In a rapidly evolving regulatory landscape, staying informed about important changes can feel overwhelming. That's why we're dedicated to keeping you in the loop and ensuring you're well-equipped to navigate these updates. Recently, key regulatory changes have been announced that could significantly impact your operations and compliance strategies. Curious to learn more about how these changes might affect you? Read on!

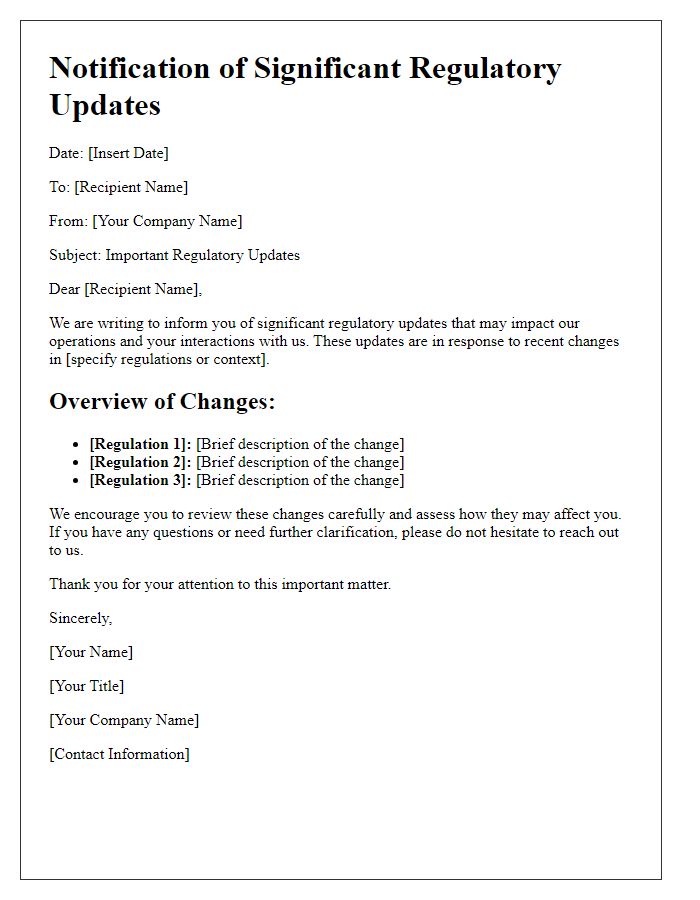

Clarity and Precision

Important regulatory changes, such as those mandated by the Securities and Exchange Commission (SEC), require companies to update compliance policies. These changes often include revisions to reporting standards, deadlines, and disclosure requirements, impacting financial statements and investor communications. For instance, the new regulations effective January 1, 2024, may necessitate a review of internal controls to ensure adherence to tighter guidelines. Organizations must also consider the implications for training personnel and allocating resources for compliance management. Clear communication regarding these changes is essential for maintaining transparency with stakeholders and ensuring ongoing regulatory compliance.

