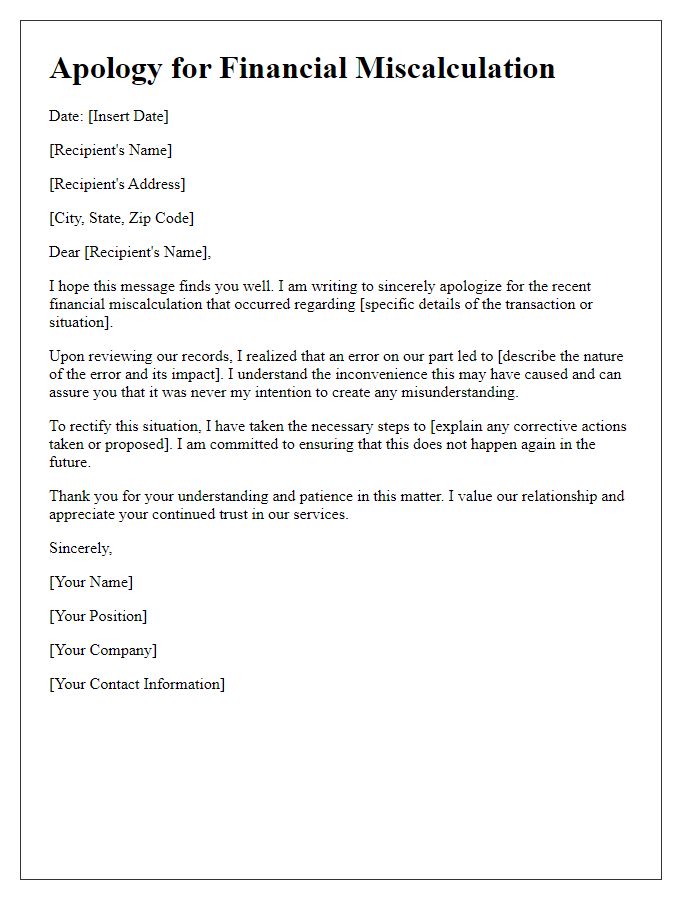

Have you ever found yourself in a bind due to a financial miscalculation? It can be a stressful situation, especially when it affects others. Apologizing sincerely and addressing the mistake is crucial to maintaining trust and transparency. If you're in this position and need a little guidance, keep reading for a helpful letter template that can pave the way to resolution.

