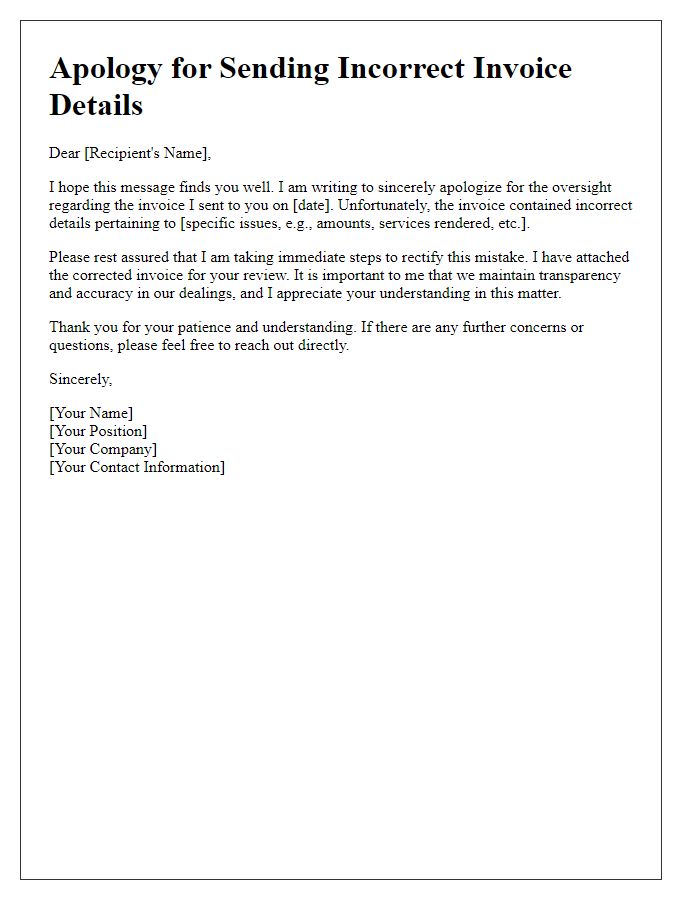

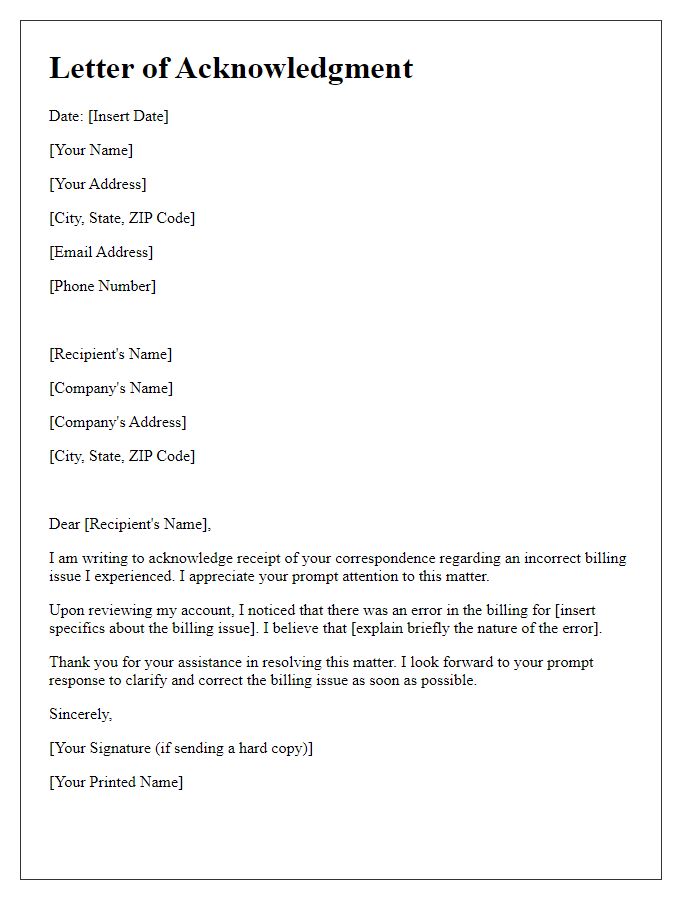

Salutation: Personalized greeting to the recipient.

