Apologizing for a non-payment issue can be a sensitive matter, and it's important to approach it with sincerity and clarity. In this article, we'll explore effective ways to craft an apology letter that acknowledges the oversight while reassuring the recipient of your commitment to resolve the situation. We'll also provide a step-by-step template for writing your own personalized letter that conveys both professionalism and empathy. Ready to learn more about how to mend those financial missteps? Let's dive in!

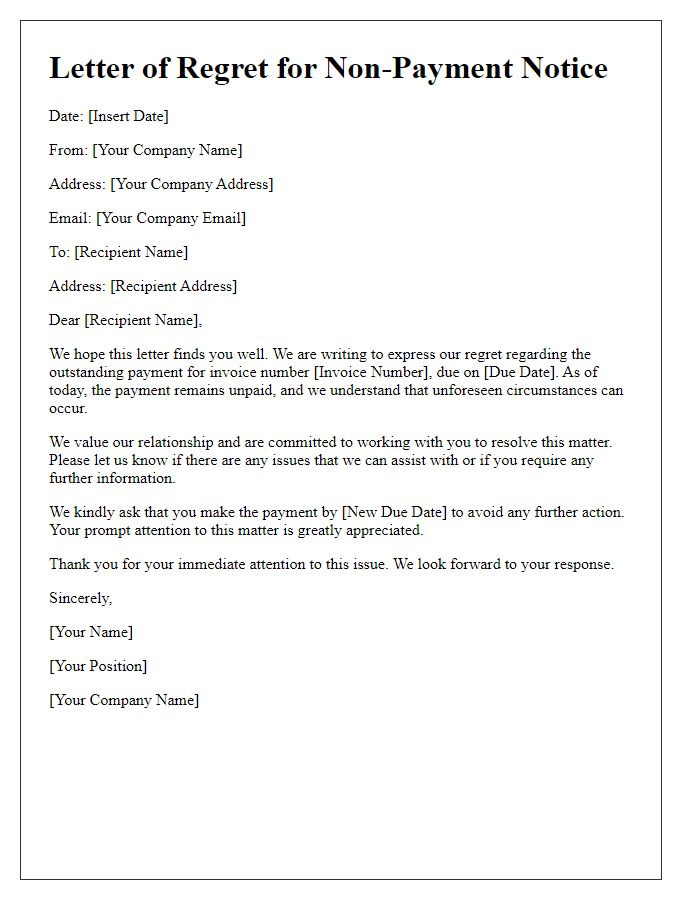

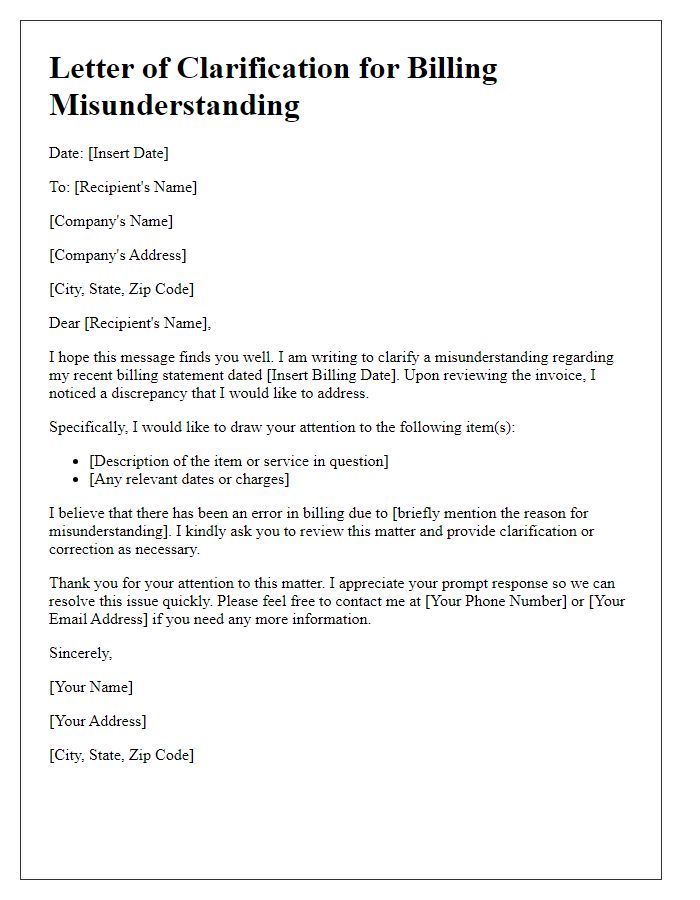

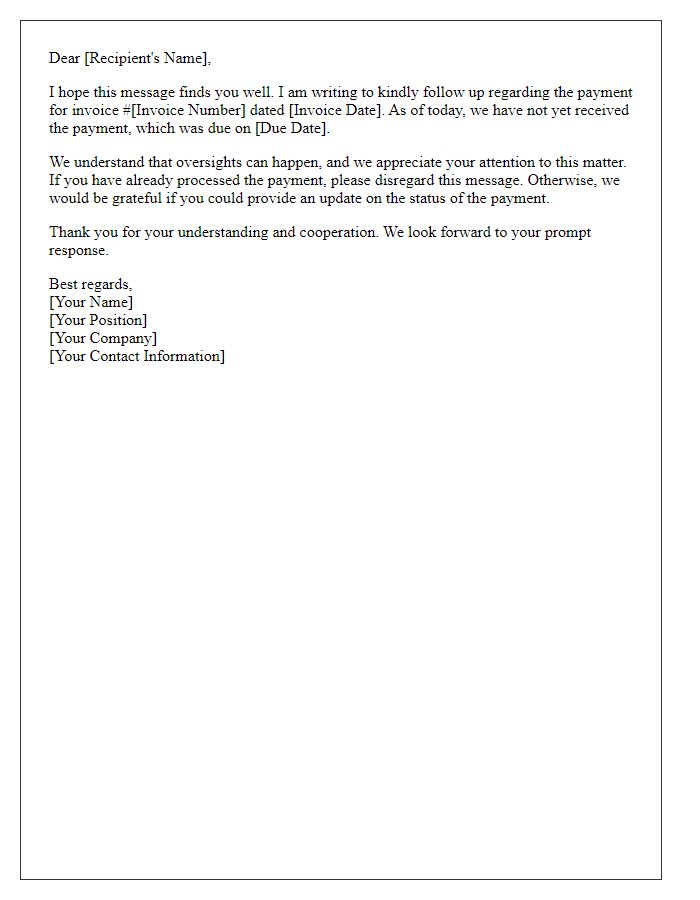

Clear identification of the issue.

A non-payment issue can lead to significant complications in business transactions, often affecting cash flow management. In numerous cases, unpaid invoices dated over 30 days from due date can trigger late fees or penalties imposed by suppliers, affecting overall operational budgets. For instance, a service provider might report an outstanding balance of $4,500, relating to services rendered in July 2023. Failure to address such issues promptly may result in service disruptions, diminished vendor relationships, or even legal action. It is crucial to identify the specific invoice numbers (e.g., INV-12345) associated with the issue to streamline communication and resolution efforts.