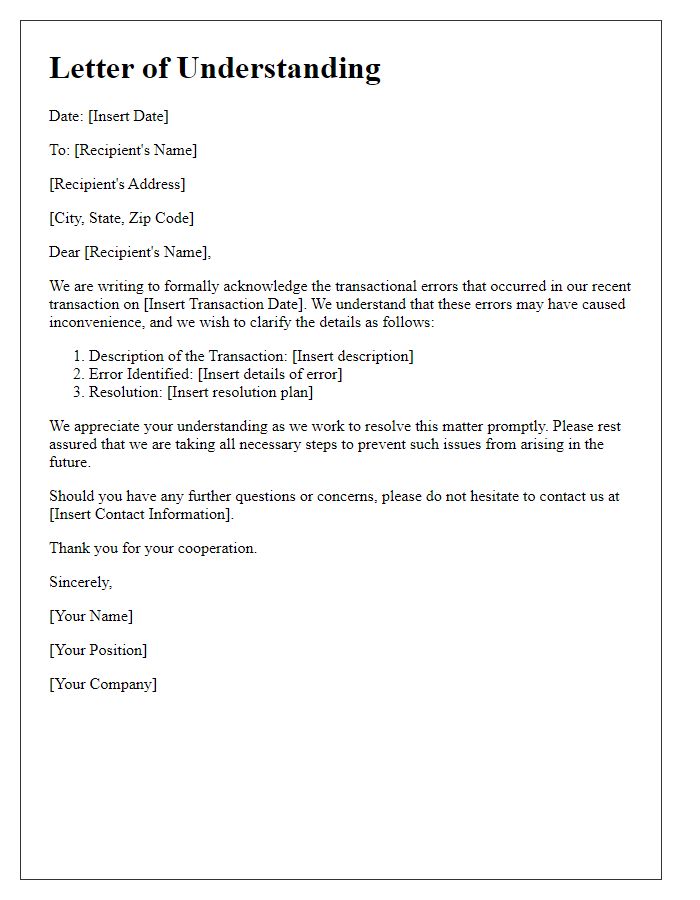

Acknowledge the error

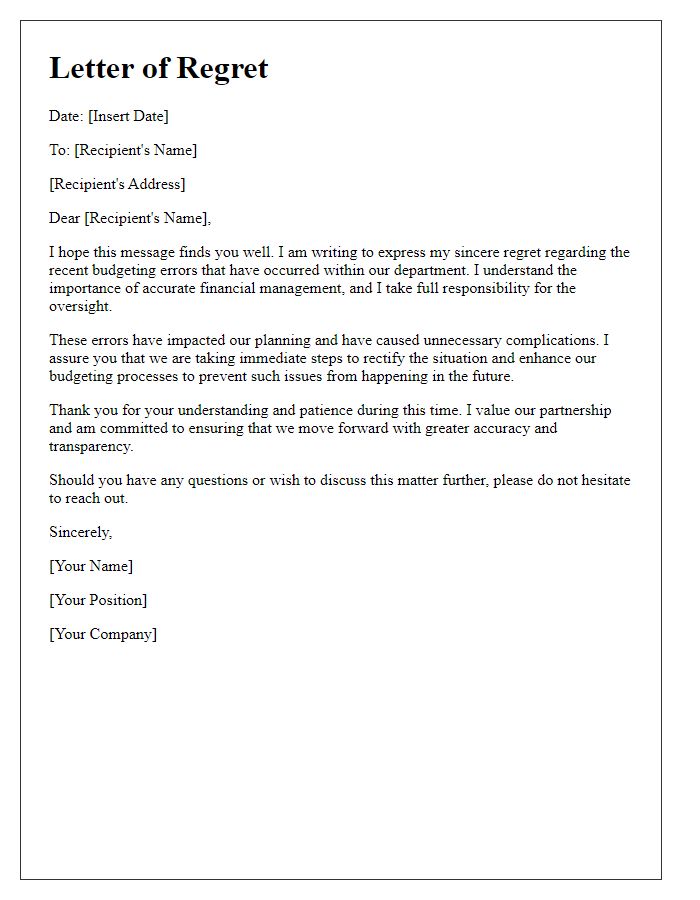

In recent financial audits, significant discrepancies emerged in the quarterly budget reports, particularly within the accounts payable section. A miscalculation of approximately $25,000 occurred due to an oversight in data entry processes, which affected the overall financial standing of the company. This error not only misrepresented our budget allocations but also hindered effective planning for upcoming projects scheduled for Q1 2024. Staff members involved in the financial reporting have been retrained to prevent recurrence of such discrepancies.Dong Shi Hui (the Board of Directors)was notified immediately to maintain transparency, ensuring trust in our financial integrity as we move forward to rectify these issues promptly.