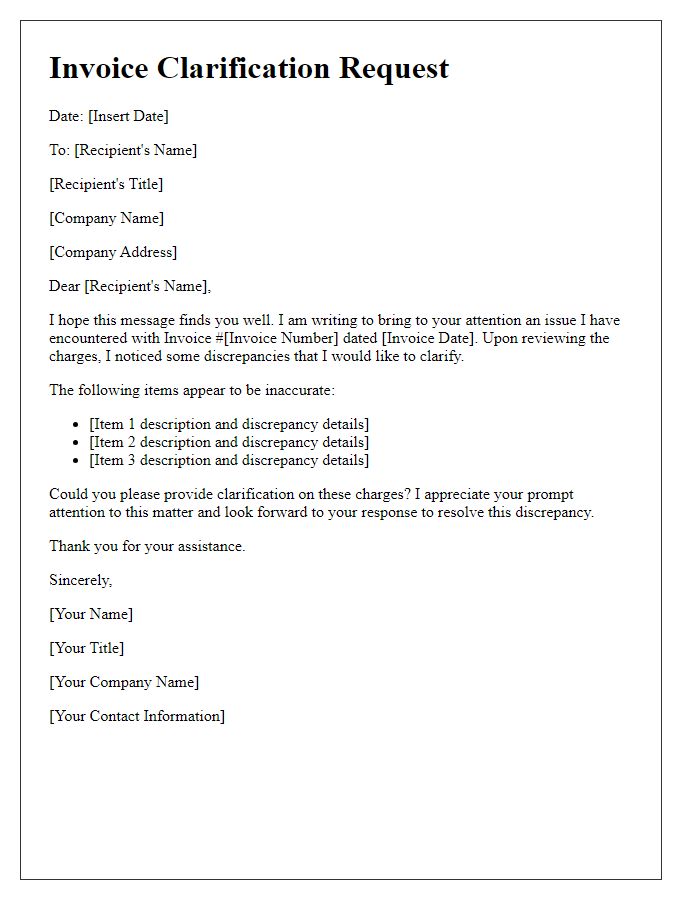

An incorrect invoice can lead to confusion and frustration for both parties involved in the transaction, highlighting issues within accounting procedures. Accurate invoice details, such as itemized services or goods, tax rates, and payment terms, are crucial for financial clarity. Failure to adhere to these standards may result in disputes, delayed payments, and mistrust in business relationships, potentially affecting sales figures. In ideal situations, prompt communication regarding any discrepancies fosters resolution and maintains goodwill, ensuring smoother future transactions.

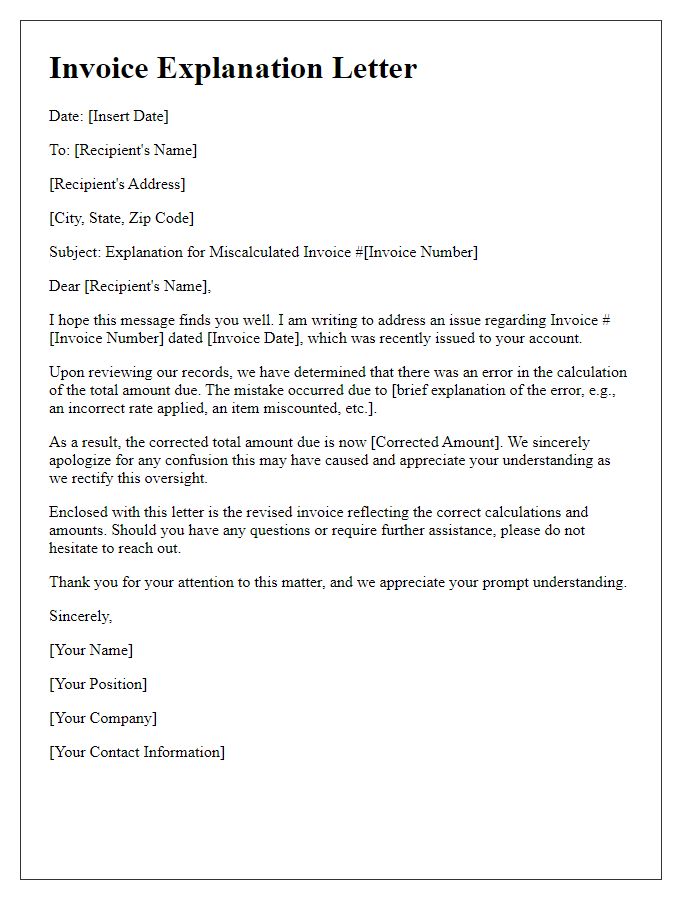

Error Acknowledgment: Clear statement of the incorrect invoice issue.