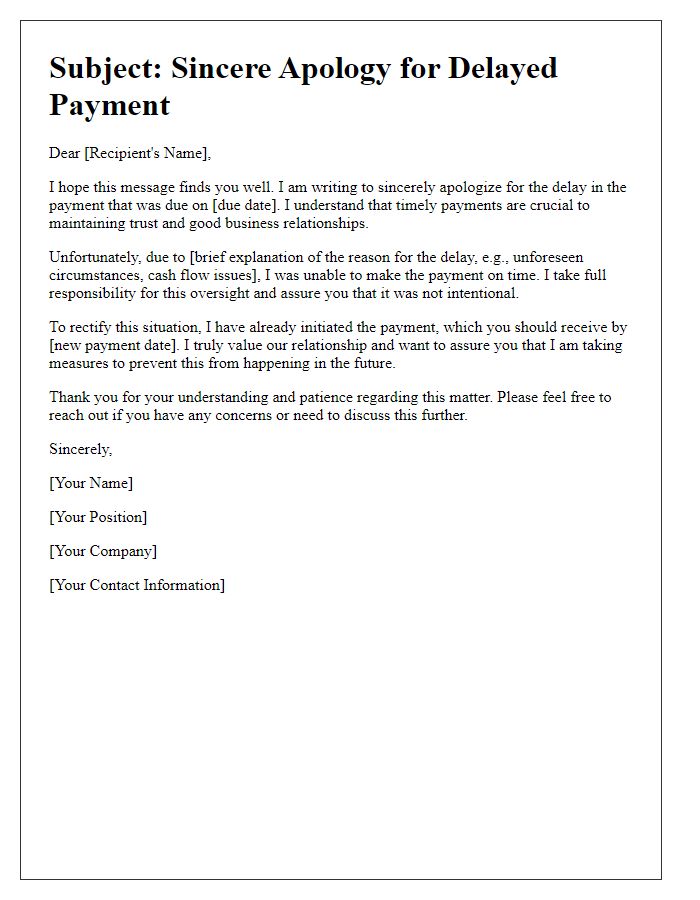

Sincere expression of apology.

Non-payment issues often lead to significant strain in professional relationships and financial transactions. Companies like XYZ Corporation, operating in the electronics sector, may face challenges when clients fail to settle invoices, resulting in a cash flow disruption of up to 30%. A sincere expression of apology typically involves acknowledging the oversight, conveying regret for any inconvenience caused, and outlining the steps taken to rectify the situation. Clients, such as local businesses in San Francisco or international partners, greatly appreciate transparency and commitment to resolve payment issues promptly to maintain trust and future collaboration.

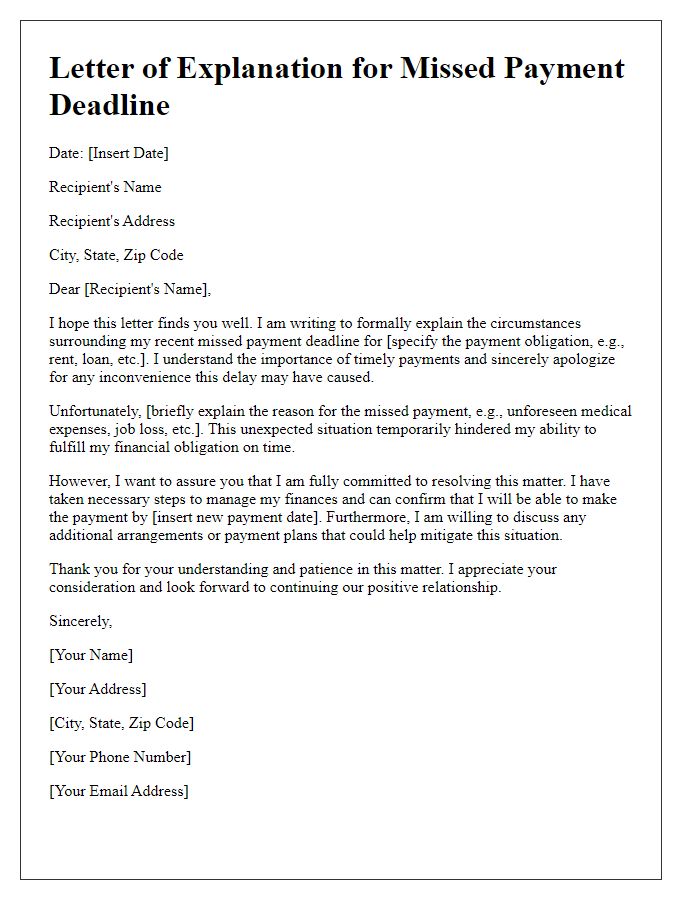

Explanation of the cause of non-payment.

