Are you nearing retirement and feeling overwhelmed by the multitude of plans and options available? It's essential to understand the details of a retirement plan agreement to secure your financial future. This agreement outlines the benefits, contributions, and terms that will guide you through your golden years. Ready to dive deeper into the intricacies of retirement planning? Let's explore more!

Personal Information

The retirement plan agreement details, including personal information, are crucial for establishing a secure financial future. Key elements such as the participant's full name, date of birth, and Social Security number serve as foundational identifiers for the plan. Additionally, current employment details, including employer name and contact information, must be accurately documented to facilitate contributions and benefits. Address information should encompass both current residence and any future addresses relevant to plan distribution. Financial information, such as annual salary, contribution percentages, and investment preferences, are essential for tailoring the retirement plan to the individual's needs. Emergency contact details, such as a family member or trusted advisor, provide necessary information for unforeseen circumstances.

Retirement Plan Type

A retirement plan type defines the framework for individuals to save and invest for their post-employment life, ensuring financial security. Common types of retirement plans include 401(k) plans, traditional IRAs (Individual Retirement Accounts), and Roth IRAs. In 2022, the contribution limit for a 401(k) was $20,500, while the limit for individuals aged 50 and older was $27,000, allowing for catch-up contributions. Traditional IRAs offer tax-deductible contributions, with a limit of $6,000 for taxpayers under 50, and the same catch-up provision logic applies. Roth IRAs are unique due to tax-free withdrawals in retirement, as long as certain conditions are met. Employers often match contributions up to a specific percentage, fostering a culture of savings and long-term investment. Understanding these various retirement plan types helps individuals tailor their savings strategies to fit personal financial goals and lifestyle needs.

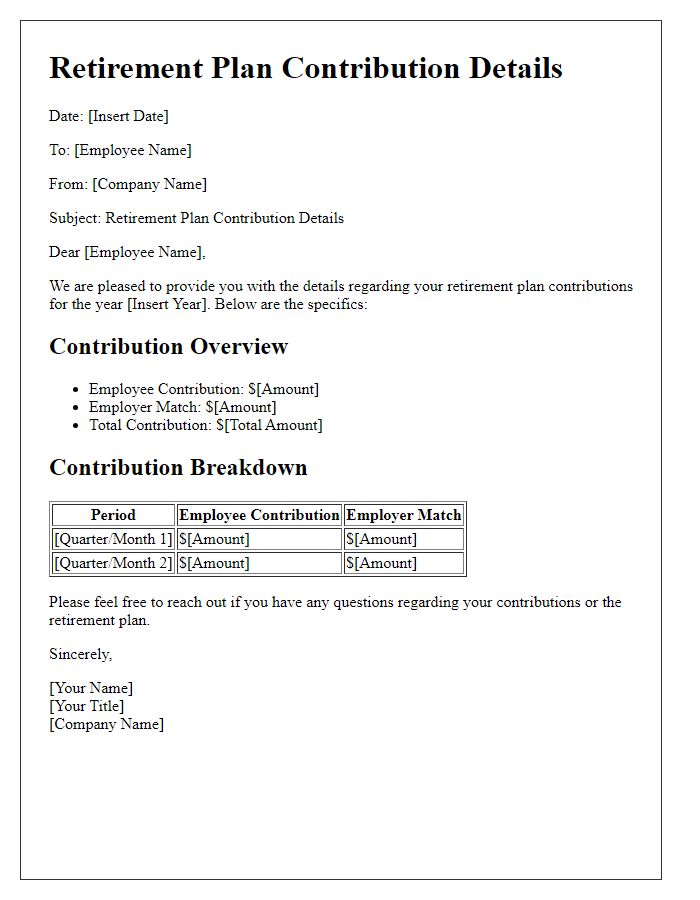

Contribution Details

The contribution details for a retirement plan agreement encompass the specific amounts allocated by both the employer and the employee towards the individual's retirement savings. Employers often match contributions up to a certain percentage, commonly ranging from 3% to 6% of an employee's salary, ensuring enhanced growth of the retirement fund. Employees are typically allowed to contribute pre-tax income, which may include a percentage of their salary capped at IRS limits of $20,500 for individuals under 50 years old and $27,000 for those aged 50 and above for the year 2023. These contributions are essential for building a robust retirement portfolio, ultimately influencing the financial security of individuals when they reach retirement age, particularly in alignment with the target retirement dates or milestones specific to the retirement plan established.

Vesting Schedule

A vesting schedule outlines the timeline during which an employee earns ownership of employer contributions to their retirement plan, such as a 401(k). Typically, this schedule includes specific milestones based on years of service, often structured as a percentage of contributions that become fully owned over a designated period. For example, a common schedule may feature a five-year cliff, wherein an employee earns 0% of contributions until the end of the fifth year and thereafter accrues ownership in increments, reaching 100% ownership after an additional five years. It is crucial to understand the implications of such a schedule on long-term financial planning, especially in high-turnover industries or for employees planning early retirement.

Distribution Options

Distribution options for retirement plans, such as 401(k) or IRA, include various strategies for accessing funds upon retirement. Lump-sum distributions provide all funds at once, with tax implications determined by the amount withdrawn (federal tax can be as high as 30% for large sums). Periodic withdrawals allow retirees to receive regular payments, which can be monthly or annually, helping with budgeting and tax management. Additionally, retirees can choose annuities, converting their retirement savings into a guaranteed income stream for a specified period or lifetime. Rollovers into a different tax-advantaged account, such as a Roth IRA, offer potential tax benefits while retaining the investment's growth potential. Understanding these options is essential to achieving long-term financial security in retirement.

Comments