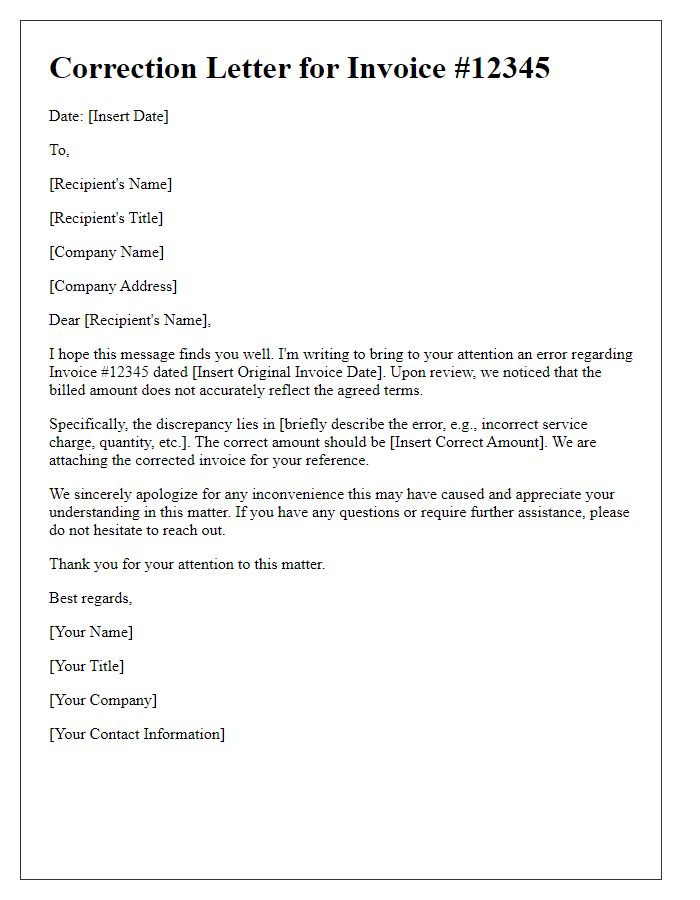

Inaccurate invoices can lead to significant confusion and frustration for clients and businesses alike. The recent invoice number 12345, dated October 15, 2023, incorrectly listed the amount due as $1,500 instead of the accurate total of $1,200 as per our agreed contract for services rendered. This discrepancy stemmed from a clerical error in our billing department, which inadvertently miscalculated usage fees for the month of September 2023. Such inaccuracies can disrupt financial planning and client trust, highlighting the importance of accurate and timely billing. Our team is currently implementing additional verification steps to prevent similar occurrences in the future and ensure consistent transparency in all transactions.

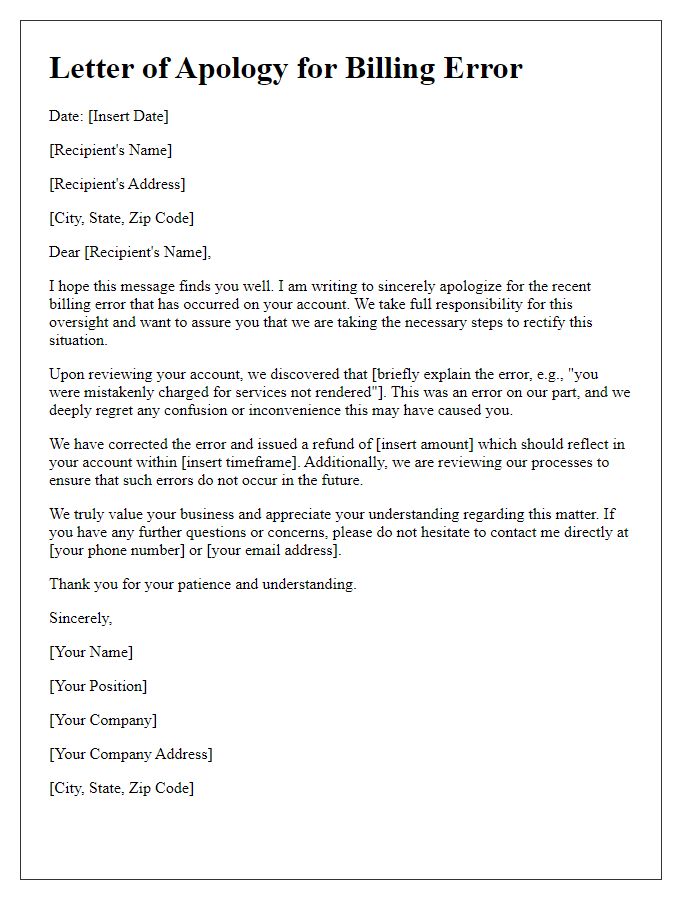

Apology: Sincere expression of regret for the inconvenience caused.

An incorrect invoice can lead to confusion and frustration for clients and businesses. An apology for such a mistake should convey a sincere expression of regret and recognition of the inconvenience caused. Accurate and timely invoicing is essential for maintaining trust in professional relationships. Acknowledge specific aspects, such as the incorrect amount, invoice number 1023, and the date issued on January 15, 2023. Corrective action should involve issuing a revised invoice promptly, detailing the adjustments made. Additionally, offer a point of contact for any further questions or concerns to ensure clarity and transparency moving forward.

Resolution and Next Steps: Detailed correction plan and reassurance.

An incorrect invoice can lead to financial confusion and mistrust in business relationships. Accurate billing is crucial for maintaining clear communication and professional integrity. An apology for the misunderstanding is essential, highlighting the importance of correcting the error promptly. A correction plan should include a review of the initial invoice issued on July 15, 2023, detailing the discrepancies found and the adjustments made. Steps to prevent future occurrences could involve additional training for the accounting team and implementing a double-check system before invoices are sent out. Reassurance of commitment to high standards of financial accuracy will help restore confidence and maintain strong partnerships.

Comments