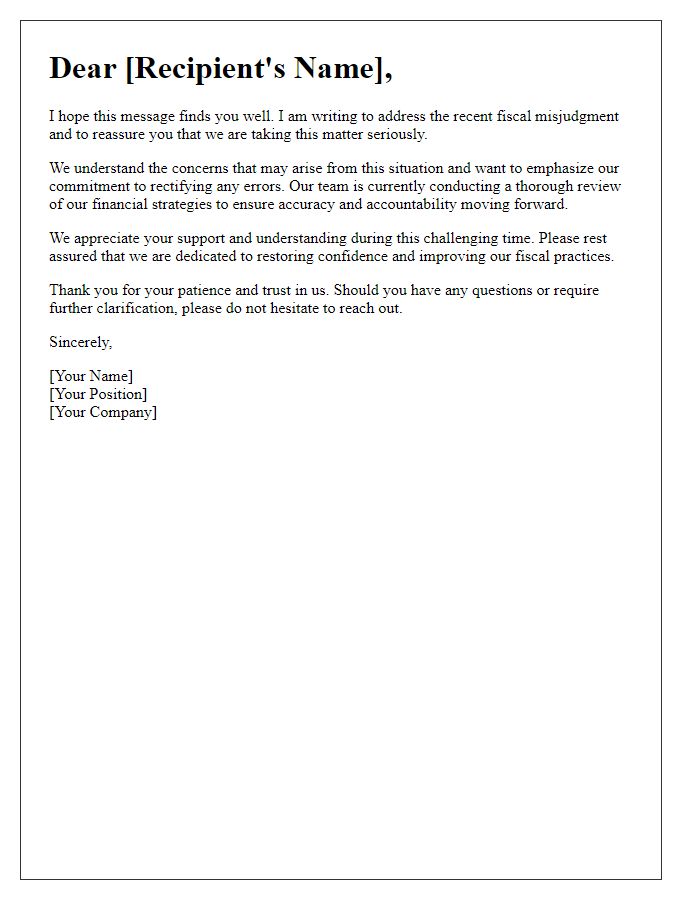

Take responsibility

In recent financial transactions, an unforeseen miscalculation occurred, rectifying which is essential for maintaining trust. The miscalculation, significantly affecting the annual budget of our organization, arose during the third quarter report preparation. Errors in accounting entries led to discrepancies that were overlooked. Comprehensive internal audits in subsequent weeks revealed these inaccuracies. Immediate measures are being implemented to enhance our financial protocols, ensuring greater accuracy in future reports. Ongoing training for the finance team is being scheduled to address potential calculation errors effectively.