Non-payment issues can often arise due to unexpected circumstances, such as cash flow challenges or administrative errors. For businesses, unforeseen events like a significant decline in sales or unexpected expenses, including repair costs, can critically impact their liquidity. Individuals may encounter situations such as medical emergencies or job loss that disrupt their ability to meet financial obligations. Additionally, technical errors within payment systems or delays in the banking process can lead to missed payments. Understanding all these factors highlights the complexity surrounding non-payment and the necessity for proactive communication with creditors or service providers.

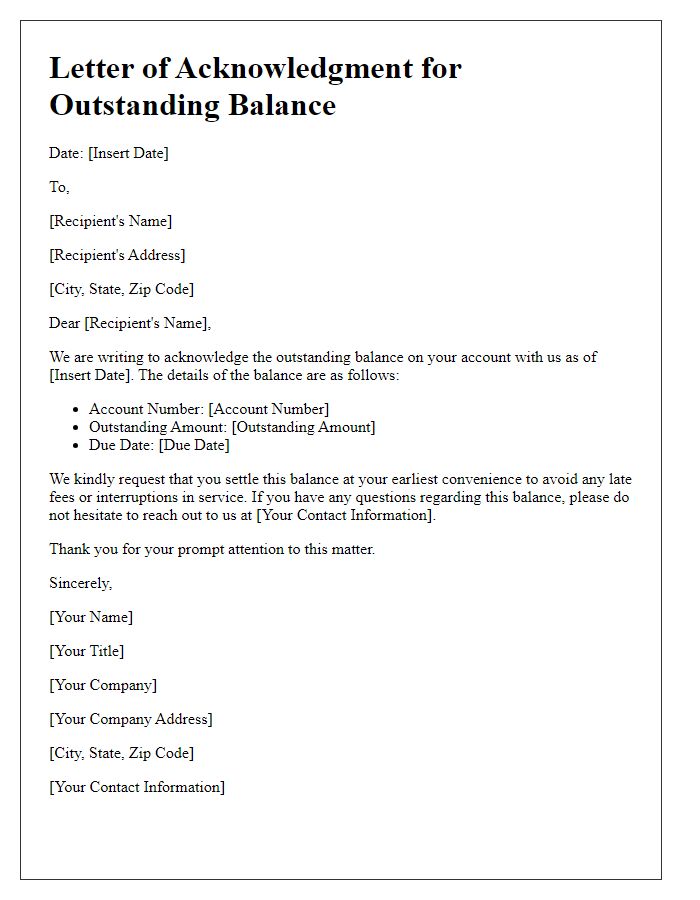

Assurance of corrective measures and resolution timeframe.

Delays in payment can severely impact business relationships and financial stability. Affected parties, such as vendors or service providers, may experience cash flow disruptions (known as liquidity crisis) due to late payments, which can linger for weeks or months. Specific measures, like implementing new payment processing software (targeting efficiency), can resolve these issues in a timeframe of approximately 30 days. Additionally, regular communication with stakeholders (like suppliers) can enhance trust, ensuring that all parties are updated on any corrective actions. The introduction of monthly financial reviews can sustain accountability and prevent future occurrences of non-payment issues, fostering a healthier financial ecosystem.

Contact information for further communication.

A non-payment issue can lead to significant consequences, affecting the financial health of businesses and individuals alike. Late payments often stem from various situations including cash flow shortages or unforeseen emergencies. When addressing such matters, clear communication is vital, highlighting the importance of timely payments in maintaining trust within relationships. Providing detailed contact information, such as an email address, phone number, or dedicated customer service representative, facilitates open dialogue and ensures effective resolution of the issue at hand. Establishing a mutual understanding can help prevent future occurrences, safeguarding against potential disruptions in services or strained partnerships.

Comments