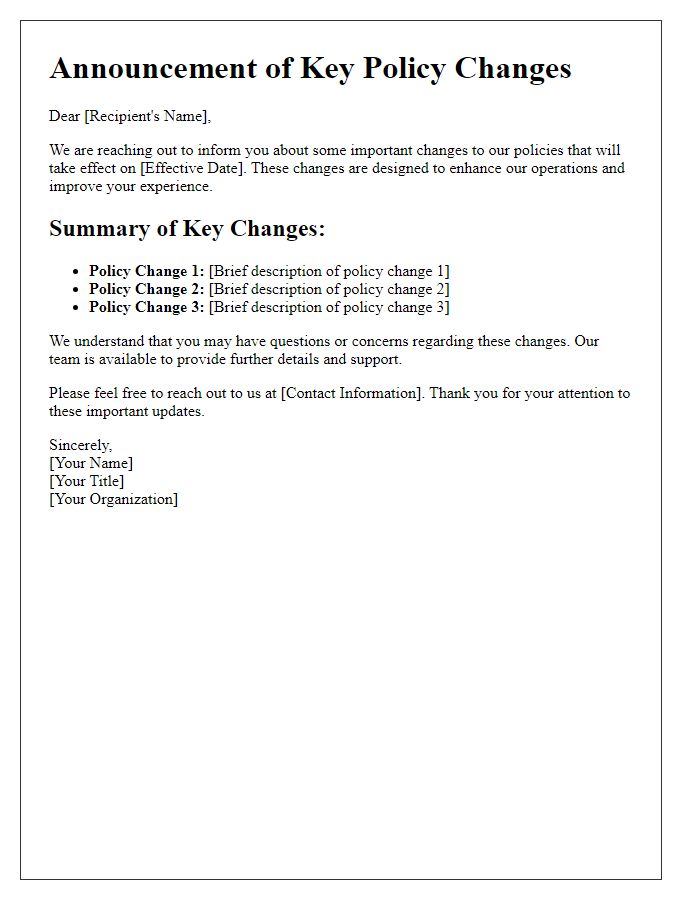

Audience-Centric Language

Recent changes in financial regulations, specifically the Dodd-Frank Act modifications, significantly impact banking and investment sectors in the United States. These amendments aim to enhance consumer protections and promote transparency in financial transactions. Stakeholders must comply with new reporting requirements, which include stricter guidelines for risk assessment and capital allocation, influencing portfolios worth trillions of dollars. Firms operating in this landscape should prepare for increased scrutiny from regulatory bodies, particularly the Securities and Exchange Commission (SEC). Understanding these shifts is crucial for strategic planning and ongoing operational success. Additionally, participation in upcoming webinars and workshops organized by the Financial Industry Regulatory Authority (FINRA) is recommended for clarity on compliance obligations.

Compliance and Deadlines

Regulatory changes, imposed by governing bodies such as the Financial Conduct Authority (FCA) or the Securities and Exchange Commission (SEC), can create significant impacts on business operations. Effective compliance, with specific deadlines typically set within a 30 to 90-day window, requires thorough reviews of existing policies and procedures. Organizations might have to update internal controls and risk management frameworks to align with new standards. Missing deadlines could result in financial penalties or reputational damage. It is crucial to conduct audits and provide tailored training to ensure all employees are informed and prepared for these changes. Moreover, effective communication of these updates plays a vital role in ensuring organizational readiness and adherence to the new regulatory environment.

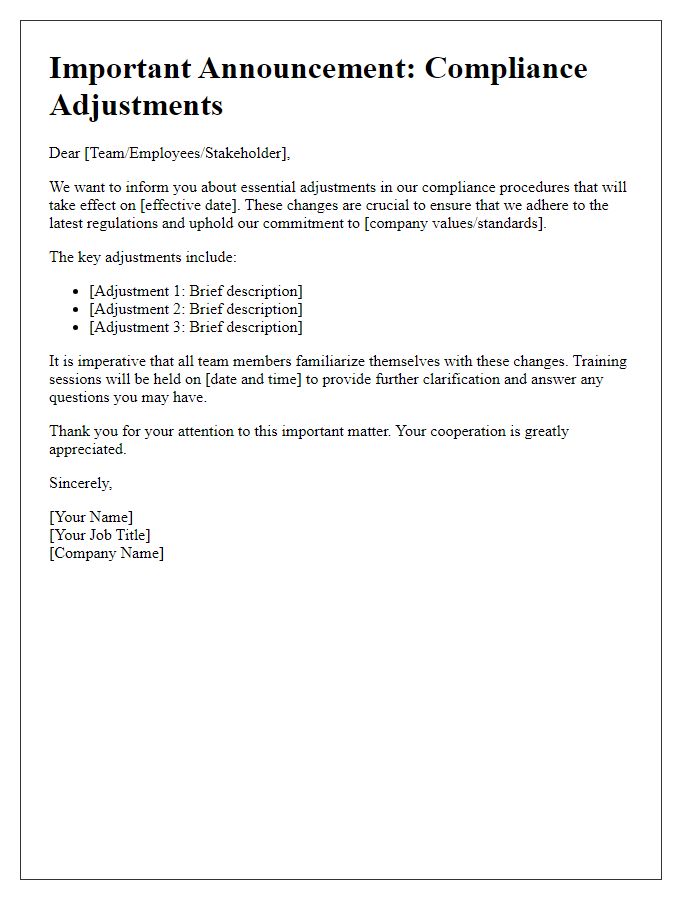

Implications and Benefits

New regulatory changes implemented by the Environmental Protection Agency (EPA) in October 2023 aim to enhance emissions standards for automotive vehicles, specifically targeting carbon dioxide output. The updated regulations mandate a reduction of 20% in emissions by 2025 for all new cars sold in the United States, promoting the adoption of electric and hybrid vehicles. This shift not only addresses climate change concerns but also supports public health by reducing air pollution levels in urban areas such as Los Angeles and New York City. Compliance with these standards is expected to stimulate innovation within the automotive industry, leading to increased investment in sustainable technologies. Additionally, consumers may benefit from incentives such as tax credits and rebates for purchasing eco-friendly vehicles, fostering a greener economy while addressing environmental issues.

Contact Information for Support

Important regulatory changes impacting businesses and consumers are being implemented starting January 2024. The changes will affect regulations set forth by the Federal Trade Commission (FTC), which oversees advertising practices and consumer protection laws in the United States. Organizations must ensure compliance with these updated guidelines to avoid potential penalties. Key aspects of these regulatory changes include stricter reporting requirements concerning data privacy practices and enhanced transparency in advertising. For assistance or clarification regarding these new regulations, companies may contact the designated support team at the FTC, available through their official website or dedicated helpline, ensuring timely and effective communication.

Comments