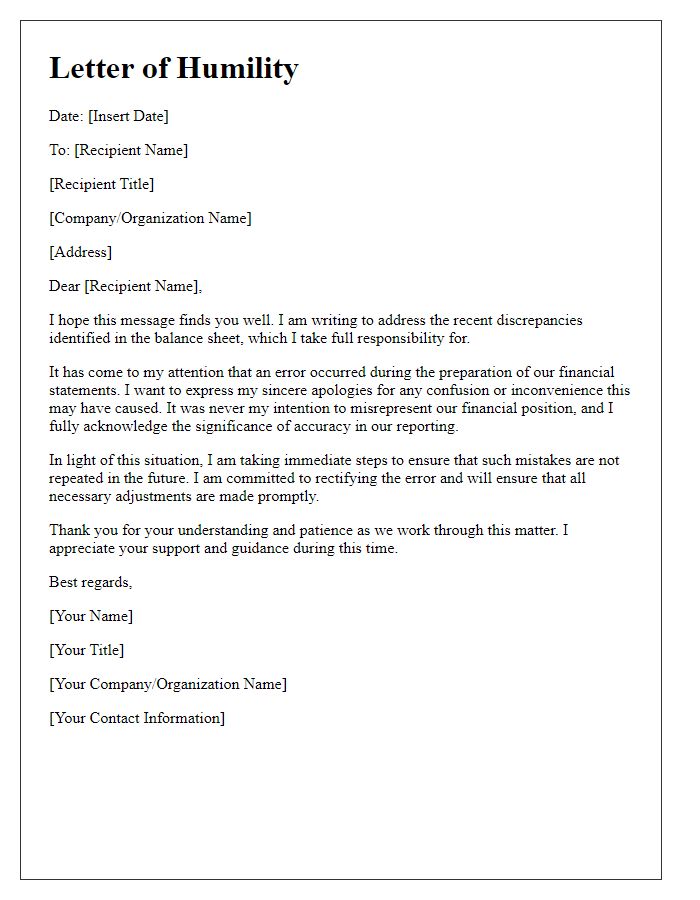

Explain the cause

Financial miscalculations can significantly impact a company's operations and relationships with clients. Common causes include human error during data entry, misinterpretation of financial statements, or software glitches in accounting programs. For instance, a missed decimal point can lead to an incorrect total, while outdated software might miscalculate taxes due. In high-stakes environments like investment banking, even minor errors can lead to substantial financial discrepancies, affecting cash flow and profitability. Regular audits and updates in accounting practices, as well as thorough staff training on financial systems, are essential to mitigate these risks and maintain trust with clients and stakeholders.

Present corrective actions

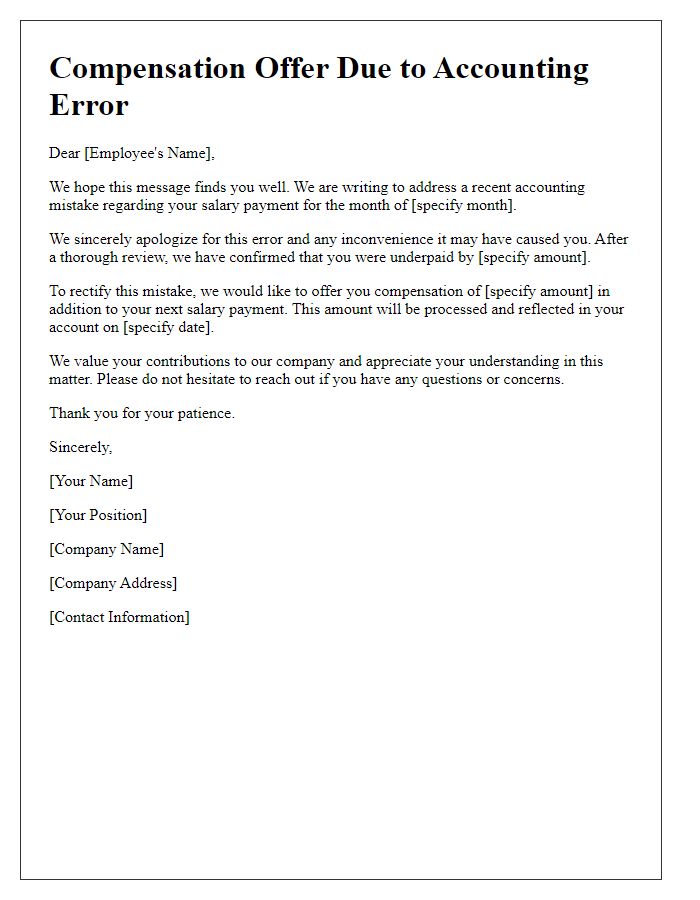

In recent months, our financial reports indicated discrepancies that necessitated prompt attention, notably a $10,000 miscalculation in our quarterly budgeting estimates for Q3 2023. We have implemented a thorough auditing process to ensure accuracy in our accounting, including additional training for our finance team on new software tools designed to minimize human error. A dedicated task force is now established, focused on revising our financial tracking systems, integrating real-time analytics to provide up-to-date insights into our fiscal health. Continuing audits will be conducted monthly to prevent future errors. We are committed to regaining trust and ensuring responsible financial management moving forward.

Offer reassurances and future prevention steps

In recent months, an error in financial calculations has led to discrepancies impacting budget allocations for the upcoming fiscal year. This miscalculation, identified during the quarterly audit in September 2023, resulted in an overspend of approximately $10,000. To prevent such occurrences in the future, our finance team has integrated a revised double-check system and initiated regular training sessions for staff on financial accuracy and budgeting procedures. Additionally, monthly financial reviews will be implemented to swiftly identify any inconsistencies. These steps aim to reinforce our commitment to financial integrity and ensure transparency moving forward.

Comments